- The present realized losses have declined, with an overall contraction in the loss profile barring explicit capitulation events.

- Most coins on the move were acquired relatively close to the current spot price and thus are not locking in a large ‘realized’ payload.

- The ratio between the total unrealized profit held by the market and its yearly average can provide a macro-scale indicator for a recovering market.

The global cryptocurrency market plunged almost 2% on Thursday morning, dragged down by losses in several major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB). The bearish sentiments come after the U.S. Federal Reserve hinted that there is no break in rigorous rate hikes, sending jitters across the crypto market.

Moving forward, the Central Bank is expected to show vigilance in efforts to stamp out high inflation and has thus reiterated its hawkish tone.

At the time of writing, BTC’s price was auctioning for $22,725 after losing 2.17% on the last day. Its market cap had also plunged 2.18% to $438.08 billion. Nevertheless, despite the plummeting stats, the king crypto was up 10.76% in trading volume over the past 24 hours to $29.472 billion.

Shifting Tides: Spending Activity In Response To The Recent Price Uptick

After a fiery month of market volatility, Bitcoin is polarizing above a crucial supply zone, putting the average Bitcoin holder into a pattern of unrealized profit. This demonstrates a probable shift in the macro market tides.

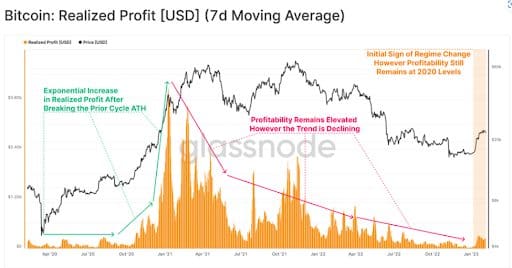

Glassnode charts show an explosion in profit-taking as investors sold their holdings following the stringent monetary policies around October 2020. However, the trend decreased dramatically since the peak in Jan 2021 but then revolted to detox over the next two years back to the dips recorded in 2020.

While a recent recovery in realized profits can be seen in response to the latest price action, it remains salient in response to the excitement witnessed across the 2021-2022 cycle.

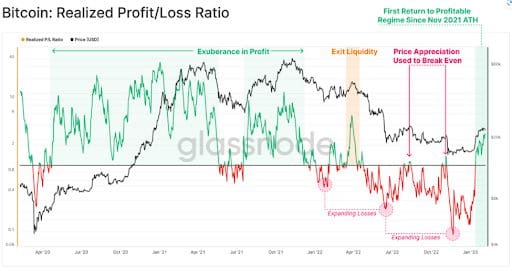

The losses the market recorded during this period started expanding post-January 2021 to reach an initial peak during the May 2021 sell-off, which Glassnode records as a ‘bear of historic proportions.’

Nevertheless, the present level of realized losses has dropped towards the cycle baseline of around $200 million per day, with a general contraction in the loss profile that barred clear capitulation events.

The Realized Profits to Losses ratio shows changes in the dominance structure between the two after the price action dip after the November 2021 peak, a period full of losses kicked in to drive the Realized P/L Ration below 1. The severity continued to increase with every capitulation in price action.

That notwithstanding, the first sustained profitability period can be seen since the April 2022 exit liquidity event, indicating the onset of a change in profitability seasons.

The Bitcoin Sell-Side Risk Ratio is a criterion used to compare the size of total realized profit and loss as a percentage of the Realized Cap. Based on this metric, the combined volume of realized profit and loss remains relatively small relative to the asset size. This points to the size of spending events being marginal in scale, particularly compared to the euphoria witnessed during the bull market and the FTX collapse.

In general, this means that average, most currently rallying coins were acquired relatively close to the prevailing spot price, which means they are not locking in a significant “realized” profit.

From Red To Green: Profit zone

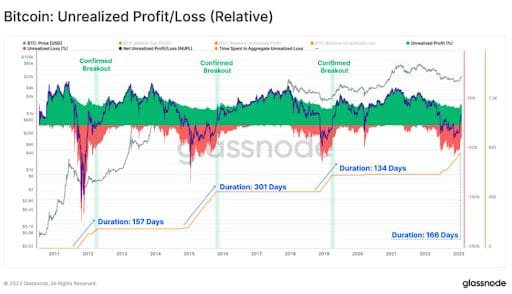

Net Unrealized Profit/Loss Ratio (NUPL) reveals that the recent price surge has initiated Bitcoin spot price above the average acquisition price of the broader crypto market, putting the market back into the hands of unrealized profit. In this regime, the average holder is back in the profit zone.

A comparison of the duration of negative NUPL across all the previous bear markets shows a historical resemblance between the bear markets of the present cycle (166-days) and the 2011-12 (157-days) with that of the 2018-19 (134-days). Nevertheless, the 2015-16 bear market distinguishes itself in terms of duration, witnessing a period of unrealized loss almost twice as prolonged as the second cycle seen in 2022-23.

The latest bull run has seen the BTC price surge above several key on-chain cost-basis models, presenting a notable improvement in the financial position of the market.

The momentum metric now approaches the equilibrium breaking point and is similar to the recoveries seen in the bear markets of 2015 and 2018. Historically, confirmed breakouts above this equilibrium point were tallied with a shift in macro market structure. It is also worth mentioning that the duration below this equilibrium point has been similar across the major bear markets.