- Whales pulled $9M worth of LINK off Binance, signaling growing confidence.

- LINK trades near $18.85, consolidating in a bullish pennant with targets up to $28.

- Rising Open Interest and aggressive futures buying hint at a potential breakout above $20.

Chainlink whales are moving again — and that’s usually not something the market ignores. Onchain Lens recently spotted a new wallet pulling 490,188 LINK, roughly $9 million worth, off Binance. That withdrawal brought the wallet’s total holdings to about 771,095 LINK valued near $14 million. Big moves like this often hint at confidence returning, and it looks like large holders are quietly stacking while supply on exchanges keeps dropping.

Accumulation Builds a Bullish Foundation

Historically, heavy whale withdrawals have come just before major LINK rallies. This time seems no different. The steady accumulation suggests that institutions or long-term holders might be positioning early — potentially expecting a breakout in the near term. It’s the kind of behavior that has traders watching closely for confirmation.

At the same time, Chainlink’s price structure has tightened up. The token’s been consolidating inside a bullish pennant, hovering around $18.85 and testing resistance at $19.91. If bulls can push through that zone, the next major targets lie at $23.77 and $28.06. On the flip side, if $16.51 support gives out, LINK could stall temporarily, though the broader structure still leans positive. The RSI sitting around 48 leaves room for upside — momentum’s not overheated, but it’s definitely building.

Futures Data Backs the Bullish Case

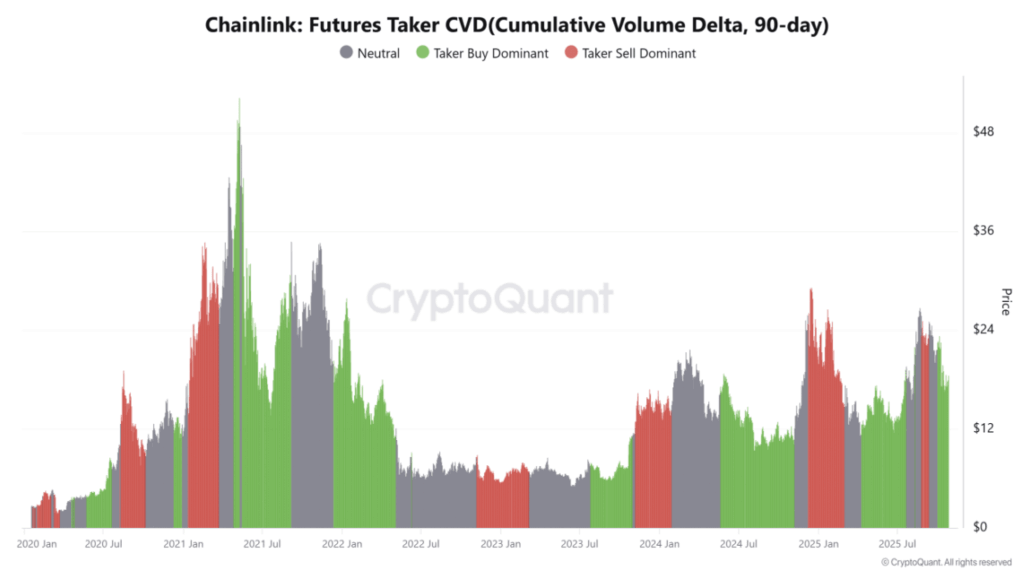

CryptoQuant’s Futures Taker CVD data shows traders are getting aggressive on the buy side. Market buys are outpacing sells, which usually signals strong conviction that prices will move higher. This kind of assertive trading behavior lines up neatly with the ongoing whale accumulation — both pointing toward growing optimism.

Meanwhile, Open Interest jumped 7.7% to nearly $695 million, signaling more capital flowing into Chainlink’s derivatives markets. Rising OI combined with whale accumulation typically means speculators are preparing for volatility — and usually, that’s when big moves happen. The setup suggests traders are betting on continuation rather than correction.

All Eyes on $20

Right now, all signs seem to converge around one key level: $19.91. That’s the resistance bulls need to crush for a confirmed breakout. If LINK manages to close above it with strong volume, $23 and beyond could come into play quickly.

As it stands, Chainlink’s setup looks strong — tightening pennant formation, whale accumulation, and rising trader participation all paint a picture of quiet strength. It’s that kind of calm before the storm moment that makes people nervous to blink, just in case the next candle does something wild.