- $352M in futures positions were liquidated in 24 hours, with $227.7M from shorts and $124.6M from longs.

- Ethereum led with $78.4M liquidated, followed by Bitcoin with $63.9M.

- Short squeezes drove much of the action as BTC and ETH surged near record highs.

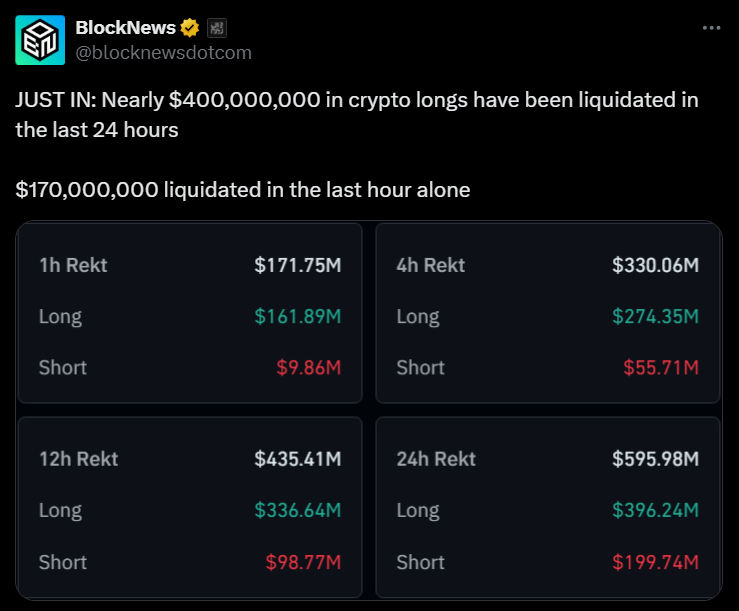

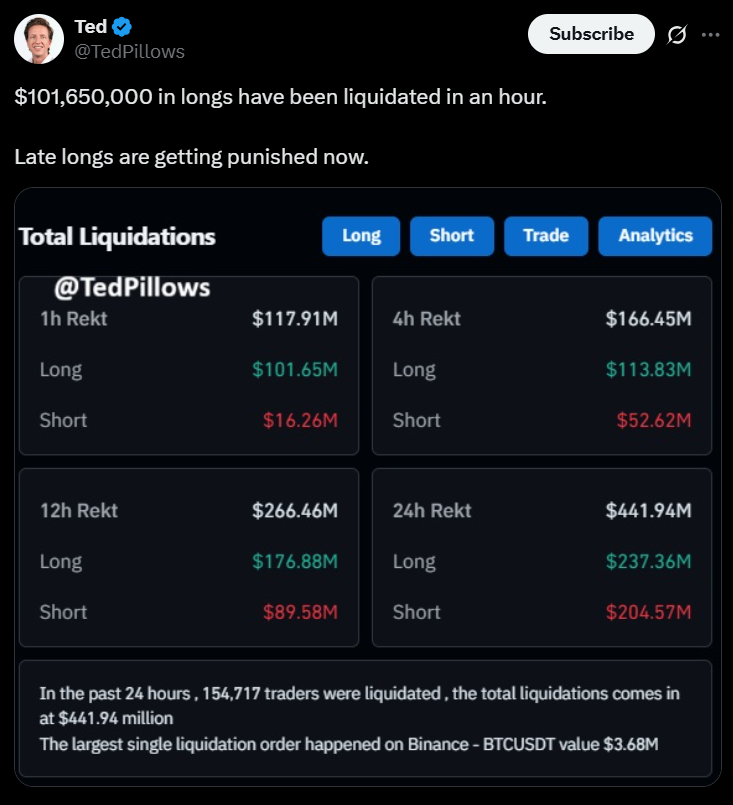

The crypto futures market saw $352,260,000 in liquidations over the past 24 hours, according to CoinGlass data. Short positions bore the brunt of the move, with $227.7 million liquidated, while long positions accounted for $124.6 million. The scale underscores the volatility sweeping across digital assets as prices swing near record levels.

Ethereum Tops the Liquidation Charts

Ethereum was the most heavily affected asset, with $78.4 million in liquidations. Of that, $60.2 million came from short positions as ETH surged, while $18.2 million was wiped out from longs. Bitcoin followed with $63.9 million in liquidations, split between $48.1 million in shorts and $15.8 million in longs. Together, BTC and ETH accounted for nearly 40% of all liquidations in the period.

Shorts Under Pressure

The dominance of short liquidations reflects traders being caught offside by bullish momentum across the crypto market. Bitcoin recently touched new all-time highs above $125,000, while Ethereum closed in on $4,800, fueling sudden squeezes. With shorts forced to cover, upward moves were amplified, adding further volatility to already frothy conditions.

What Traders Should Watch

The scale of liquidations highlights rising leverage and aggressive positioning across crypto futures. If momentum continues, further short squeezes could push prices higher. On the other hand, any sharp reversal could put overextended longs at risk. For now, liquidations remain a reminder that volatility is back in full swing, especially around major milestones for Bitcoin and Ethereum.