- Ethereum rejected at $4,763, now stuck in the $4.47k–$4.6k range.

- Perpetual volume fading shows traders are pulling back from leverage.

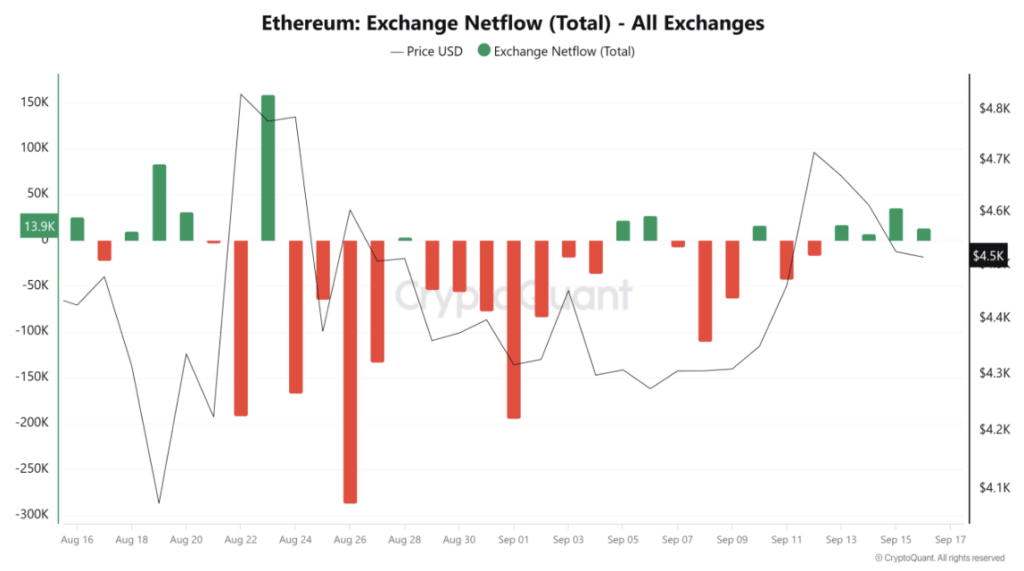

- Spot inflows of 13.9K ETH signal selling pressure, hinting at possible stagnation.

Ethereum tried to push past $4,763 earlier this week but got slapped back down, slipping as low as $4,469 before steadying near $4,499. The dip, though mild, reflects fading appetite from traders, especially in the leveraged markets where activity has cooled fast. Exchange flows also aren’t helping, with over 13,000 ETH moving onto exchanges in just a few days — a sign that some holders might be looking to cash out.

This combination of weaker buying and fresh inflows on exchanges has left ETH kind of stuck, chopping sideways between $4.47k and $4.6k, without the juice needed for a breakout.

