- XRP crashed 70% in minutes before rebounding, sparking insider speculation.

- Institutions like Reliance Global are adding XRP to corporate treasuries.

- Ripple expands globally, securing a UAE license and rolling out RLUSD in Africa.

XRP’s had quite the year — the token’s up more than 347% since January, now trading around $2.41. But yesterday wasn’t smooth sailing. Out of nowhere, a sharp sell-off hit the market, sending shockwaves across the crypto space and leaving traders scrambling to figure out what just happened.

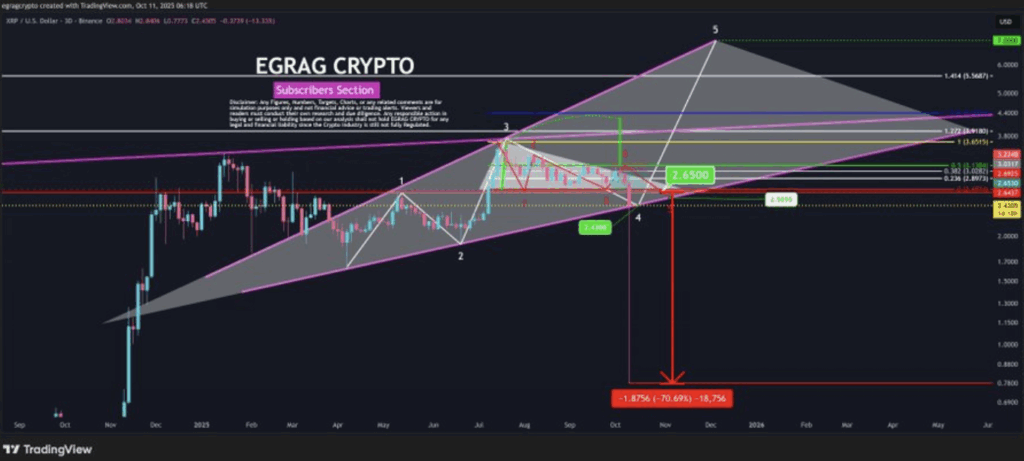

The drop was brutal. Within eight minutes, XRP plunged nearly 70%, crashing from $2.65 to just $0.78 before bouncing back. Bitcoin and Ethereum also dipped, though nowhere near as severely — falling about 13% and 15%, respectively. For many XRP holders, it felt less like a correction and more like someone had pulled the rug.

Market analyst Egrag Crypto suggested the crash was likely engineered to wipe out overleveraged long positions. The timing didn’t help either — large short positions were reportedly opened just hours before the move, which raised eyebrows about potential insider activity.

Still, even after the carnage, XRP didn’t completely unravel. The token’s managed to hold key support levels, showing a surprising level of strength given the panic. And as dust settles, the narrative is shifting back to fundamentals — XRP’s growing role in institutional finance and global payment systems.

Institutions Quietly Back XRP as a Treasury Asset

What’s fueling optimism is the increasing number of big companies adopting XRP for more than just trading. Reliance Global, a Nasdaq-listed firm, recently added XRP to its digital treasury, treating it like a reserve asset rather than a speculative bet. That’s a huge step toward legitimizing XRP as a real balance sheet component, not just a “crypto token.”

Similarly, VivoPower launched a new initiative called XRPFi, blending corporate finance with blockchain-based yield strategies powered by the XRP Ledger (XRPL). It’s a small but telling sign that traditional firms are starting to tap XRP for efficiency and yield — not hype.

Ripple’s own moves have been equally aggressive. The company’s $1.25 billion acquisition of Hidden Road, a prime brokerage platform, signals a clear push deeper into institutional infrastructure. With that deal, Ripple can bring its post-trade systems directly onto XRPL, effectively positioning XRP as a financial backbone for cross-border clearing and settlements.

Ripple Expands Its Global Network and Challenges SWIFT

Ripple’s ambitions aren’t stopping at brokerage. The firm’s global payment network is expanding fast, and the RLUSD stablecoin rollout is the latest example. Recently launched in Africa, RLUSD is being integrated with Chipper Cash, VALR, and Yellow Card to power blockchain-based remittances and enterprise settlements.

In the UAE, Ripple has made even bigger strides — earning a regulatory license from the Dubai Financial Services Authority (DFSA). This makes it one of the few blockchain payment providers allowed to operate within the DIFC, one of the world’s most respected financial hubs. Ripple also locked in partnerships with Zand Bank and Mamo, further strengthening its Middle East foothold.

All these developments point in one direction: Ripple is positioning XRP at the center of next-generation payments — faster, cheaper, and far more integrated with real-world finance. While short-term volatility keeps traders nervous, the long-term picture looks increasingly clear.

The Bigger Picture

XRP might’ve just weathered one of its wildest trading days ever, but the token’s still standing strong. The crash flushed out weak hands and overextended traders, while the fundamentals — institutional growth, global expansion, and real utility — remain intact.

If anything, this chaos might’ve been a reset before the next wave. Because while the charts tell one story, the money — and the partnerships — are quietly telling another.