- TRON records 9–10M daily transactions and $25B in USDT flows, but TRX price has slipped below $0.34.

- Retention is weak, with cohort rates falling from 19% to just 2%, showing most new users don’t stick around.

- Spot market selling dominates, with a -35M Delta suggesting TRX could fall to $0.32 unless sentiment flips bullish.

TRON has been buzzing with activity lately. The network has been clocking between 9 to 10 million daily transactions, pushing nearly $25 billion in USDT transfers every single day, and recording over 15 million active accounts. That kind of volume screams adoption. And yet, when you look at the token itself, TRX hasn’t exactly been riding the same wave.

Just four days ago, TRX hit $0.35. Since then, it’s been sliding. At press time, the price sits around $0.336, down a little over 3% in the last 24 hours and nearly 4% on the week. Clearly, there’s a disconnect between what the charts are saying and what the network is doing.

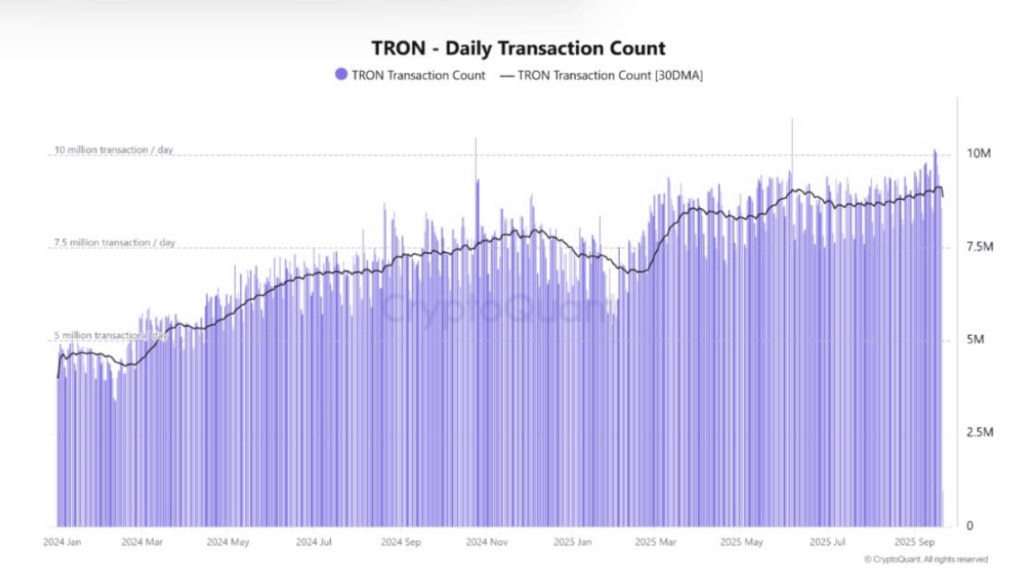

Daily Transactions Push TRON to New Highs

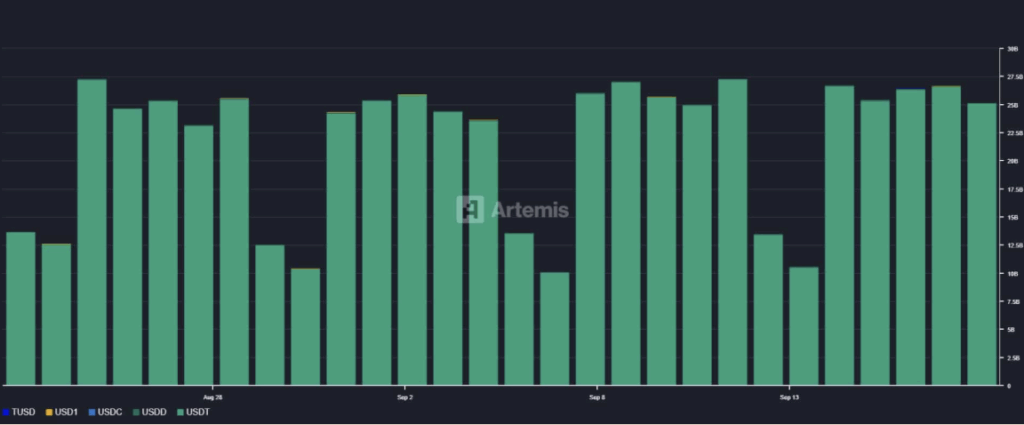

CryptoQuant data paints a clear picture—TRON is seeing a baseline of over 9 million daily transactions, up 20% compared to January. That’s a serious increase in activity. Stablecoins are driving much of it. According to Artemis, USDT transfers alone are holding steady at around $25 billion every day.

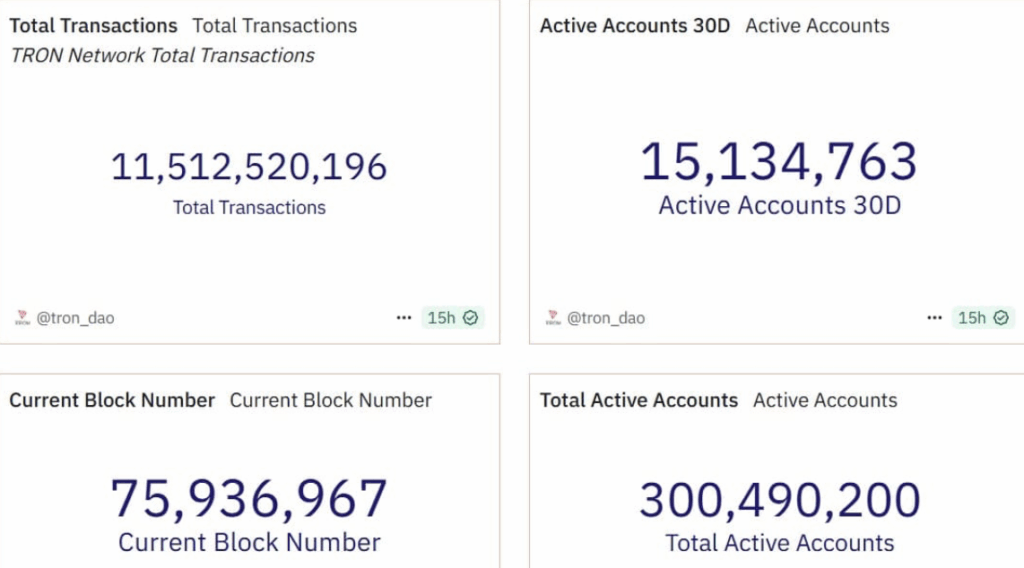

