- Ethereum is trading around $3,900 after $93M in ETF outflows, with $3,800 serving as key support before a possible rebound.

- BlackRock sold $101M worth of ETH, signaling short-term caution among institutions.

- Analysts like Tom Lee and Arthur Hayes remain bullish, projecting ETH could hit $10K–$22K by 2027.

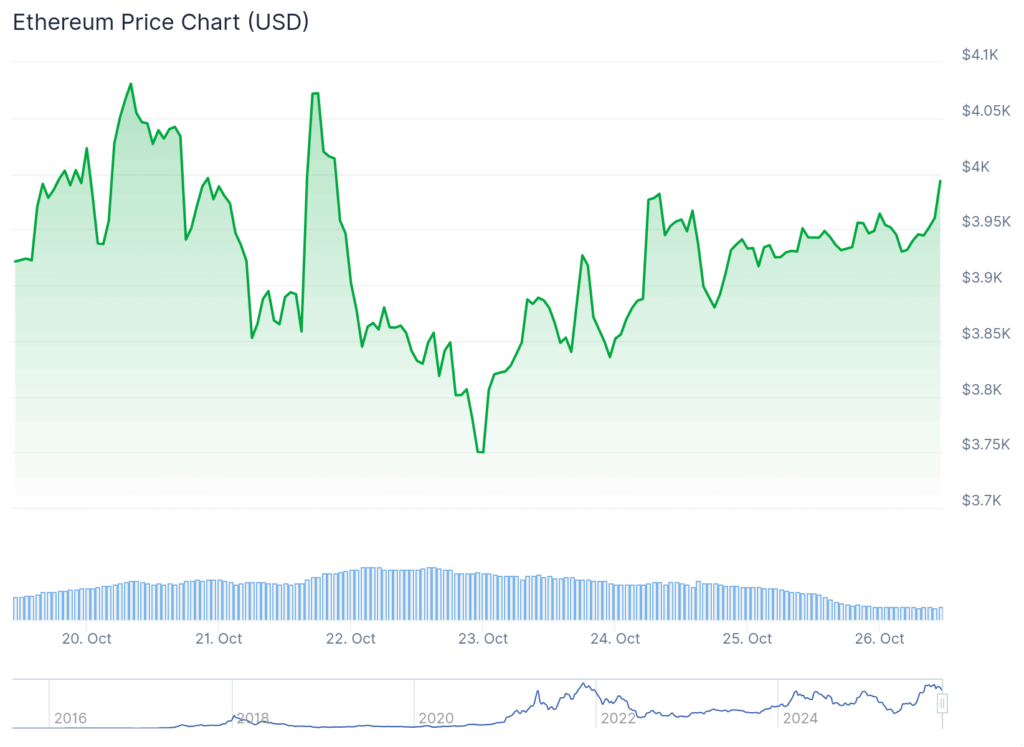

Ethereum’s been dancing around the $4,000 mark all week, testing resistance over and over but failing to stick the landing. The second-largest cryptocurrency is holding near $3,900 — still solid — even as $93 million flowed out of Ethereum ETFs. The short-term sentiment feels shaky, but long-term analysts are staying optimistic, with some still calling for a massive run toward $10,000 or even beyond in the next few years.

Short-Term Pullback, Long-Term Faith

Right now, ETH is trading around $3,926, with market cap hovering near $474 billion and daily trading volume over $34 billion. Analysts like Ted Pillows think a quick retest of the $3,800 level could come before the next real move higher. Historically, that zone has been a reliable support level — where buyers tend to step in to stop further drops. A clean bounce from there might finally give Ethereum the momentum to reclaim $4,000 convincingly.

On the ETF side, it’s been a rough stretch. BlackRock sold about $101 million worth of ETH, contributing to $93 million in total outflows across Ethereum ETFs. These institutional redemptions usually point to short-term caution — funds pulling back while the market cools off. Still, on-chain metrics remain strong, and many investors are viewing this dip as nothing more than a pause before the next push.

Analysts Still See a $10K–$20K Future

Despite the near-term struggle, Ethereum’s big-picture outlook remains overwhelmingly bullish. Ali Martinez and Arthur Hayes both project ETH climbing toward $10,000 by 2027, citing consistent growth in DeFi activity and institutional adoption. Hayes even called recent volatility “just noise in an uptrend.” Meanwhile, Tom Lee says Ethereum’s fair value might sit somewhere between $12,000 and $22,000 — making current prices look almost cheap by comparison.

Technically, ETH needs a daily close above $4,000 to confirm momentum, with the next resistance sitting near $4,140. If it breaks that, $5,000 becomes the next obvious target. But if price dips below $3,800, traders will be watching $3,550 as the critical support zone. Either way, the sentiment is clear: short-term pressure, long-term conviction. Ethereum might just be catching its breath before the next leg higher.