- Whales purchased over $200M in ETH, showing rising institutional demand.

- Exchange balances are shrinking, signaling reduced sell pressure.

- A Fed rate cut could act as a catalyst for ETH to break above $4,800.

Ethereum is moving through one of those tricky phases where the charts don’t give away much but the undercurrent tells another story. Price is hovering near important levels, holding around $4,515, while volatility and uncertainty dominate the wider crypto market. On the surface, it feels like consolidation. But beneath, something bigger is brewing — institutions and whales are stacking ETH, and that signals confidence in its long-term role.

One key factor shaping Ethereum right now is supply on exchanges. It’s shrinking, steadily, as coins move into cold storage and long-term wallets. That drop in available supply usually translates to less sell pressure, reinforcing the idea of quiet accumulation while retail eyes the daily swings.

Fresh numbers from Arkham add more weight. Just yesterday, three new whale wallets scooped up over $200 million worth of ETH. Big money isn’t hesitating, even in choppy conditions. They’re positioning for what many believe could be Ethereum’s next big breakout — whenever the market decides to move.

Institutional Buying Strengthens Ethereum Outlook

Arkham’s latest report confirmed that whales transferred roughly $205 million worth of ETH from FalconX into fresh wallets, marking another sign of rising institutional involvement. These aren’t small retail buys. They’re large, deliberate moves that underline Ethereum’s growing importance in the broader digital economy.

The recent sideways action isn’t about weak fundamentals — it’s more tied to uncertainty in the macro landscape. Traders may focus on the noise of quick pullbacks or rallies, but institutions see long-term adoption, lower exchange balances, and the growing case for ETH as core infrastructure. Exchange data keeps showing coins flowing out, and that’s a bullish sign when combined with big whale accumulation.

The spotlight now turns to next week’s U.S. Federal Reserve meeting. Markets expect a rate cut, and if that happens, risk assets like ETH could benefit from fresh liquidity inflows. A dovish Fed might end up being the trigger that aligns with the accumulation trend already in play.

Ethereum Price Analysis: Key Levels to Watch

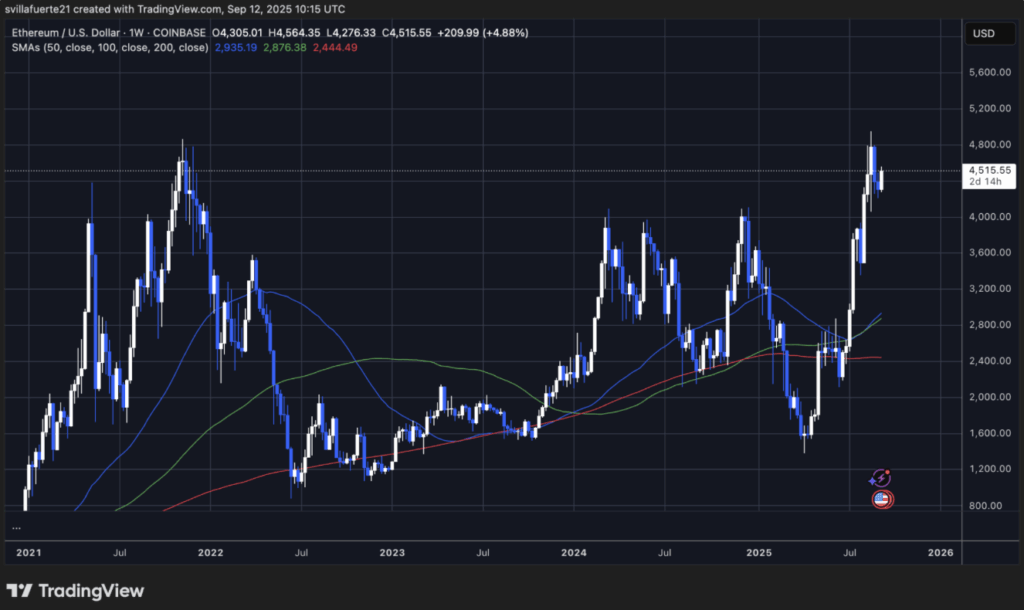

At $4,515, Ethereum has bounced strongly this year, climbing from lows near $1,600 and nearly touching $4,800. That run has made ETH one of the top-performing altcoins of 2025, thanks in large part to institutional demand and the shrinking supply story.

On the technical side, ETH is sitting comfortably above its major moving averages. The 50-week SMA is rising at $2,935, the 100-week SMA at $2,876, and the 200-week SMA remains a strong base down at $2,444. This alignment points to a solid long-term uptrend.

For bulls, the challenge now is breaking and holding above $4,800. If that resistance gives way, ETH could quickly aim for the $5,200–$5,500 zone. On the flip side, if volatility picks up, immediate support lies near $4,300, with stronger backing closer to $3,800.

Final Thoughts: Ethereum’s Next Breakout?

Ethereum’s price may look calm on the charts, but the fundamentals show quiet strength. With whales scooping up hundreds of millions in ETH and exchange supply drying up, the stage is set for a potential breakout. Add in a possible Fed rate cut, and the timing could align for ETH to push past resistance and target new highs.

The next few weeks may decide whether Ethereum reclaims $4,800 and powers toward $5,500, or if it dips back into support zones. Either way, institutions seem unfazed by the noise, betting on ETH’s staying power long after the daily volatility fades.