- VeChain slips to 78th with a $1.91B market cap amid market correction.

- Analysts expect sideways action but note a potential Q4 rebound if Fed cuts rates.

- October’s bullish historical trend could help VET recover lost ground.

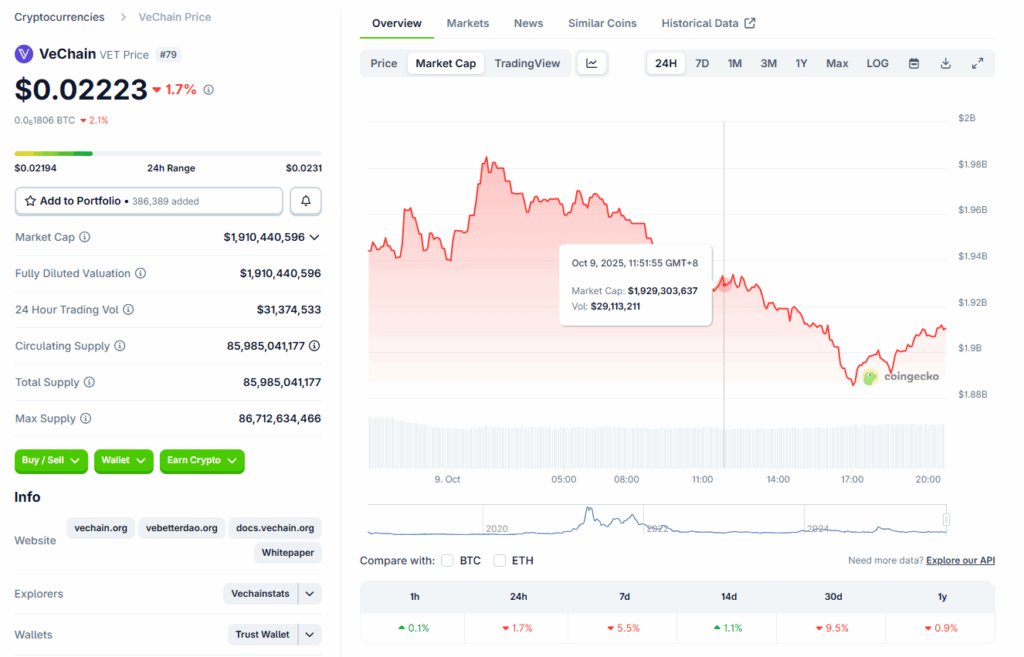

VeChain (VET) has continued its bearish streak, slipping out of the top 50 and landing in 78th place by market capitalization. The asset’s market cap now stands at $1.91 billion, down significantly from earlier highs. Over the past month, VET has dropped 8.1%, with a 4.6% decline over the last week and a modest 0.7% correction in the past 24 hours, according to CoinGecko data.

The downturn reflects a broader cooling across mid-cap altcoins amid global market uncertainty. Once a leader in blockchain supply chain solutions, VeChain now faces muted investor enthusiasm as momentum shifts toward higher-yield tokens and newer infrastructure plays.

Why VeChain Is Struggling

VeChain had shown strength in late 2024, climbing as high as $0.0777, but since then, the token has faced steady pressure. Macroeconomic challenges, including trade tensions and slowing global growth, have dampened appetite for riskier assets. The most recent correction also coincided with profit-taking cycles that hit altcoins particularly hard.

Still, VET’s fundamentals remain intact. Its enterprise partnerships and focus on real-world utility continue to set it apart from purely speculative projects. The challenge, however, lies in reigniting investor confidence and liquidity after months of sideways trading.

Signs of Potential Recovery

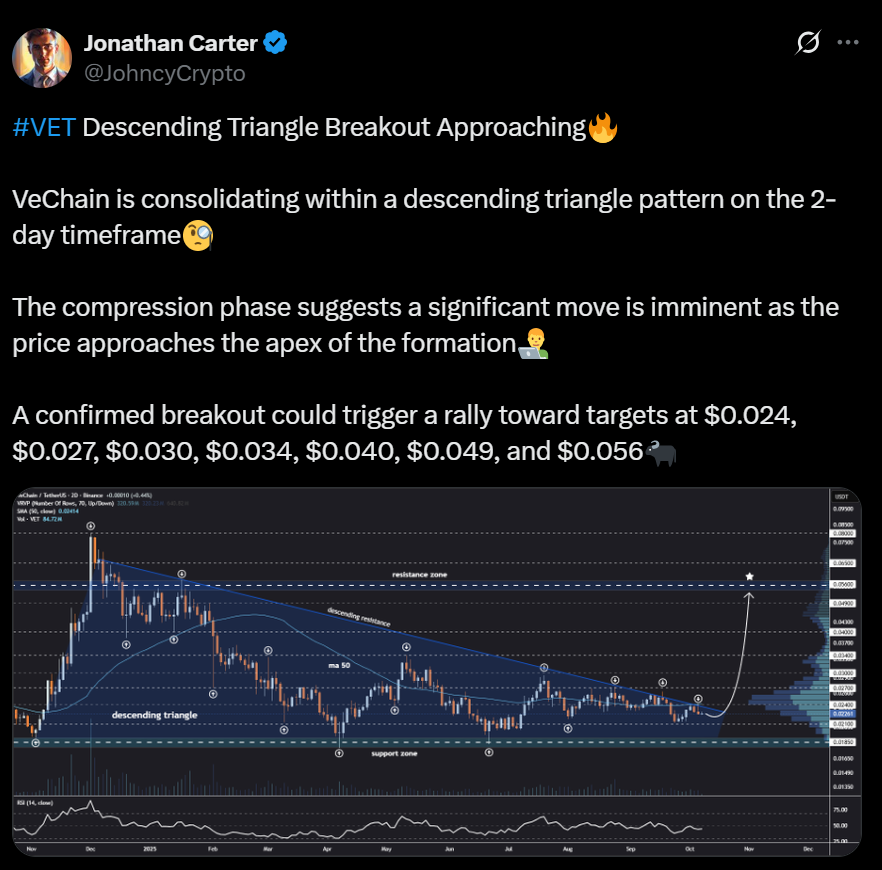

Some analysts expect the coming weeks to bring relief. The Federal Reserve is anticipated to roll out another interest rate cut, which could spark renewed inflows into risk assets like crypto. If that happens, VeChain may reclaim its December 2024 price levels, supported by a broader market rebound.

Historically, October has been a bullish month for cryptocurrencies, and with Bitcoin nearing a potential retest of its all-time high, a rising tide could lift altcoins like VET. A market-wide rally could also help VeChain regain visibility among institutional and retail traders who have shifted focus elsewhere.

What Analysts Are Saying

Despite optimism around macro catalysts, CoinCodex forecasts a more conservative outlook. The platform predicts that VET’s price will consolidate near current levels for the coming weeks, targeting around $0.029 by November 29. For long-term investors, this could signal a period of accumulation before the next major move.

Final Thoughts

VeChain’s fall to 78th in market cap is a clear signal of the sector’s competitiveness. However, with potential monetary easing ahead and Bitcoin setting the tone for the next market cycle, VET still has room to recover. If macro conditions improve and investor sentiment turns risk-on, VeChain could stage a slow but steady comeback through Q4.