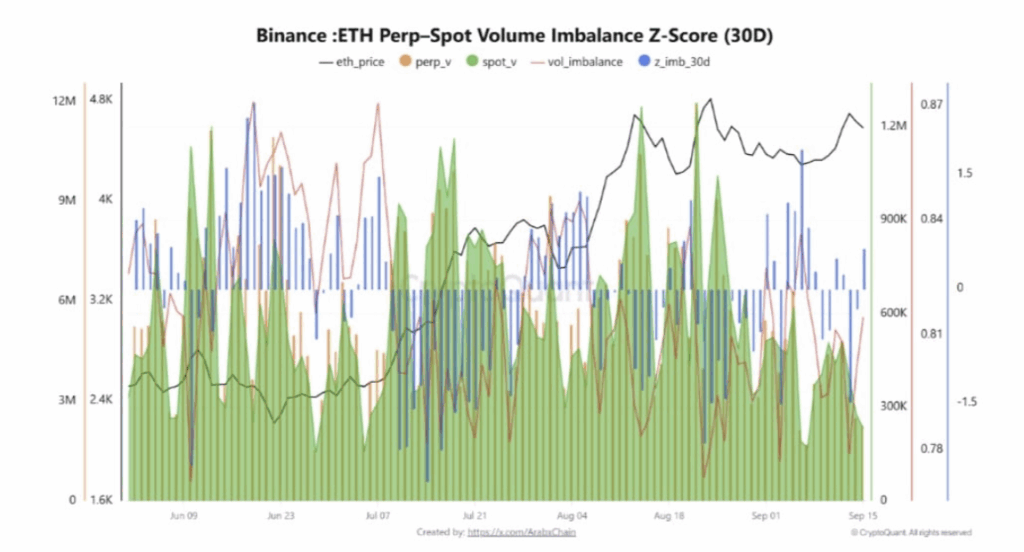

Perpetual Demand Slips, Traders Pull Back

Perpetual contracts have been losing steam. Data from CryptoQuant shows ETH’s Z-Score swinging between 0.0 and -1.0 these past two weeks. That basically means perps are no longer dominating volume, as speculators back away from leverage.

It’s not panic-selling — more like traders taking a step back, waiting to see where the market heads. But with less leverage in play, Ethereum lacks that push higher it often gets during strong bullish cycles.

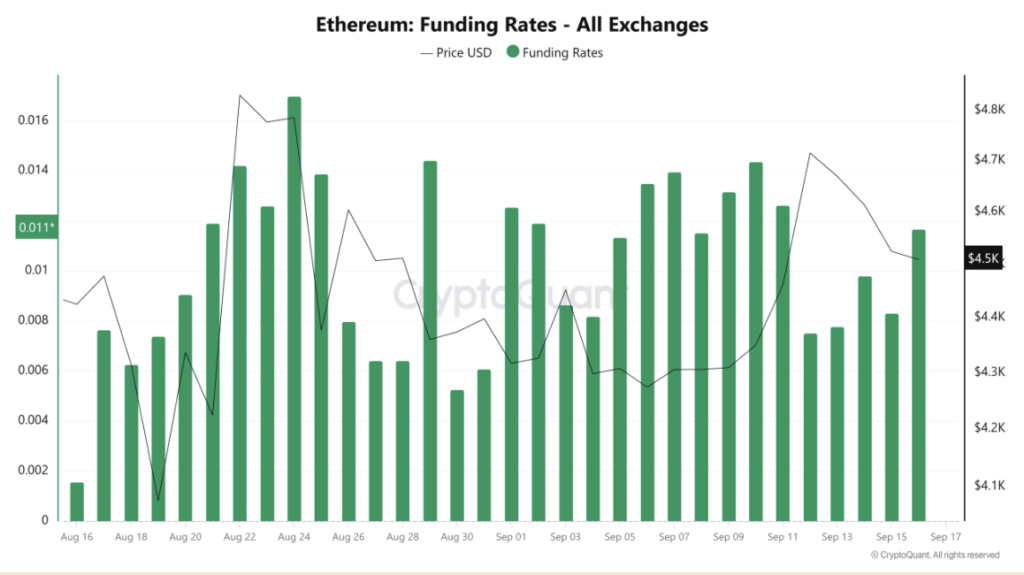

Positive Funding Rates Keep Bulls Alive

Even with fading perp activity, ETH’s Funding Rates remain in positive territory, sitting at 0.011 — the highest in five days. That suggests traders still lean bullish, at least sentiment-wise.

The catch? With fewer players opening fresh long positions, the market could be vulnerable to a long squeeze. Without enough conviction behind these positive rates, even a small wave of selling could flip momentum quickly.

Spot Market Shows Heavy Selling Pressure

The spot market isn’t picking up the slack either. Trading volume has stayed under the 1M mark for days, way below the levels seen during ETH’s stronger rallies earlier this summer.

Exchange Netflows back that up — inflows of 13.9K ETH point to aggressive selling, not accumulation. Buyers are quiet, sellers are dominant, and that imbalance has kept ETH trapped in its narrow range.

What’s Next for Ethereum Price?

Right now, Ethereum’s outlook looks more like stagnation than a fresh breakout. With leverage shrinking, spot demand muted, and exchange inflows rising, ETH is likely to stay capped between $4,470 and $4,600 for now.

Unless new demand kicks in — either from leverage traders returning or stronger spot buying — ETH’s push toward $5,000 may have to wait.