• BONK gained 4.6% to $0.00001394, breaking out above key resistance.

• Trading volume surged 67%, confirming growing trader participation.

• Sustaining above $0.00001380 could set up a move toward $0.00001450+.

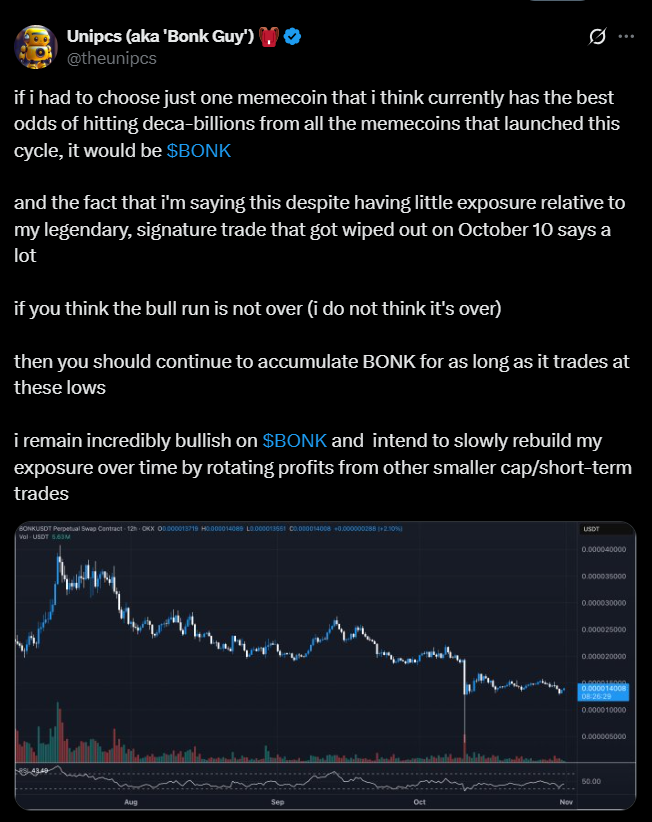

Solana’s leading meme coin BONK (BONK-USD) has flipped bullish again, gaining 4.6% to reach $0.00001394 and extending its recent recovery streak. The rebound marks a breakout above $0.00001380, where the token established strong buying support, and a new local high near $0.000013968 has emerged.

According to CoinDesk Research’s technical model, BONK’s 24-hour trading range tightened between $0.00001281 and $0.00001410, showing a more controlled volatility phase despite higher market participation. Traders appear to be regaining confidence, as BONK continues to print consecutive higher lows, forming a solid ascending structure.

Volume and Sentiment Show Fresh Optimism

Trading activity surged sharply, with volume up 67% compared to the 24-hour average, totaling around 1.15 trillion tokens. This uptick confirms renewed interest in BONK and the broader meme coin space, particularly among speculative traders looking to ride early momentum into November.

Sentiment across Solana-based meme assets has also improved, with cautious optimism returning to the market. Traders are now focusing on the $0.00001400–$0.00001410 resistance range as the next key target for BONK to breach.

Key Levels to Watch

If BONK can sustain momentum above $0.00001380, it could push higher toward $0.00001450 and beyond in the short term. However, a failure to hold that breakout level could send the token back into range-bound consolidation, erasing recent gains.

For now, technical structure and liquidity favor further upside, supported by increasing speculative volume and expanding volatility. BONK’s resilience amid broader market weakness has positioned it as one of the few meme tokens with short-term breakout potential.

Meme Coin Market Regains Attention

As meme coin trading reawakens heading into November, BONK’s recent moves suggest a possible sector rotation toward high-volume speculative assets. While risk remains high, BONK’s current setup reflects healthy market participation and a gradually improving sentiment that could carry over into the next week’s sessions.