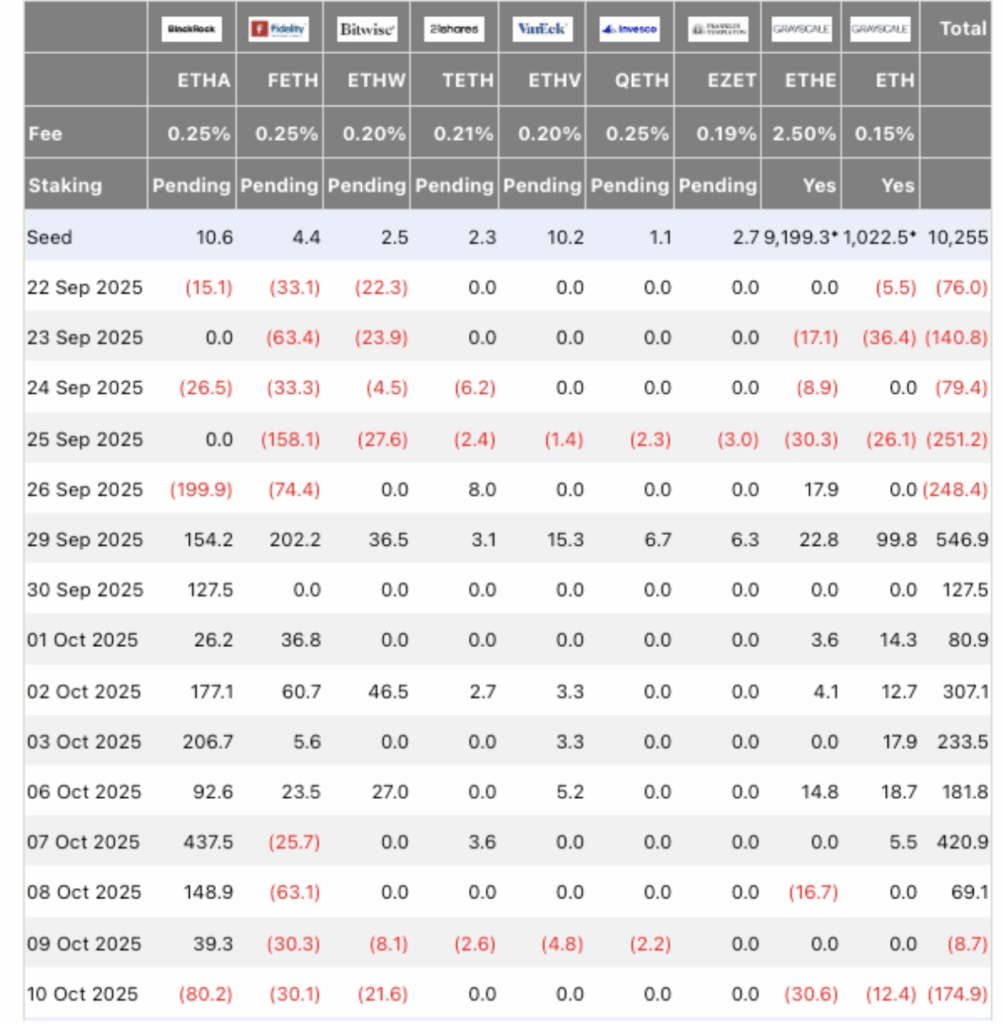

- BlackRock sold $80 million in Ethereum, sparking a 14% drop before ETH rebounded above $3,800.

- Despite ETF outflows, staking deposits surged by $114 million, showing growing long-term confidence.

- Validator activity increased as fewer users exited staking, hinting that ETH holders are staying bullish.

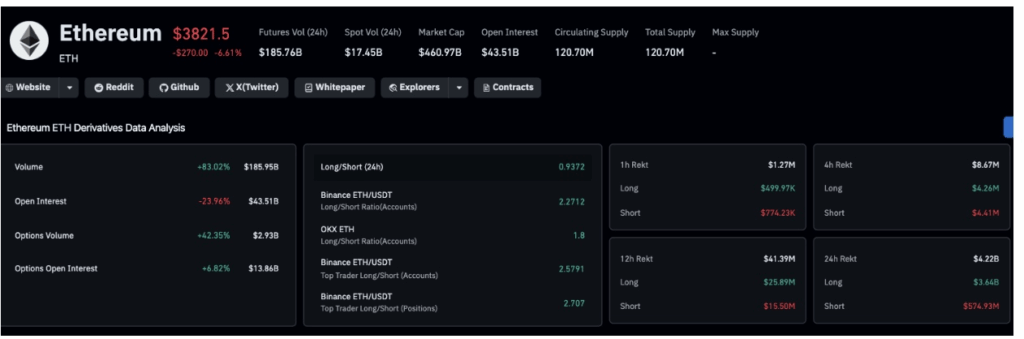

Ethereum had a wild weekend. The price plunged to $3,500 on Saturday after BlackRock reportedly sold off around $80 million worth of ETH, triggering a wave of liquidations across the market. Bitcoin slipped too, but not as badly—dropping just 7% while Ethereum tumbled over 14%. By late Saturday, ETH managed to claw its way back above $3,800, thanks in part to a surprising $114 million surge in staking inflows that steadied the decline.

