- ASTER jumped from $1.84 to $2.18 after Binance listed it.

- $2.10 remains the critical pivot for the next breakout toward $3+.

- Whale inflows, FUD debates, and strong technical levels make this one of the most-watched tokens right now.

Aster (ASTER) has been riding a wave of fresh momentum after Binance dropped its listing, sparking a sudden burst of volatility that carried the token from $1.84 to as high as $2.18. Analysts are already pointing at the $3 and even $3.55 zones as the next big checkpoints if bulls can keep the heat on.

At press time, ASTER sits around $2.06, slightly off its intraday highs but still holding firm. Traders say the key is simple — defend the $2.10 mark, flip it into support, and the road to $3 starts to open. Lose that level, though, and things could get choppy fast.

ASTER Price Analysis: Breakout Levels Traders Must Watch at $2.10 and $2.50

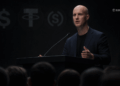

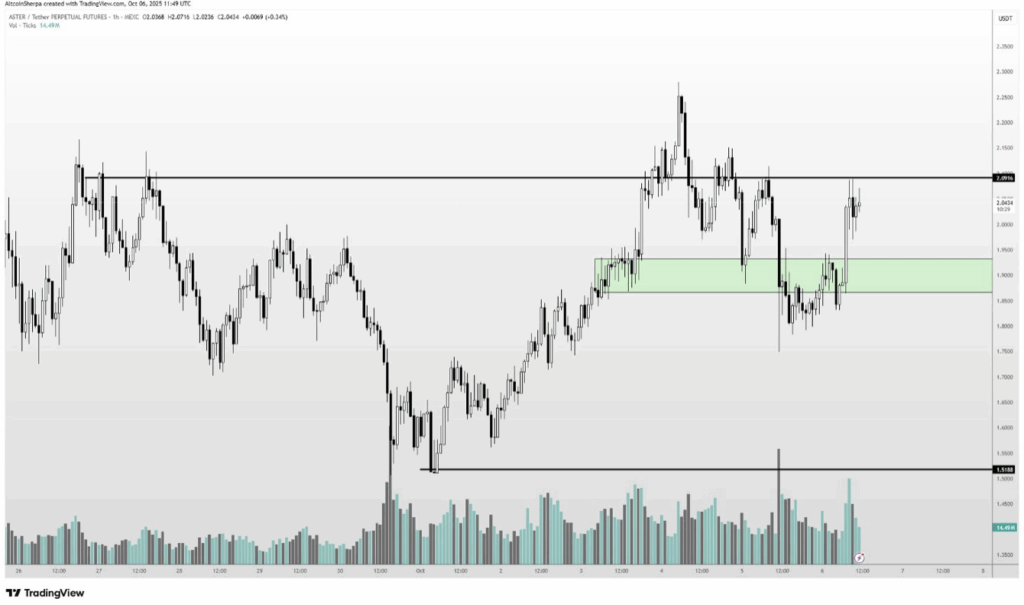

Altcoin Sherpa, a trader known for his short-term setups, said ASTER “looks fairly strong” right now but stressed that reclaiming $2.10 is a must. On the hourly chart, the token has been smacked down several times at that exact level, making it the pivot point for the next move.

TraderSZ added his map of resistances: $2.14, $2.43, and a weekly high at $2.50. Beneath that, an accumulation zone sits near the mid-$1.90s, with deeper support around $1.86. That band, he noted, would be the “safety net” if price action turns ugly.

Meanwhile, Captain Faibik outlined a bullish breakout structure with eyes set on $3.55, but once again, the $2.10 reclaim is the trigger everyone’s watching.

ASTER Crypto Forecast: Whale Moves, and Resistance Levels

On-chain sleuths caught a whale scooping up about $6 million worth of ASTER around the listing, bumping their stack to nearly $12.5 million before transferring the lot to Binance. Moves like this can mean two things: either prepping for a big sell into liquidity or fueling market-making. Either way, it thickens order books and makes price discovery more volatile right after a listing.

For now, the roadmap seems pretty clear: hold $1.90–$1.96 on dips, push above $2.10, then test $2.43 and $2.50. A daily close above the weekly high could wipe out a lot of overhead supply and set the stage for a proper run toward $3, maybe stretching into $3.40–$3.60 if momentum traders pile in.

