- Aster surged 38% after CZ revealed a $2M personal token purchase.

- Market suffered $1.8B in liquidations, yet Aster defied the trend.

- Analysts predict a potential breakout, but caution over supply and hype.

Crypto markets have been in freefall this week — billions wiped out, red everywhere — yet somehow Aster (ASTER) managed to break through the chaos. The token surged nearly 38% in just a few hours after Binance co-founder Changpeng Zhao (CZ) revealed he’d bought roughly $2 million worth of Aster tokens using his own money.

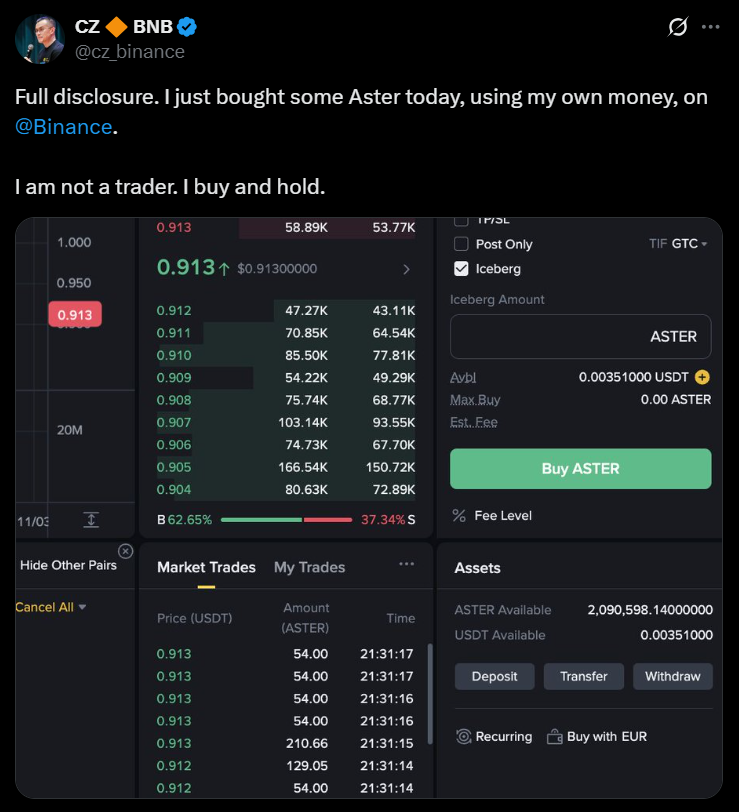

In a short post on X, CZ said he’d picked up around 2.09 million tokens at about $0.91 each, adding almost offhandedly that he’s “not a trader” and prefers to “buy and hold.” The comment landed quietly at first — and then, boom — the market went wild. Trading volume exploded over 1,100%, reaching $2.3 billion, while total value locked in the Aster ecosystem shot up to nearly $1 billion. It was the kind of chain reaction that only CZ seems capable of setting off.

Blood on the Floor, Except for Aster

The timing was almost ironic. As Aster was taking off, broader markets were collapsing under a wave of liquidations totaling roughly $1.8 billion. Ethereum longs were hit hardest, losing about $500 million, while Bitcoin traders saw another $497 million vanish. According to OKX data, a few liquidation orders reached almost $48 million each — brutal even by crypto’s standards.

Bitcoin fell more than 7%, dipping below $100K, and Ethereum slid around 13% to $3,150. Amid the carnage, Aster stood out like a defiant green candle — one of the few assets climbing as everything else burned.

Analysts See a Bigger Move Coming

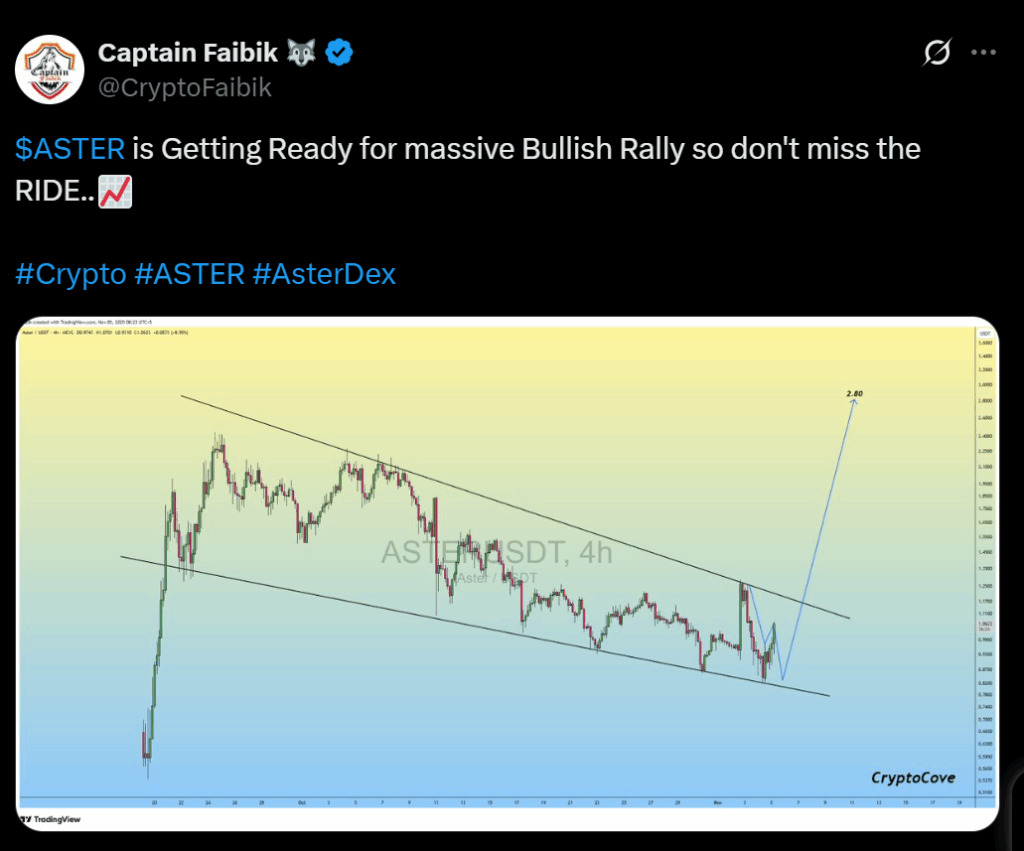

Crypto analyst Captain Faibik was quick to jump in, saying the setup looks primed for a breakout. His chart points to a descending parallel channel on the 4-hour timeframe, hinting at a possible move toward $2.80. “$ASTER is getting ready for a massive bullish rally,” he wrote, and judging by the sentiment online, plenty of traders agreed.

CZ himself described Aster’s growth as a “strong start,” giving the token an extra layer of legitimacy in a week when credibility was in short supply.

Still, a Word of Caution

Not everyone’s convinced this rally has legs. Analysts at CoinDesk warned that while the buzz is real, the fundamentals haven’t necessarily caught up yet. They noted that traders should be wary of the project’s large token supply, fierce competition, and the risk of a price built more on narrative than substance.

Aster’s 8 billion token max supply doesn’t help either — over half of it’s set aside for community rewards and airdrops. The platform runs as a hybrid decentralized exchange offering both spot and perpetual trading, plus a few high-leverage features and privacy tools like hidden orders.

Holding the Line

As of now, Aster is trading around $1.06, still holding strong above pre-CZ levels despite a bit of profit-taking. Whether this turns into a sustainable altcoin rally or fades once the hype cools off remains to be seen.

One thing’s for sure, though — CZ might not be running Binance anymore, but when he moves, the market still listens.