On top of that, active accounts over a 30-day window have hit 15.1 million, while the total number of accounts has now blown past 300 million. Those are staggering adoption numbers. Still, not all is as rosy as it looks.

Retention Issues Raise Questions

Despite this growth, user retention on TRON is struggling. Artemis data shows the network’s monthly cohort retention rate has plunged—from 19% earlier this year to just 2% now. In simple terms: people try TRON, but most don’t stick around.

Take May 2025 as an example. About 6.2 million new users joined that month, but only 12% of them were still active three months later. That’s a lot of churn, suggesting TRON is good at pulling people in but not so great at keeping them engaged.

Bearish Pressure Builds on TRX

While the network is booming, TRX investors are leaning bearish. Spot Taker CVD data shows sellers have been in control, with a -35 million Delta logged in just 24 hours. Coinalyze backs this up, showing 206 million in sell volume compared to 171 million in buys.

Historically, when sellers dominate spot markets like this, prices tend to dip further. If the pattern continues, TRX could slide toward $0.32. On the flip side, if sentiment flips bullish and the heavy network usage starts to weigh in, a rebound back to the $0.35 resistance zone isn’t out of the question.

Key Takeaway

TRON’s ecosystem is thriving on the surface—transactions, stablecoin flows, and account growth all point to real adoption. But investor sentiment is shaky, and without stronger retention, TRX risks more price pressure before any sustainable rally.