- Solana jumped past $228 after Chinese fashion brand MOGU invested $20M in BTC, ETH, and SOL, while Safety Shot added $5M in BONK.

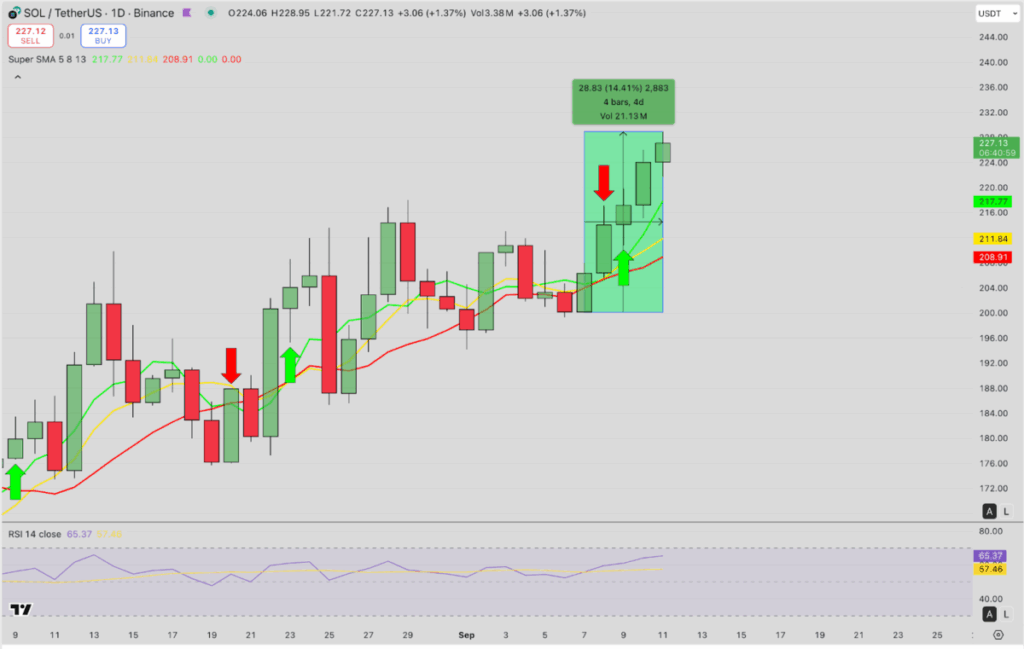

- A golden cross on the daily chart fueled a 14% rally in 4 days, with RSI at 65 showing more room to run.

- Key support sits at $217–$208, while upside targets remain at $240–$250 if momentum holds.

Solana just keeps climbing. After four straight green days, SOL tacked on another 2% Thursday, nudging past $228 for the first time since February. The spark this time? A surprise $20M treasury allocation from Chinese fashion group MOGU—and, on top of that, Nasdaq-listed Safety Shot threw $5M into BONK, Solana’s meme darling. Momentum feels heavy, and with a golden cross flashing on the daily chart, traders are already eyeing the $240–$250 range.

Corporate Cash Goes Global

MOGU confirmed in a press release that its board approved up to $20M in digital assets—spreading across Bitcoin, Ethereum, and of course, Solana. It’s a strong signal that the corporate treasury trend isn’t just U.S. companies anymore. Meanwhile, Safety Shot created a subsidiary to manage its digital assets and stacked $5M worth of BONK, boosting its holdings to over $63M. Between China’s corporate entry and U.S. public firms doubling down, Solana’s ecosystem feels like it’s in the middle of a serious adoption wave.

Golden Cross Fuels the Rally

On the charts, things look just as bullish. Earlier this week, Solana’s 5-day moving average crossed above the 8-day and 13-day averages—your classic golden cross. Since then, SOL has surged 14% in four days, while RSI hangs at 65—strong but not overheated yet. Price is holding well above support at $217, keeping the bullish setup intact. If momentum keeps rolling, $240 is the near-term wall, with $250 looming as the next big test.

Key Levels to Watch

Still, it’s not all upside. If SOL slips back below $217, bears could drag it toward $208 where the 13-day average sits. But with volume up 4% intraday—outpacing the actual price move—speculative longs are sniffing around. The takeaway? Corporate inflows + technical signals = a recipe for traders to stay long, unless the market throws a curveball.