- Solana’s $BSOL ETF led with $56 million in first-day trading but saw SOL price drop 3.6%.

- Hedera’s $HBR ETF had low volume ($8M) yet HBAR jumped 4.9%, signaling growing retail interest.

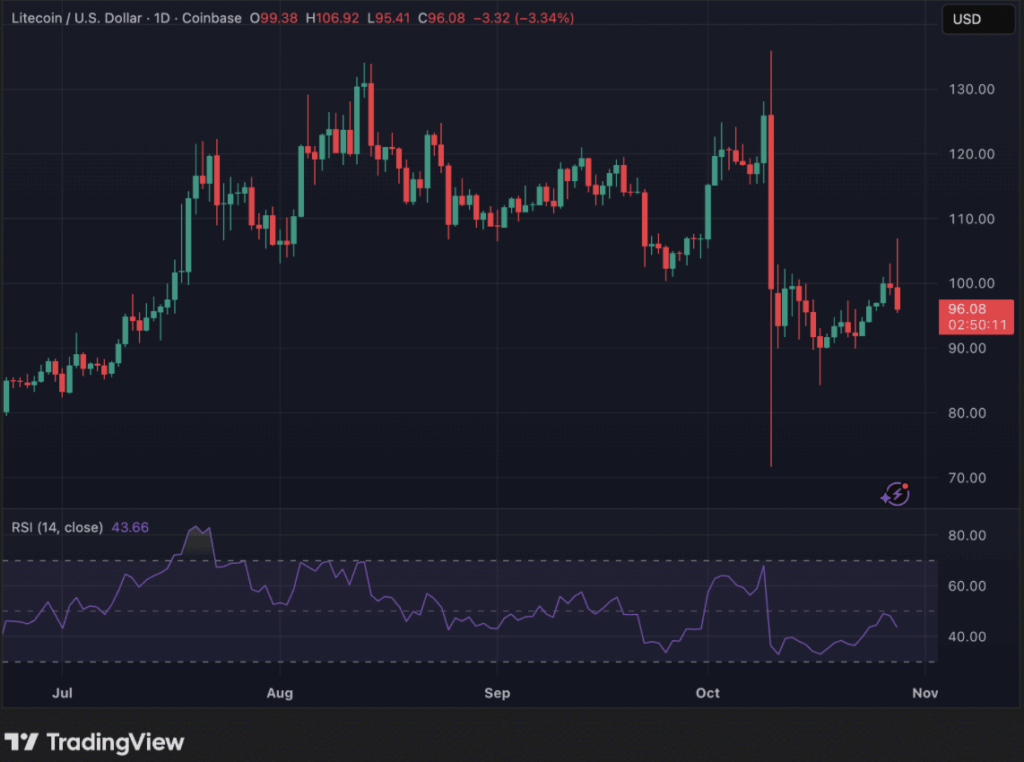

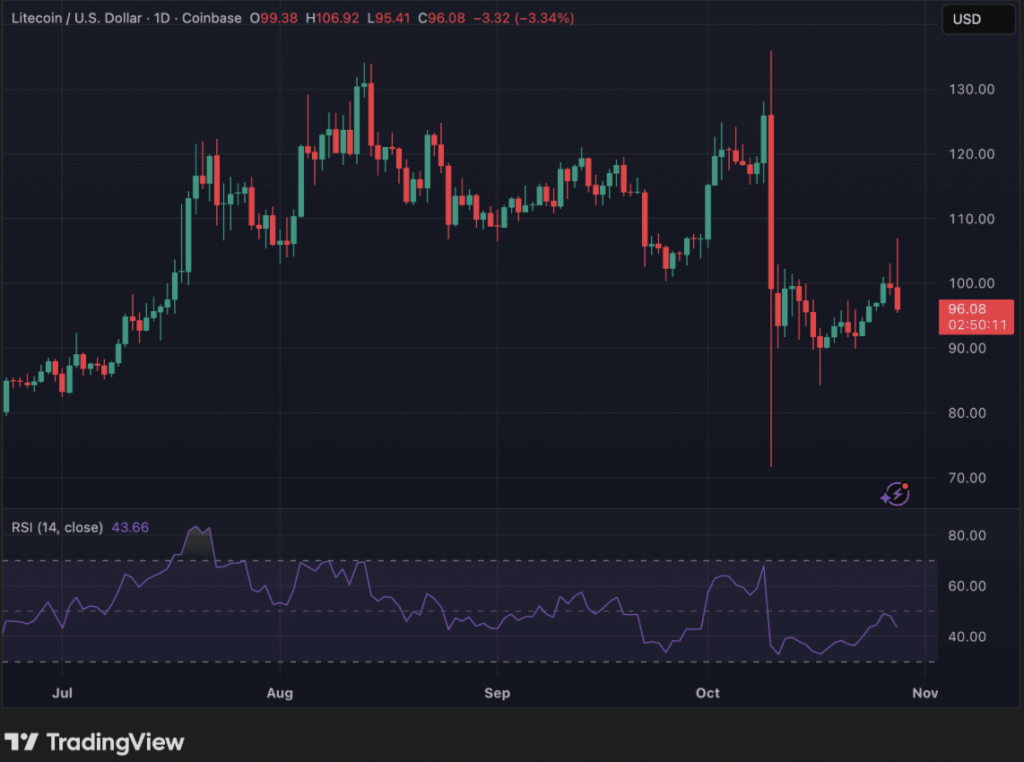

- Litecoin’s $LTCC ETF struggled with weak demand, reflecting fading hype for legacy crypto assets.

The first wave of U.S. altcoin ETFs finally hit the market on October 27, expanding the crypto ETF scene beyond Bitcoin and Ethereum. But instead of fireworks, the results were a little uneven. While Solana, Hedera, and Litecoinall saw trading debut under their new tickers — $BSOL, $HBR, and $LTCC — their market reactions couldn’t have been more different.

Solana ETF Sees Huge Demand, But Price Stumbles

Solana’s $BSOL ETF from Bitwise absolutely crushed the first-day stats, clocking in around $56 million in trading volume, the biggest of any ETF launch this year. But despite all that attention, SOL’s price slipped 3.6%, falling back to roughly $191 after briefly touching $203.

Technical charts show the RSI at 45, which signals neutral momentum — not really bearish, but not exciting either. A lot of traders believe the drop was classic buy the rumor, sell the news behavior. The hype leading up to the ETF probably pushed the price up, and now we’re just seeing profit-taking kick in.

Hedera ETF Surprises with Small Volume, Big Price Jump

