- Peter Schiff says Bitcoin “fundamentally fails as money” and will trend toward zero.

- He cites gold’s superior performance and Bitcoin’s fragile liquidity.

- Regulatory tightening and sentiment shifts could accelerate Bitcoin’s collapse.

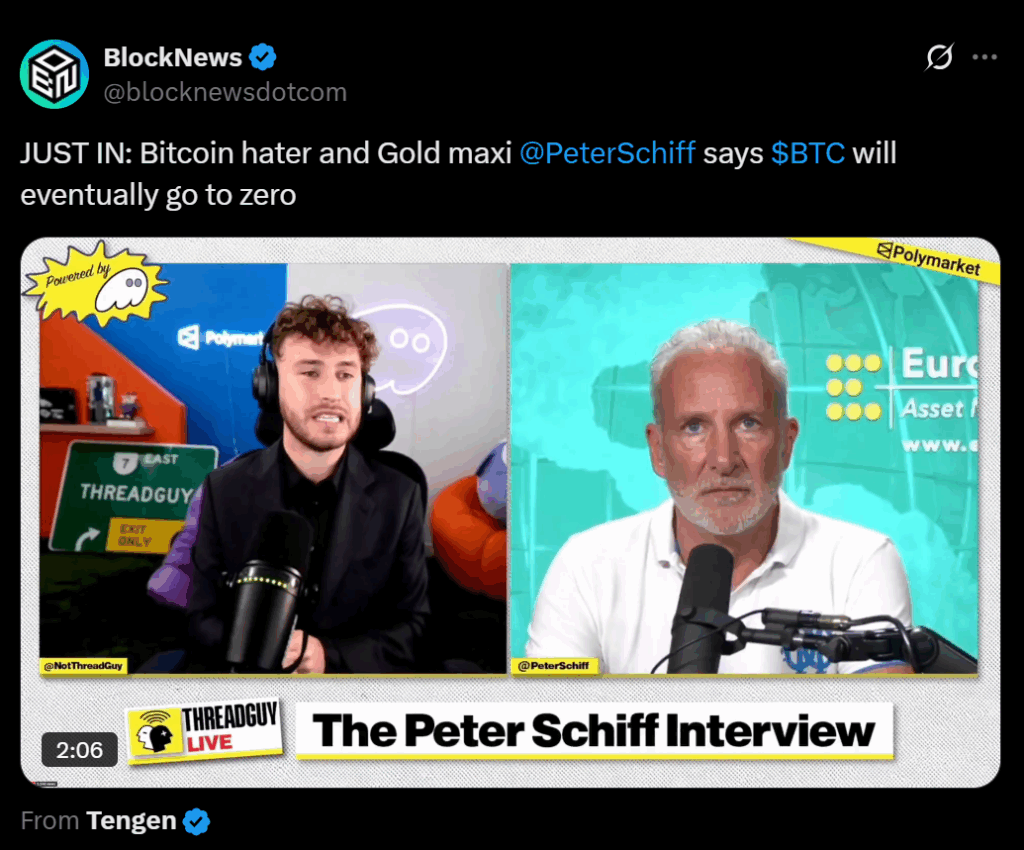

Peter Schiff has once again doubled down on his long-running call that Bitcoin will eventually hit zero, this time during a live Twitch chat with Threadguy. His reasoning? Bitcoin, he says, isn’t money—it’s just belief. According to Schiff, BTC “fundamentally fails as money” because it’s not a stable medium of exchange or widely accepted unit of account. Without cash flow, intrinsic value, or redeemable backing, the only thing holding price up is confidence. When sentiment cracks, he argues, that confidence can vanish fast—sending price into a free fall.

Gold Shines When Bitcoin Bleeds

For Schiff, the “digital gold” story collapses under pressure. Every time markets panic, gold catches a bid while Bitcoin stumbles. He points to the June selloff, when oil and gold rallied but BTC dipped, calling it proof that Bitcoin acts like a high-beta risk asset, not a safe haven. In his view, if Bitcoin can’t hold up when fear spikes, it fails the one test that defines real gold’s value.

ETF Hype Can’t Fix Liquidity Fragility

Schiff also takes aim at Bitcoin ETFs, calling them a “false fix” for a market built on unstable liquidity. He warns that ETF and institutional buying concentrates flows—fine while demand lasts, but dangerous when it reverses. “Who buys from you at size when you need out?” he asked Michael Saylor earlier this year. In his eyes, Bitcoin’s float isn’t just miner output—it’s every long-term holder who could panic-sell once the narrative breaks.

Governments Can Still Squeeze Crypto

The fourth prong of Schiff’s case is regulation. He believes governments will gradually choke Bitcoin’s real-world use—limiting on-ramps, tightening custody, and enforcing tougher taxation—until the “crypto as money” dream fades. This summer, he called Bitcoin a “decentralized Ponzi propped up by politics,” arguing that even friendly rhetoric from Washington can’t offset the growing operational pressure. His prediction: the next global credit crunch will reveal Bitcoin’s fragility rather than its strength.

Gold Outperforms, Bitcoin Underperforms

Finally, Schiff returns to the scoreboard. On days when gold rises and Bitcoin lags, he says it’s the ultimate tell: institutions chasing safety still choose metal, not math. Each divergence, he argues, erodes Bitcoin’s macro credibility. As he put it this week, “The digital gold narrative is bleeding out in real time.”

Whether or not his “zero” thesis proves right, Schiff’s reasoning is consistent: no intrinsic value, weak liquidity, government risk, and gold dominance. To him, Bitcoin’s survival depends not on philosophy—but on flows.