- XRP fell to $2.85 as the crypto market lost $60B in one hour, with BTC dipping to $120K.

- The token has been trading sideways in October, with volume falling to $7.1B.

- XRP ETF approval in November could unlock institutional inflows and trigger a breakout above $3.

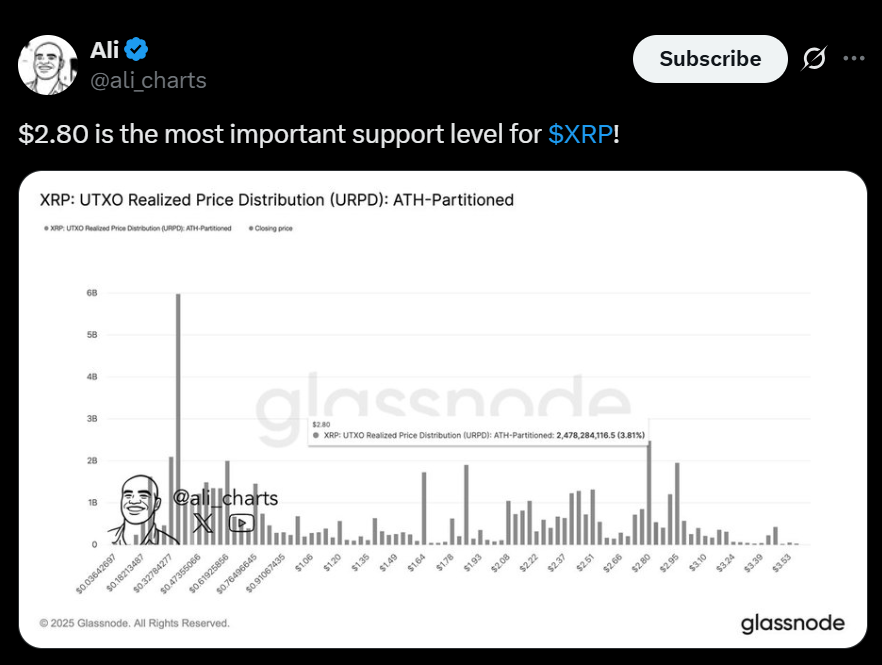

The crypto market shed over $60 billion in value within a single hour on Wednesday, pulling Ripple’s XRP down to $2.85. It marked the second time this month XRP briefly broke above $3 before slipping back into the $2.80 range. Bitcoin also corrected from its $126,080 all-time high on Monday to around $120,000, highlighting the volatility dominating October trading.

Sideways Action Defines XRP in October

XRP has been largely stagnant this month, moving sideways with limited momentum. Over the past two weeks, the token has risen just 1.5%, while its daily trading volume slipped to $7.1 billion — down $1.4 billion since the start of October. Despite repeated rebounds back to $3, the lack of strong buying pressure has left XRP consolidating without a clear breakout.

Accumulation Opportunity or More Risk?

For swing traders, XRP’s repeated dips to the $2.80 level may present an opportunity to accumulate before potential rebounds. Historically, the token has bounced back to $3 after each drop. If Bitcoin reclaims the $125,000 range, XRP could once again follow the broader market higher. With both retail and institutional traders watching closely, the setup remains a mix of caution and optimism.

XRP ETF Approval Could Be the Game-Changer

The SEC recently delayed its decision on pending XRP ETF applications until November. A green light could unlock major institutional inflows, replicating the dynamic seen when Bitcoin ETFs were first approved. Back then, BTC soared from $60,000 to over $100,000, signaling how impactful ETF approval can be. For now, the ETF outcome looms large as the next major catalyst that could determine XRP’s Q4 trajectory.