- CleanCore Solutions Inc. revealed a 285M DOGE buy ($68M) with plans to scale to 1B coins.

- Treasury chief Marco Margiotta positioned DOGE as more than a meme—an asset with utility.

- Whale accumulation, Musk’s backing, and pending ETF filings are fueling stronger demand.

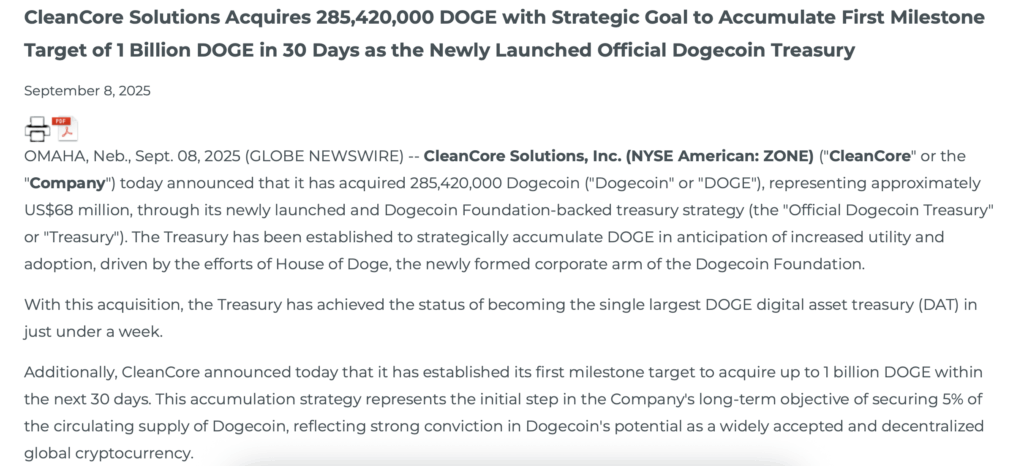

A cleaning and disinfection company isn’t the first place you’d expect to find a crypto whale, but CleanCore Solutions Inc. (NYSE American: ZONE) just flipped that idea upside down. The firm revealed it has accumulated a massive 285 million DOGE—worth close to $68 million—and plans to boost its stash to a jaw-dropping one billion coins within the next 30 days. The announcement immediately catapulted CleanCore to the top of the corporate Dogecoin leaderboard, surpassing other treasury plays that usually revolve around Bitcoin.

Dogecoin Rebrand: From Meme to Digital Asset

What makes the move even more interesting is the man steering it—Marco Margiotta, who handles CleanCore’s treasury and also leads the “House of Doge” initiative. Margiotta framed the purchase not as a meme gamble but as part of a strategy to reposition Dogecoin as a legitimate digital asset with actual utility. For a company outside the typical crypto bubble, the move signals an attempt to rebrand DOGE from cultural joke into something with staying power in corporate finance.

Whale Activity and Musk’s Shadow

CleanCore isn’t acting in isolation either. Blockchain data shows whales have been active, snapping up more than 240 million DOGE in a single day. This surge hints at wider institutional interest beginning to surface. Add in Elon Musk’s constant nods to Dogecoin—tweets, interviews, product tie-ins—and the market psychology gets another layer of fuel. Musk’s influence remains a huge driver of DOGE sentiment, making every corporate buy seem like part of a bigger narrative.

Wall Street Pushes Toward Dogecoin ETFs

If that wasn’t enough, traditional finance is circling too. Big names like Grayscale, Bitwise, 21Shares, REX Shares, and Osprey Funds have all filed applications with the SEC for spot Dogecoin ETFs. Approval isn’t guaranteed, but even the filings themselves mark a milestone. It shows DOGE is moving deeper into the mainstream investment arena, and with a listed company like CleanCore now holding a billion-coin target, the meme token’s future looks a little less like a joke and more like a serious play.