- Metaplanet bought 5,268 BTC worth $600M, raising its total holdings to 30,823 BTC ($3.6B) and ranking 4th among corporate holders.

- Its Bitcoin Yield spiked to 309% in late 2024 before stabilizing at 33% this year, showing strong per-share BTC exposure growth.

- Public companies now hold over 1M BTC ($116B), with ETH and SOL treasuries also expanding rapidly.

Japanese investment firm Metaplanet has quietly pulled off a massive move, buying another 5,268 BTC—roughly $600 million at today’s prices. That latest purchase brings its total stash to 30,823 BTC, valued around $3.6 billion. With this haul, the Tokyo-listed company leapfrogged into the fourth spot among corporate Bitcoin holders, edging past Bitcoin Standard Treasury Company. The average buy-in? About $116K per coin, leaving Metaplanet sitting on an unrealized profit of more than 7.5% already.

Bitcoin Yield Skyrocketed in 2024

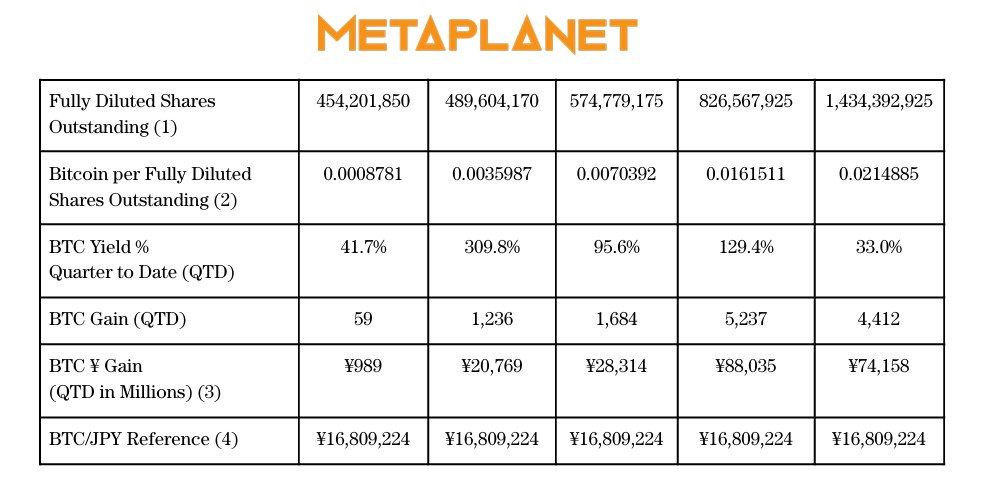

Metaplanet only began stacking sats in April 2024, but its pace has been nothing short of aggressive. By the end of that year, its Bitcoin Yield—a metric showing BTC exposure per share—soared to 309.8%. That meant each share carried more than triple the Bitcoin backing compared to when the strategy began. The speed of accumulation far outpaced any dilution from new shares. In 2025, the figure settled back to 33%, showing continued growth but at a steadier, more sustainable clip.

Public Treasuries Holding Tight

The company’s strategy plays into a larger trend: public corporations now hold over 1 million BTC, worth around $116 billion—nearly 5% of Bitcoin’s total supply. Broader treasuries, including ETFs, governments, exchanges, and private companies, control close to 3.8 million BTC, translating to about $442 billion. And it’s not just Bitcoin. Ethereum treasuries now hold more than 12 million ETH, while Solana-based treasuries sit on nearly 21 million SOL. Clearly, corporate balance sheets are evolving fast, with Metaplanet becoming one of the loudest signals yet.