- Pantera Capital says Solana is still under-allocated by institutions, with less than 1% of supply held compared to Bitcoin (16%) and Ethereum (7%).

- A potential Solana ETF in late 2025 and treasury firms like Helius adopting SOL could ignite a major demand wave.

- Higher staking yields, faster throughput, and efficient accumulation may help Solana treasuries outperform BTC and ETH reserves in 2025.

Big investment firm Pantera Capital says Solana is standing right at an inflection point, ready to step into broader adoption across consumers, fintechs, and big institutions. Unlike Bitcoin and Ethereum, which already have ETFs and massive corporate allocations, Solana’s institutional journey is still in its early days. Pantera argues that this gap—institutions owning less than 1% of SOL’s supply—creates an asymmetric opportunity once demand starts to catch up.

Right now, there are no Solana ETFs on the market, and only five public companies report SOL holdings. Compare that with Bitcoin, where about 16% of supply sits with institutions, or Ethereum with roughly 7%. Despite that, Solana’s network activity—transactions, throughput, daily usage—already tops its bigger rivals. And with names like Stripe and PayPal actively building on Solana, the fundamentals are getting harder to ignore.

Solana ETF and Treasury Demand Could Be Game-Changers

Pantera hinted that a Solana ETF could arrive as soon as Q4 2025, something they believe would unlock a wave of institutional demand. They framed it simply: Bitcoin and Ethereum have had their ETF moment; Solana’s is still ahead. That leaves plenty of room for institutions to rotate into the asset once the door opens.

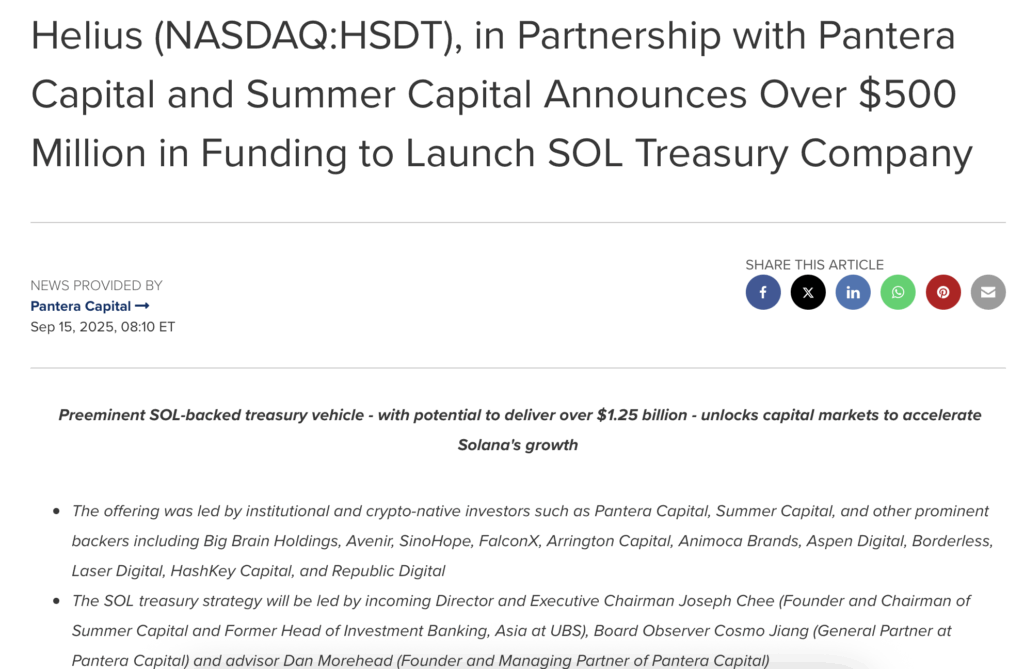

Adding to the momentum, Nasdaq-listed Helius Medical Technologies just raised over $500 million through an oversubscribed PIPE deal. The company’s plan? Deploy capital into SOL as its primary reserve asset and create a treasury vehicle to open new growth opportunities. Summer Capital joined Pantera in backing the offering, with shares priced at $6.881 and warrants set at $10.134. Moves like this signal that treasury adoption may be one of Solana’s strongest near-term growth drivers.

Why Solana Treasuries Could Outperform BTC and ETH

Analysts are beginning to argue that Solana treasury firms may outperform those holding Bitcoin or Ethereum in 2025. One big reason: yield. Solana currently offers staking returns around 7–8%, while Ethereum sits closer to 3–4%, and Bitcoin doesn’t generate yield at all. That makes it easier for treasuries to reinvest rewards and accelerate NAV growth over time.

Add to that Solana’s unmatched throughput and massive user activity, and the case strengthens. Even though ETH has a much larger market cap, SOL consistently handles more transactions, which translates to greater utility for treasury firms holding it.

Yes, Solana comes with higher volatility—about 80% compared to BTC’s 40% and ETH’s 65%. But for treasury mechanics, that volatility can actually be an advantage. It makes financing tools cheaper and token accumulation faster, which amplifies long-term returns. As Galaxy’s Michael Marcantonio put it, the combination of higher yield, throughput, and efficient accumulation could make Solana treasuries one of the best-performing plays heading into 2025.

The Bigger Picture

Pantera’s message was clear: Solana’s adoption curve hasn’t even started to bend upward yet. With ETFs likely on the horizon, treasury firms locking SOL into reserves, and real-world fintech giants already building on the network, the setup looks strong. If institutions begin to close the under-allocation gap, Solana could see a surge of demand that reshapes its market position over the next cycle.