- Aster has surged to the top of DeFi revenue charts, backed by CZ and YZi Labs.

- Its ASTER token powers governance, rewards, and fee discounts across the ecosystem.

- With multi-chain liquidity, MEV protection, and yield-bearing collateral, Aster is redefining decentralized derivatives trading.

Aster, the decentralized perpetuals exchange that detonated onto the scene in September 2025, has done more than just make noise. It has flipped revenue charts, hijacked market sentiment, and sent shockwaves through the DeFi derivatives sector.

Backed by YZi Labs and Binance founder CZ, Aster is not another protocol—it is a full-blown ecosystem engineered to challenge centralized exchanges and dominate the perpetuals DEX meta. So, let us take a closer look at the architecture, mechanics, and ambitions of the platform that has traders calling it the most explosive launch of the year.

What Is Aster?

Aster is a decentralized exchange platform designed to deliver professional-level trading with the accessibility and transparency of decentralized finance. It offers both perpetual and spot trading through an integrated interface that works across four major blockchain networks — BNB Chain, Ethereum, Solana, and Arbitrum.

At its core, Aster is powered by ASTER, a utility token that drives governance, rewards, and platform access. The platform is built to combine speed, security, and efficiency while addressing persistent challenges in DeFi trading such as fragmented user experience, high fees, limited capital efficiency, and poor execution quality.

Notably, ASTER token is the native utility token of the ecosystem. With a fixed supply of 8 billion, ASTER acts as the connective tissue of the Aster platform. It fuels governance processes, unlocks premium features, provides fee optimization, and supports a broader community governance framework. This token serves both as a tool for everyday trading optimization and as a mechanism to coordinate long-term growth within the Aster ecosystem.

Core Components

Aster is built on a foundation of modular, high-performance components that work together to deliver a seamless trading experience. Core components include:

Dual-Mode Trading System

Aster splits its trading interface into two distinct modes. Simple Mode is built for accessibility, offering one-click execution with up to 1001x leverage and MEV resistance. Pro Mode caters to advanced users with a full orderbook, grid trading automation, hedge mode, and multi-asset margin support. This bifurcation allows Aster to serve both retail and professional traders without compromise.

Trade and Earn Program

This mechanism transforms idle collateral into productive assets. Users can stake BNB to receive asBNB, a liquid staking derivative that earns rewards while serving as margin. USDF, a yield-bearing stablecoin pegged to USDT, is deployed in delta-neutral strategies on Binance, generating passive income while being used for leveraged trading.