The FUD Storm Around ASTER

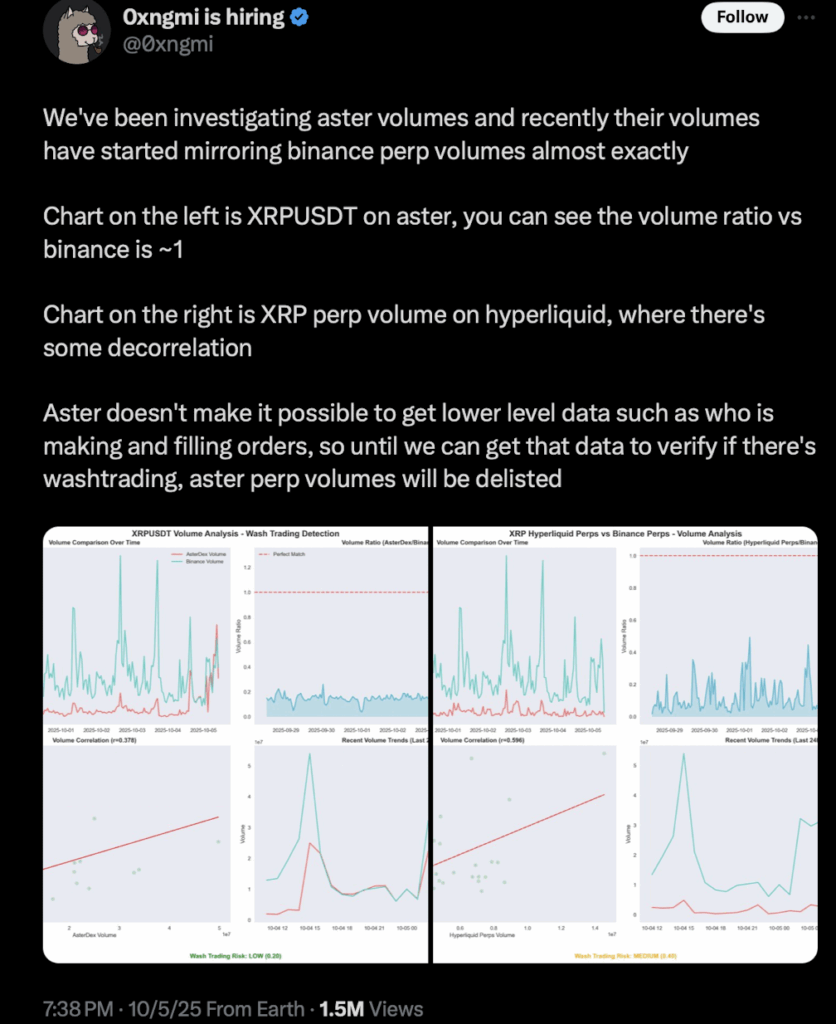

Of course, no rally comes without a dose of drama. Crypto Rover claimed ASTER was being hit with a coordinated FUD campaign, right as DefiLlama’s co-founder 0xngmi announced they’d delist ASTER perpetual volumes from their platform. The issue? The reported perp numbers were tracking Binance’s data almost too perfectly, raising suspicions of wash trading.

0xngmi explained that it wasn’t about picking sides, just about data integrity. In his words: “we did this before… previously ASTER revenue data didn’t exclude rebates… people came up with conspiracy theories anyway.” The spat stirred community chatter, but traders know the deal — separate the noise from the charts.

Binance listings have historically been double-edged: they widen exposure and liquidity, but sometimes also give early whales a clean exit ramp. That means ASTER could still face selling pressure even while retail interest grows.

Aster Price Outlook 2025: Will Bulls Drive ASTER Toward $3.55?

In the near term, the playbook is straightforward. Strength lives above $2.10–$2.14, with confirmation at $2.50. Weakness shows if ASTER loses $1.90, likely trapping the price back into a messy mid-range and stalling the $3 dream.

For now, momentum is alive, liquidity is flowing, and ASTER’s chart structure is tight enough to keep both traders and whales glued to their screens.