- SEC Chair Paul Atkins pushes Project Crypto, calling for onchain capital raising without endless legal battles.

- Most tokens “aren’t securities,” paving the way for unified licenses and crypto “super apps.”

- Regulatory tone shifts sharply from Biden’s crackdown to Trump’s pro-crypto push for U.S. dominance.

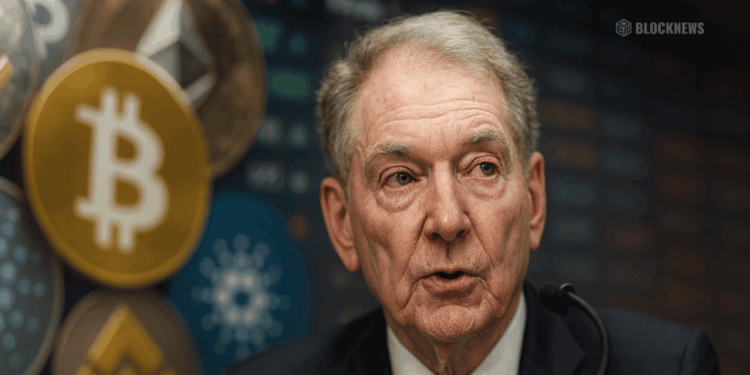

The U.S. Securities and Exchange Commission is flipping the script. In a keynote speech to the Organization for Economic Co-operation and Development (OECD), SEC Chair Paul Atkins made it clear: crypto entrepreneurs and investors should be able to raise money onchain “without endless legal uncertainty.”

Atkins, who has been front and center in reshaping policy under President Trump’s push to make America the “crypto capital of the world,” doubled down on his belief that most crypto tokens aren’t securities at all. Instead, he argued they fall outside the SEC’s jurisdiction, a stance that could reshape how projects launch and scale in the U.S.

Project Crypto: A New Era for U.S. Digital Markets

Atkins outlined what he calls Project Crypto—an ambitious initiative to modernize securities rules so markets can move fully onchain. The plan goes beyond just definitions. It’s about giving platforms the green light to integrate trading, lending, and staking all under one regulatory license. Think of it as building the framework for America’s first wave of crypto “super apps.”

“As we call on our partners to foster investor confidence and dynamic markets in their jurisdictions, these same priorities compel us, in the United States, to unleash the potential of digital assets in ours,” Atkins told the audience.

This pivot follows the recent stablecoin legislation that passed earlier this summer, the first major crypto law to clear Congress. Progress is also underway on the Clarity Act, a market structure bill that would finally settle whether oversight belongs with the SEC or the Commodity Futures Trading Commission (CFTC).

A Rejection of the Biden-Era Crackdown

Atkins didn’t hold back when reflecting on the previous administration’s crypto stance. He said Biden’s SEC “weaponized” subpoenas and enforcement, a strategy he called both ineffective and damaging. Instead of fostering innovation, it pushed startups, jobs, and capital offshore.

“For too long, the SEC has subverted the crypto industry,” Atkins said. “That chapter belongs to history.”

In his vision, regulation should be the minimum effective dose—just enough to protect investors without strangling innovation. He praised SEC Commissioner Hester Pierce’s Crypto Working Group, which is pushing forward clarity on tokenization, staking, and digital asset rules.

What’s Next: A Golden Age or Just Big Talk?

The SEC and CFTC will host a joint roundtable on Sept. 29 to discuss “innovative products” like perpetual contracts and DeFi protocols. Atkins insists the ultimate goal is to spark a golden age of financial innovation on U.S. soil—from tokenized stock ledgers to entirely new asset classes.

Whether the U.S. actually delivers on this promise is another question. For now, though, it’s clear that America’s regulatory tone has shifted from defensive to ambitious. And that might just open the door to the kind of crypto growth we haven’t seen before.