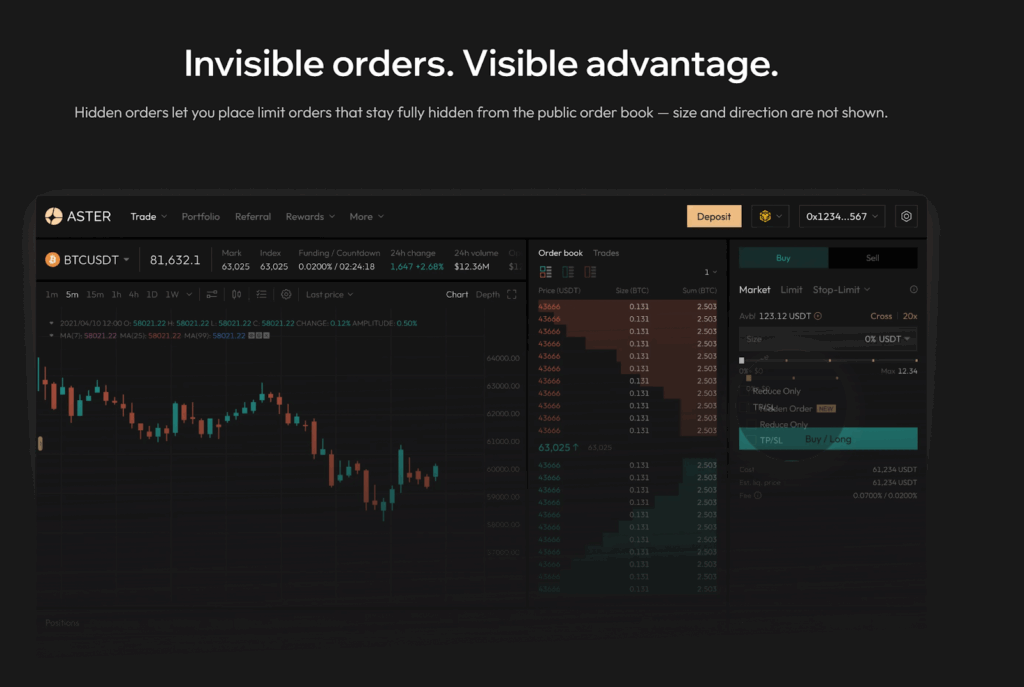

Hidden Orders

To combat front-running and sandwich attacks, Aster introduces Hidden Orders that remain invisible until execution. This feature protects large trades from MEV exploitation and ensures fair pricing, especially for institutional participants.

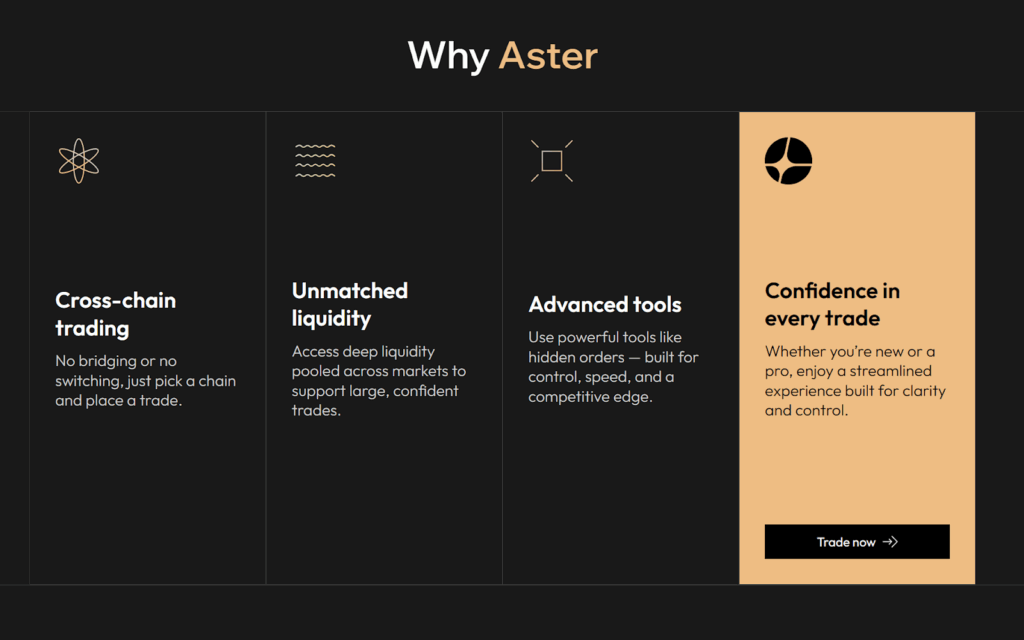

Cross-Chain Liquidity Aggregation

Aster pulls liquidity from multiple blockchains without requiring users to bridge assets or manage multiple wallets. This native multi-chain architecture provides deep liquidity and optimal execution across ecosystems.

What Problems Does It Solve?

Aster is a direct response to the limitations of existing platforms. Some key problems it addresses:

- Fragmented Trading Experience – Many DeFi traders must navigate multiple platforms to access full functionality. Aster centralizes spot trading, perpetual contracts, and yield optimization under a single interface, eliminating complexity.

- Low Capital Efficiency – Traditional exchanges require capital to be locked without generating returns. Aster’s Trade & Earn program allows yield-bearing assets as collateral, producing simultaneous trading profits and passive income.

- MEV Exploitation and Poor Execution – MEV attacks degrade trade execution quality. Aster’s MEV-resistant Simple Mode ensures fair pricing and protects traders from front-running.

- High Fees and Complexity – Advanced trading tools are often costly and inaccessible. Aster addresses this with low fees, intuitive interfaces, and two modes tailored to different user skill levels.

Utility and Offerings

Aster offers a range of utilities that go beyond basic trading, blending innovation with functionality to deliver a complete decentralized trading experience. This includes:

ASTER Token

ASTER serves multiple functions across the Aster ecosystem. Token holders can:

- Participate in governance decisions, influencing the platform’s future direction.

- Access premium features such as priority trading and higher position limits.

- Benefit from fee discounts and revenue sharing mechanisms.

- Use ASTER in staking programs to earn rewards.