On the flip side, Hedera’s $HBR ETF didn’t grab massive attention volume-wise — just about $8 million traded on day one — but the token itself popped nearly 4.9%, landing around $0.193. Its RSI climbed to 53, showing clear signs of bullish pressure.

That’s an interesting twist because it suggests that retail traders and smaller funds might be shifting toward lower-cap Layer-1s like Hedera, betting on potential staking rewards or future inflows. Basically, even though the ETF wasn’t as hyped as Solana’s, people seem to be warming up to HBAR’s long-term value story.

Litecoin ETF Struggles to Attract Interest

Then there’s Litecoin — which didn’t have the best day. The $LTCC ETF barely hit $1 million in first-day volume, and LTC’s price dropped 3.3% to around $96. Technicals weren’t looking too bright either, with an RSI near 43, hinting at weak buying interest.

It’s kind of the same story we’ve been hearing for months: Litecoin feels more like an old-school asset rather than a cutting-edge crypto. Unless volume picks up, this ETF might only appeal to niche investors or those nostalgic for crypto’s early days.

What the Market’s Reaction Really Means

All in all, the launch of these altcoin ETFs showed that not every listing sparks a rally. Investors aren’t throwing money blindly at new products anymore — they’re being selective, choosing projects with solid fundamentals, growth potential, or staking yields.

Still, the fact that three non-BTC, non-ETH spot ETFs launched successfully on U.S. markets is a big step forward. It signals that the crypto ETF space is evolving — becoming more mature, more diverse, and maybe a little less emotional.