Data from Farside Investors showed that Ethereum ETFs saw outflows of $174 million on Friday, with BlackRock leading the exodus. Meanwhile, their Bitcoin ETF (IBIT) absorbed $74 million in new inflows, showing that some institutions were simply rotating positions from ETH into BTC. The sell pressure also lined up with broader market chaos after new U.S.-China tariffs spooked investors, sparking a series of forced liquidations that drained billions from crypto markets overnight.

Derivatives Liquidations and Market Sentiment

The fallout was rough. According to Coinglass, over $3.6 billion in ETH derivatives were liquidated within 24 hours, and the long/short ratio dropped to 0.94—a clear shift toward bearish sentiment. Traders rushed to unwind positions as volatility spiked, creating a feedback loop that pushed ETH down even faster.

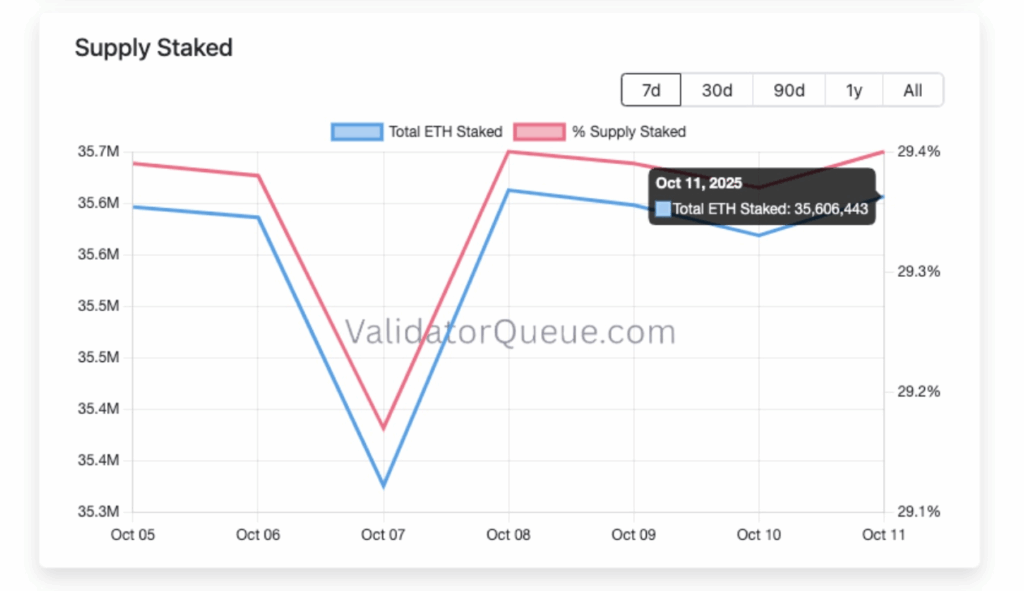

Despite the panic, Ethereum’s fundamentals didn’t really falter. The Beacon Chain showed a rise in validator deposits even as ETFs dumped tokens. For every dollar leaving institutional funds, roughly another was flowing into staking contracts—almost like retail and long-term holders were picking up what big money was dropping.

Staking Signals Confidence

On-chain data from ValidatorQueue painted a very different picture than the ETFs did. The number of new deposits jumped by nearly 1.35 million ETH, while the exit queue dropped from 2.38 million to 2.35 million ETH. That means fewer validators are pulling out, and more are joining the network. In just 24 hours, staking deposits rose by around 29,800 ETH (worth about $114 million), while withdrawals fell by roughly the same value.

In short—it looks like some traders decided to skip the panic and lock up their ETH for yield instead. This kind of behavior usually hints at confidence in Ethereum’s long-term strength. It’s like the market saying, “yeah, short-term pain, but we’re still in.”

Rebound and What Comes Next

At press time, Ethereum had bounced back to $3,823, showing resilience even as major ETFs pulled money out. Analysts think the current staking demand might cushion the downside over the next few days, especially if Bitcoin stabilizes.

BlackRock’s move might’ve sparked a sell-off, but it also highlighted the split between speculative traders and long-term believers. As staking continues to grow, Ethereum’s network security and yield potential could end up being the quiet hero holding the floor while the whales reshuffle their portfolios.