Trading Infrastructure

Aster offers a professional-grade trading ecosystem with high leverage, deep liquidity, and a range of order types. These features are tailored to meet the needs of both retail and institutional traders.

Trade & Earn

This program allows users to maximize capital efficiency by using yield-generating assets as collateral. This creates a unique layer of profitability for traders, merging active and passive income strategies in one platform.

Cross-Chain Trading

Aster’s multi-chain capability enables trading without the need for bridges or switching networks, making it a seamless environment for traders holding assets across various ecosystems.

Key Milestones and Highlights

Aster has exploded in popularity since its launch, capturing market share and mindshare at a blistering pace. Key highlights include:

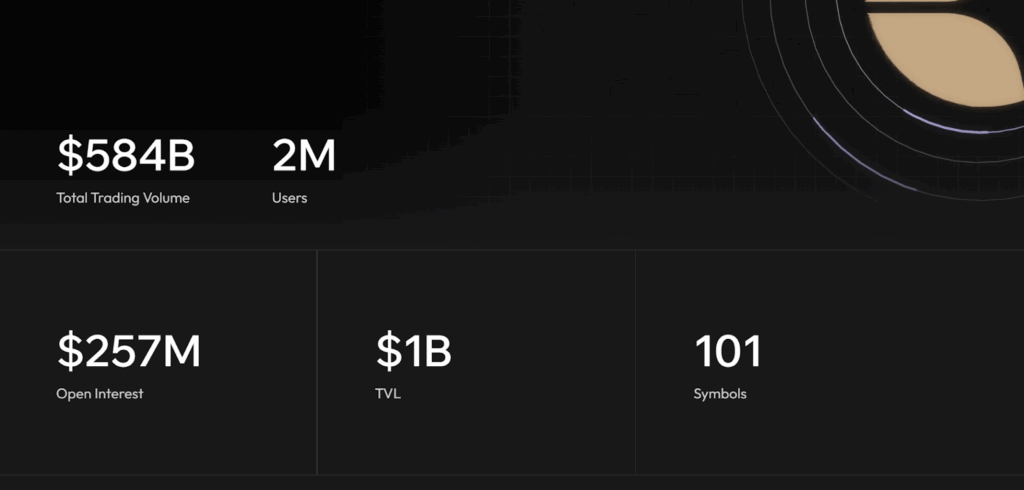

- Revenue Supremacy – Aster recently surpassed Hyperliquid in daily revenue, generating $4.58 million compared to Hyperliquid’s $2.82 million.

- Market Performance – The ASTER token surged over 7000% since launch, reaching a high of $2.12. Its market cap hovers near $3.5 billion, placing it among the top 50 cryptocurrencies.

- Institutional Interest – Backed by YZi Labs and endorsed by CZ, Aster enjoys credibility and access to the Binance ecosystem.

- Massive Airdrop – Stage 2 of the airdrop reserves 40 percent of the ASTER supply—worth over $5.5 billion at current prices—for active traders.

- User Adoption – With over 2 million users and billions in daily volume, Aster has become the go-to platform for decentralized derivatives.

Roadmap and Plans Ahead

Looking ahead, Aster plans to execute several transformative developments that aim to cement its leadership in decentralized derivatives trading. This includes:

- Aster Chain – A purpose-built Layer 1 blockchain optimized for high-frequency trading and complex DeFi strategies. It will feature sub-second transaction finality and minimal gas fees.

- Zero-Knowledge Proof Integration – This will bring enhanced privacy and scalability to the platform, allowing institutional traders to execute large positions without revealing sensitive strategy details.

- Intent-Based Trading System – A highly ambitious innovation designed to automate cross-chain strategies. It will enable traders to define their desired outcome and have the system execute the optimal pathway.

- Expanded Multi-Chain Liquidity – Continuous enhancements to cross-chain integrations will ensure that liquidity remains deep and execution remains efficient.

Final Thoughts

In conclusion, Aster represents a bold step forward in decentralized finance, merging advanced perpetual trading with yield optimization and multi-chain accessibility. By addressing critical shortcomings such as fragmented liquidity, inefficient collateral, and MEV exploitation, it delivers a unified, capital-efficient, and secure trading environment. So, as the roadmap unfolds, it will be interesting to see how the project navigates rising demand, institutional adoption, and competitive pressure in the evolving DeFi landscape.