- XRP failed to break out, triggering selling pressure and dampening bullish sentiment.

- Nearly $950 million worth of XRP moved to exchanges, signaling strong profit-taking.

- Price must hold $2.94 support or risk dropping toward $2.75, while recovery needs a push above $3.02.

XRP’s latest price move has cooled bullish hopes, with the token failing to hold momentum after briefly testing resistance. Heavy selling pressure kicked in almost immediately, leading to a pullback and weakening confidence in a breakout. The sudden wave of profit-taking appears to be the main driver of last week’s downturn, leaving traders wary of further declines.

$950 Million in XRP Moved to Exchanges Signals Heavy Selling

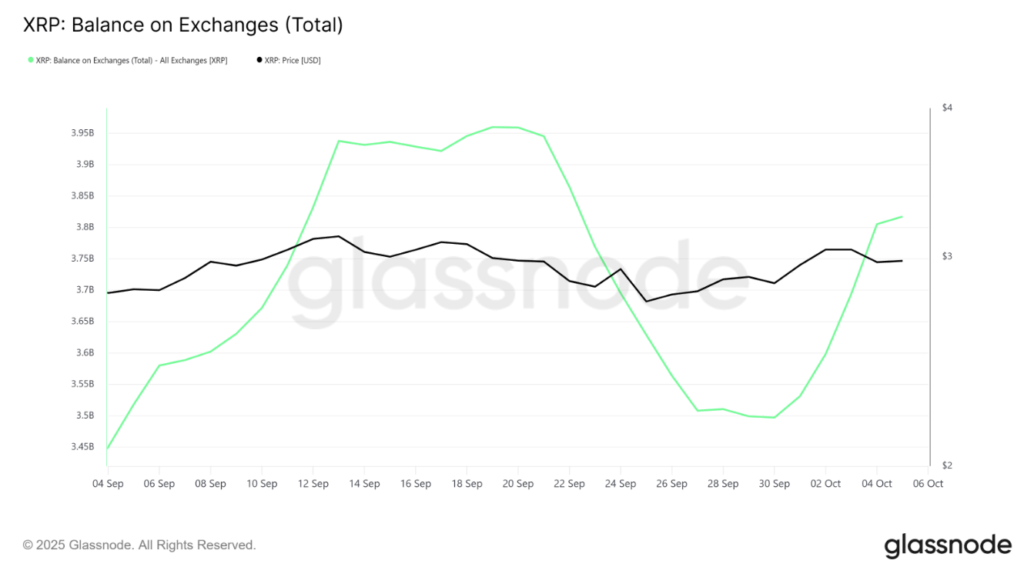

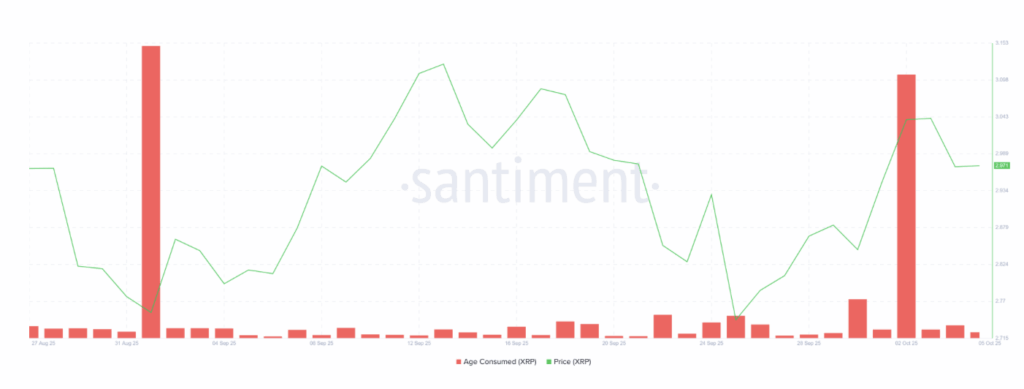

Data shows around 320 million XRP—worth close to $950 million—was moved onto exchanges in just seven days. That kind of inflow usually signals selling intent, and in this case, it reflects a shift in investor behavior. Instead of holding for longer-term gains, many chose to cash out quickly, putting extra strain on market stability. The “Age Consumed” metric, which tracks older coins coming back into circulation, also spiked sharply, suggesting long-term holders are unloading. Historically, this type of selling erodes confidence since these investors often anchor sentiment for newer market participants.

Long-Term Holders Exit, Adding to XRP Bearish Momentum

With long-term holders exiting and exchange balances rising, XRP’s bearish case has grown stronger. At the time of writing, the token trades near $2.96, barely clinging to support at $2.94. Its earlier attempt to break out of a descending wedge failed, leaving the chart tilted toward weakness. If the selling trend keeps up, XRP could slide further to $2.85 or even $2.75, testing the wedge’s lower boundary. Such a drop would confirm that bears remain in control of the market.

XRP Price Prediction: What It Needs for a Bullish Rebound

Despite the bearish pressure, recovery isn’t off the table. If confidence returns and the sell-off slows, XRP could mount a rebound. The first target would be $3.02, and clearing that level could open the way to $3.12 or higher, giving bulls a chance to invalidate the current downtrend. For now, though, sentiment is shaky, and the market needs stronger demand to shift momentum back in favor of buyers.