- Gold’s 5–6% crash triggered a capital rotation into crypto.

- Softer rate expectations and sub-4% yields lifted risk appetite.

- Light leverage and clean positioning amplified the rebound.

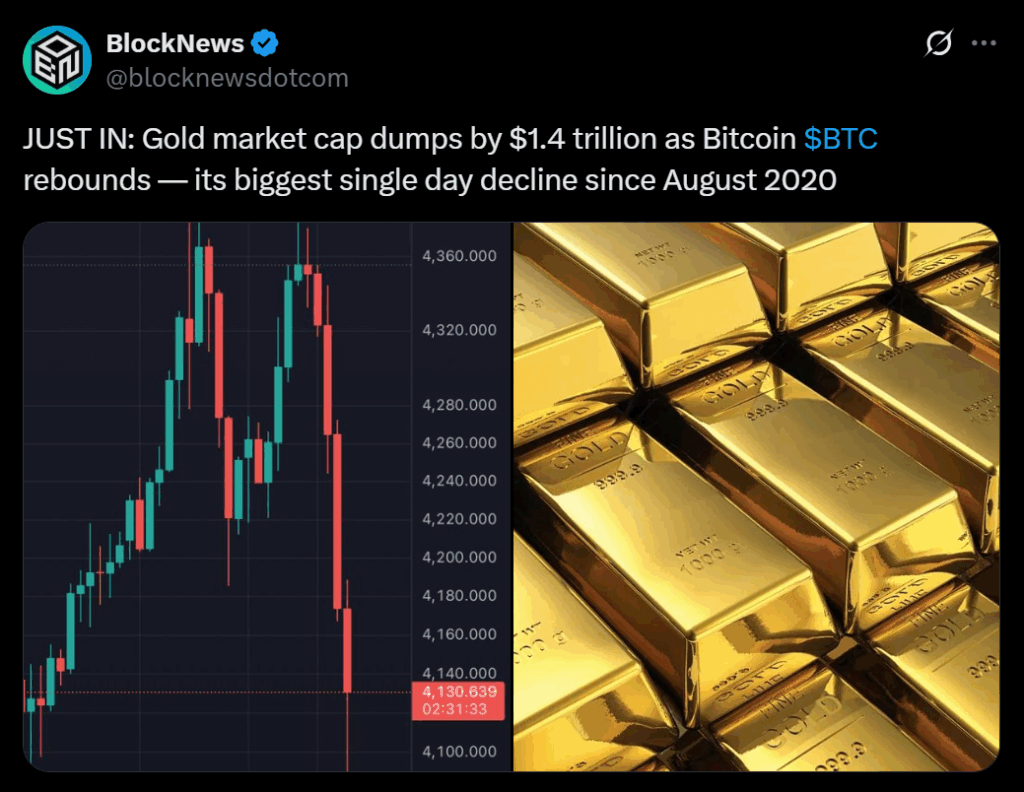

Crypto ripped higher intraday after a shaky open—the classic shakeout-then-slingshot. Under the hood, three forces did most of the lifting: a violent safe-haven unwind in metals (which sparked rotation), friendlier macro expectations on rates, and a cleaner market structure after last week’s historic flush. Here’s the rundown with today’s numbers.

1) A shock selloff in gold flipped the “risk” switch

Gold had its biggest one-day drop since 2020, tumbling roughly 5–6% from yesterday’s record toward $4,11x/oz by mid-session. That’s a dramatic reversal in less than 24 hours—and when the “ultimate hedge” pukes that hard, fast money often rotates into the most liquid risk asset on the board. Today, that rotation impulse lined up with a quick bounce in majors after Bitcoin briefly probed the low $108K–$107K area and snapped back.

The mechanics are simple: big, sudden de-risking in metals forces profit-taking and frees up capital; some of that flows to high-beta plays that can move now. Crypto fits the bill. As gold slid, the dollar index edged higher to the 98.6–98.9 zone, which normally pressures risk—but the sheer size of the metals unwind overwhelmed that headwind and lit up dip-buyers across BTC and large caps.

2) Rate expectations turned a shade easier—and yields dipped under 4%

Fresh polling today showed economists now expect two more Fed cuts before year-end (October and December meetings), taking the policy rate toward 3.75–4.00%. Even if the path beyond 2025 is foggy, the near-term shift helps risk assets: cheaper money, looser financial conditions, better multiple support. Markets love direction of travel, and the direction—right now—is toward additional easing.

You could see that relief in the U.S. 10-year slipping back to roughly ~4.00% (even ~3.99%) through the session. Crypto behaves like a long-duration asset; every basis-point drop in yields softens the “gravity” on high-beta. With Treasuries calm and no surprise hawkish headlines, the tape had room to breathe, letting the rebound extend beyond a mere scalp.

3) Structure favored a face-ripper: leverage lighter after last week’s washout

The market came into today de-risked. In the past two weeks we’ve seen multiple, record-scale liquidation waves—single-day wipes running into the billions—that cleared crowded longs and forced hedges. That kind of purge resets positioning so that even modest buy programs (or an external catalyst like the gold puke) can punch prices higher, fast. It’s reflexive: cleaner books → thinner resistance → bigger percentage moves on the way up.

You can feel the difference on intraday breaks: instead of immediate waterfall selling, dips are getting bought quicker, and squeezes travel further before stalling. Put another way—after the October carnage, the market’s powder keg has less loose leverage sitting on top. That lowers the threshold for squeeze-driven upside when a fresh catalyst hits (today: metals mayhem + rates relief).