- Ethereum is testing a major resistance zone around $4,000–$4,100 after bouncing from $3,800 support.

- Analysts highlight a potential cup-and-handle pattern, suggesting a breakout if ETH closes above $4,100 on volume.

- Upcoming CPI data and the Fed meeting could act as catalysts for Ethereum’s next move, either toward $4,250 or back to $3,800.

Ethereum’s holding steady near $4,000, just under a crucial resistance zone that could decide its next big move. After defending the $3,800 support, the market’s now asking the same question — will ETH finally punch through overhead pressure, or is another rejection waiting around the corner?

ETH Holds Ground Around $3,800

Ethereum has managed to claw its way back from recent lows, currently hovering close to the $4,000 mark. The token found strong footing between $3,790 and $3,815, a zone that’s acted like a springboard several times this month. Beneath that, there’s another sturdy base forming between $3,550 and $3,670, giving buyers some breathing room if things dip again.

Analyst Ted noted that ETH has once more bounced cleanly from $3,800 and is now testing that tough $4,000–$4,100 resistance band. Historically, sellers have crowded this area, forcing prices back down. But if bulls manage to break above it — and hold — the next logical target sits near $4,236–$4,265, a zone that’s flipped between support and resistance more than once.

Right now, ETH is pretty much range-bound. The direction it takes from here will depend on how the market reacts to this resistance ceiling. A strong push through could wake up the bulls, while another rejection might drag the price right back toward support.

Technical Setup Suggests a Breakout Brewing

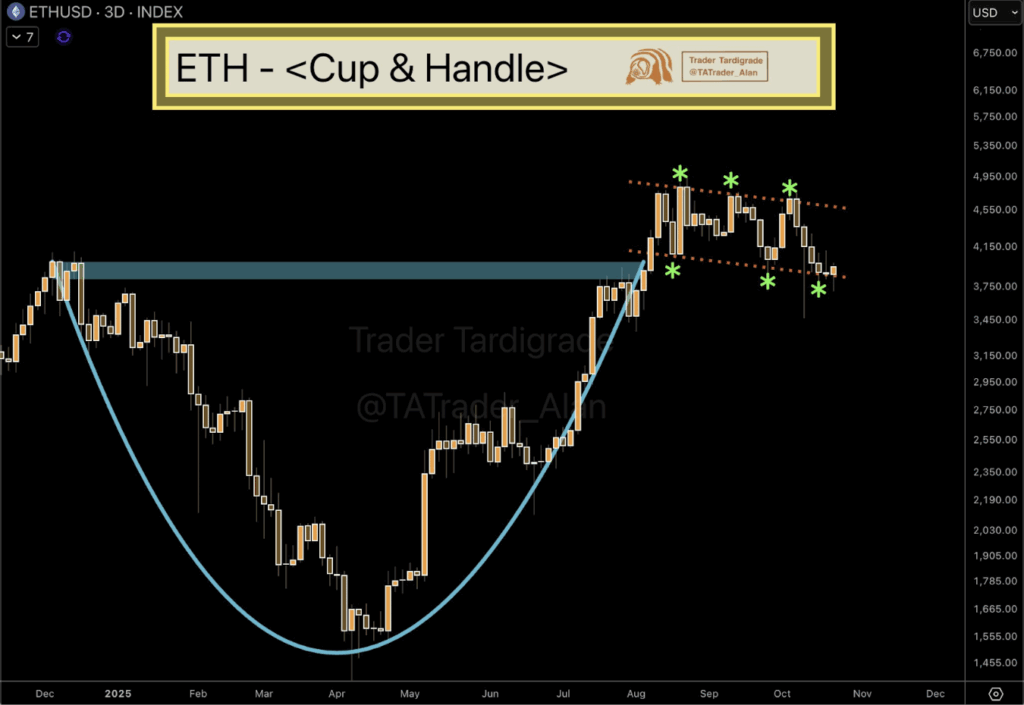

On the 3-day chart, Ethereum’s price action seems to be shaping into a classic cup-and-handle pattern — a formation that often hints at a bigger breakout down the road. The “cup” developed slowly between January and August, marking a long recovery phase after last year’s correction. Now, the “handle” appears as a downward-sloping channel, tightening momentum before a potential move.

Analyst Trader Tardigrade pointed out that ETH has made three touches on both the upper and lower bounds of this channel, forming what he calls a “controlled structure.” If the token breaks out above the top boundary on strong trading volume, it could confirm a bullish continuation.

Another analyst, Joe Swanson, mentioned a possible triple bottom near $3,750, describing it as a launchpad setup that could lead to a 10% rally toward $4,280 if $4,000 gives way. Meanwhile, EtherWizz sees the market in a Wyckoff-style reaccumulation phase, with a bold projection — a path to $7,000 if Ethereum can reclaim the $4,200 level convincingly.

Macro Events Could Steer the Next Move

There’s also the macro angle. The upcoming CPI data and the Federal Reserve’s meeting next week could rattle markets a bit, adding more volatility into the mix. Ted mentioned, “These events could bring some buy pressure in Ethereum and maybe trigger a short squeeze,” hinting that external catalysts might decide whether ETH can sustain momentum.

For now, most traders are staying cautious. Analyst Lennaert Snyder said he’s watching the $4,050 mark closely — possibly shorting if resistance holds or jumping in long if Ethereum pushes through decisively.

So far, ETH’s playing a waiting game. The $4,000–$4,100 area is the battleground to watch. A breakout could light the fuse toward higher levels, but a rejection might send the token back down for yet another retest of support. Either way, the next few sessions could decide whether Ethereum’s next chapter starts with fireworks — or frustration.