- Ethereum’s TVL grew 16x since 2020, hitting $379B in 2025.

- Institutional tokenization could 10x that number again, driving ETH’s value higher.

- The Fusaka upgrade will push Ethereum’s speed to 12,000 TPS, unlocking massive on-chain potential.

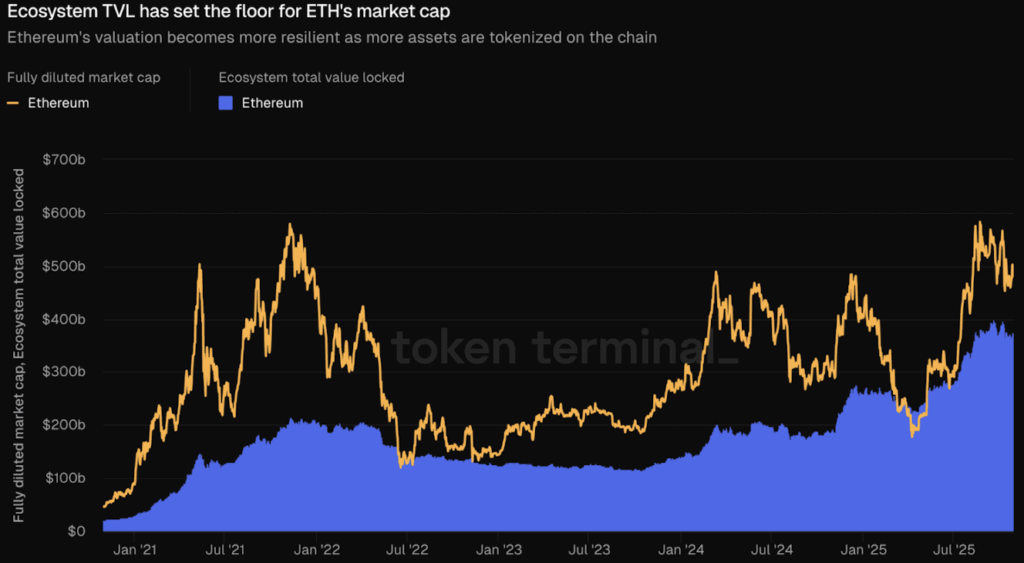

Ethereum’s rise as the backbone of decentralized finance keeps gaining steam. In just five years, its total value locked (TVL) exploded from about $24 billion in 2020 to roughly $379 billion in 2025. That’s a sixteenfold surge—insane growth that speaks volumes about how mature and deeply integrated Ethereum has become within global crypto markets. Alongside that, Ethereum’s market cap soared from $47 billion to around $502 billion, showing an 11x climb as investor confidence piled up behind ETH.

Looking at Token Terminal’s data, Ethereum’s TVL has quietly served as a stabilizer through rough patches like the brutal 2022 bear market and even the April 2025 correction. Each major dip didn’t just recover—it bounced back stronger, setting higher lows for both TVL and ETH’s valuation. That pattern kind of signals how investors now see Ethereum less like a speculative asset and more like digital infrastructure. The network’s three main drivers of TVL—stablecoins, lending, and staking—make up the bulk of its foundation. Stablecoins led by Tether dominate with $189 billion, lending protocols such as Aave chip in around $82 billion, and liquid staking systems like Lido and EigenLayer stack up another $73 billion.

Institutional Tokenization Could Multiply Ethereum’s TVL

Despite how huge those figures sound, it’s really just the start. Big financial players have barely dipped their toes into on-chain finance. BlackRock, sitting on $13.5 trillion in assets, has only about $2.9 billion tokenized on Ethereum. Fidelity, with $6.4 trillion, has just $231 million deployed. If large-scale tokenization really takes off—and it looks like it might—the TVL on Ethereum could jump 10x again over the next few years. That kind of institutional capital flooding in could reignite the correlation between Ethereum’s market cap and its TVL, pushing ETH’s fair valuation to new heights we’ve probably never seen before.

The Fusaka Upgrade Is About To Redefine Ethereum’s Speed

Next up is Fusaka, Ethereum’s upcoming major upgrade, and it’s kind of a big deal. The update plans to ramp up throughput from the current 3,100 transactions per second to around 12,000. It’s bringing in PeerDAS (Peer Data Availability Sampling) and better blob handling to slash layer-2 rollup costs. According to ETH researcher Leo Lanza, this improvement triggers something like the Jevons Paradox: the more efficient Ethereum becomes, the more people will actually use it. Basically, faster and cheaper transactions mean more demand, not less.

With DeFi, tokenization, and on-chain settlements becoming more mainstream, these upcoming EIP-7691 and blob-related upgrades are setting Ethereum to extend its lead over every other chain. What we’re seeing isn’t just network growth—it’s the evolution of the next global financial layer, built entirely on Ethereum rails.