- Solana ETFs could be approved within weeks, potentially flipping bearish price action into a rally.

- Key levels: $220 resistance, $178–$186 support; holding above could push SOL back toward $260+.

- Long-term models see Solana reaching $768–$1,083 if crypto adoption accelerates in 2025.

Solana’s retreat to the $200 zone has many traders debating whether it’s just a bear trap before another leg up. Analysts are pointing to U.S. regulatory changes that could bring Solana staking ETFs to market faster than expected. ETF specialist Nate Geraci hinted that several filings—including Franklin Templeton, Fidelity, and Grayscale—may be approved “within the next two weeks.” That kind of catalyst could turn short-term weakness into a bullish setup.

SEC Rules and Fast-Track Solana ETF Filings

The SEC’s new listing standards, approved earlier this month, cut the review period for ETF applications from nearly 270 days down to as little as 75. This opens the door for faster approvals of digital asset ETFs beyond just Bitcoin and Ethereum. Reuters noted that Solana and XRP are front-runners to benefit, with launches possible in October. Meanwhile, the REX-Osprey SOL + Staking ETF (SSK), which debuted in July, pulled in $33 million in trading volume on day one—proof there’s demand for Solana products.

Solana Price Prediction After the $200 Pullback

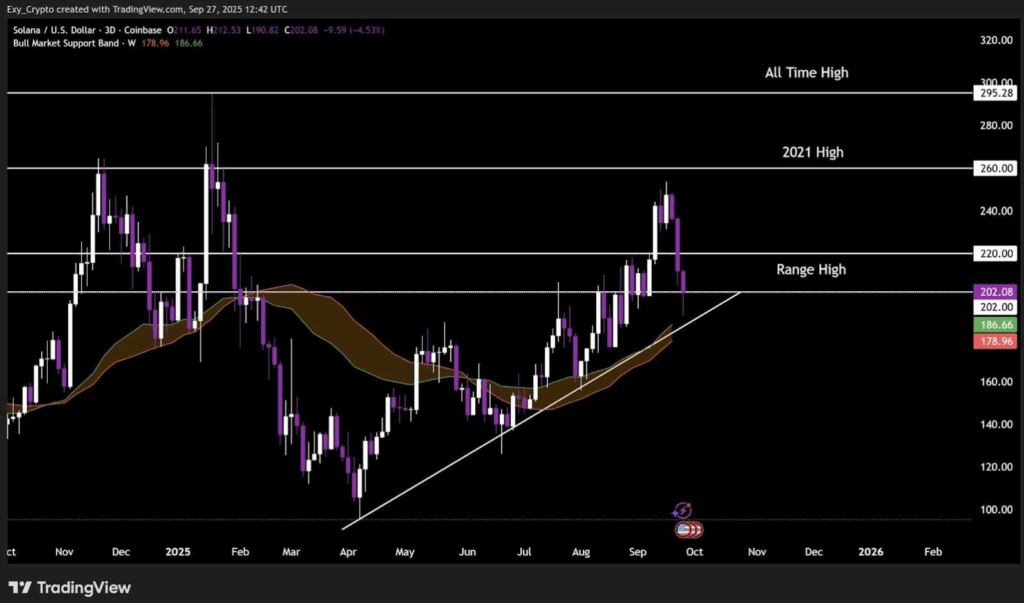

SOL traded around $202 on Saturday, down -2% daily and -10% weekly, according to Coingecko. Technical charts show a rising wedge, usually a bearish signal, but ETF approval speculation could flip it bullish. Key levels to watch: $220 is now resistance, while the Bull Market Support Band at $178–$186 offers a safety net. Historically, holding above that band aligns with extended rallies. If momentum builds, resistance sits at $260 and then the all-time high near $295.

Long-Term Solana Price Targets in 2025

Token Metrics mapped out three scenarios for Solana if the crypto market cap expands to $8 trillion. Their bear case puts SOL at $768 (+227%), the base case at $926 (+295%), and the moon scenario at $1,083 (+362%). At today’s $219 level, all three represent massive upside potential. Market data from CoinGlass also shows negative funding rates, often a sign of overextended bearish sentiment and possible local bottoms.

Market Outlook: Will Solana Spark an Altcoin Season?

Geraci suggested that ETF approvals could trigger more than just a Solana rally—they might fuel a broader altcoin season. Still, analysts warn that investor appetite for non-Bitcoin and Ether ETFs is still largely untested. For now, markets are watching October closely, as SEC decisions could reshape the landscape for altcoin investments heading into Uptober.