- TRON is holding above $0.30 support, with $0.36 and $0.42 marked as the next resistance levels.

- Strong fundamentals back price stability: 2.3M daily USDT transfers and over 334M accounts.

- Governance concerns around Justin Sun’s 64% supply control add risk, but traders remain focused on technicals.

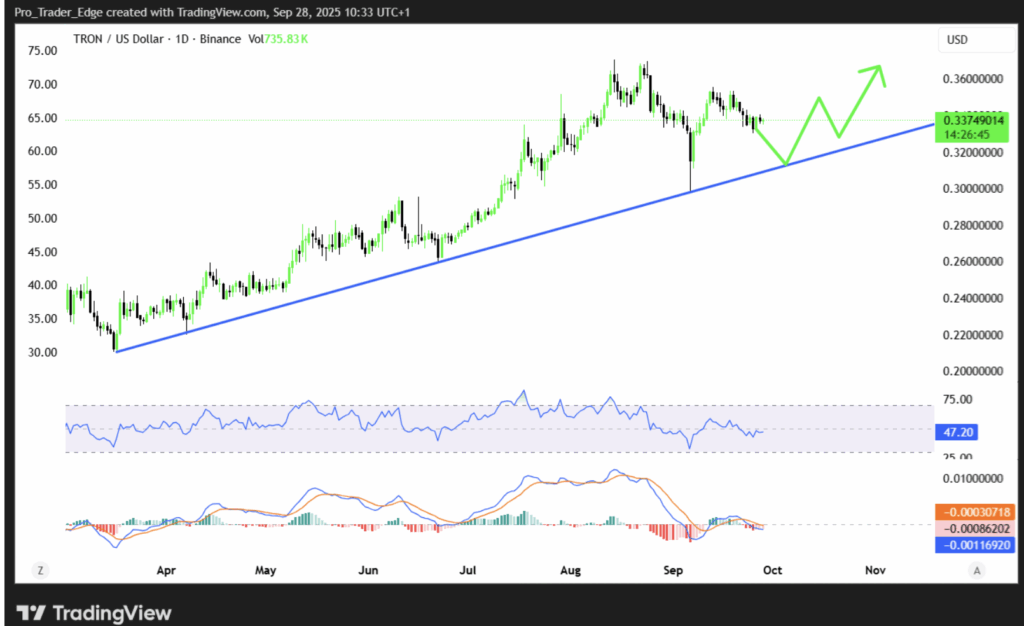

TRON has been clinging to its critical $0.30 support zone, and so far, it’s holding firm. TRX is currently trading around $0.334, showing surprising resilience in a market that’s been anything but stable. Daily moves have been mild—gains of about 0.8% to 1.1%—but the fact that the token keeps defending the $0.30–$0.32 range has traders paying close attention. Many see this foundation as the launchpad for a bigger move.

Trading volume has also spiked past $1.49 billion, suggesting stronger participation even though the price hasn’t broken free just yet. Technical eyes are on $0.36 as the next key resistance level. A clean break above that could set TRX on course toward $0.42, while the weekly chart continues to show a steady higher-low pattern—classic signs of accumulation. With a market cap holding near $31 billion, TRON remains firmly in the top 10, cementing its relevance despite a stretch of consolidation.

TRON Network Growth Supports Price Stability

Beyond price action, TRON’s fundamentals remain strong. The blockchain processes over 2.3 million USDT transfers every single day, worth roughly $22.5 billion. Its user base has grown to more than 334 million accounts, making it one of the busiest networks in crypto. Stablecoin settlement on TRON hasn’t flinched despite market turbulence, reinforcing its role as a reliable settlement layer.

On-chain data from Lookonchain backs this up, showing that adoption-driven flows have held steady even in downtrends. That kind of consistency explains why TRX has managed to defend support when many other tokens have crumbled. For bulls, the network’s strength offers a safety net—evidence that fundamentals are aligned with the technical story.

Governance Risks Add Uncertainty

But not everything is smooth sailing. Reports from AssembleAI, citing Bloomberg, suggest Justin Sun controls as much as 64% of TRON’s circulating supply. That’s a massive concentration, raising concerns about centralization and the influence one figure could have over liquidity and price movements. Critics argue this undermines TRON’s decentralization, while supporters counter that Sun’s heavy stake reduces the risk of sudden large-scale dumping.

So far, the market hasn’t reacted dramatically to these governance concerns. Price action indicates traders are more focused on technical support and resistance zones than long-term decentralization debates. Still, it’s a risk factor that lingers in the background for anyone eyeing TRX for longer horizons.

Technical Analysis: Key Resistance and Targets Ahead

On the technical side, the $0.38–$0.40 band remains the wall to beat. Every attempt to clear it has triggered profit-taking, pushing TRX back down. Failure to hold current levels could open a path toward $0.28, with $0.24 as a deeper downside target. On the flip side, indicators suggest TRX still has room for upside before momentum overheats.

Long-term, the all-time high near $0.45 is the key goal. If TRX can conquer intermediate resistance, there’s little reason it couldn’t retest that level. For now, the weekly close showed a -3% dip, but support held strong—a sign that consolidation is the dominant trend rather than breakdown.