- Ethereum price reclaimed $4,100 as support, setting up for a potential breakout.

- Technical targets point to $5,000 first, with $6,250 possible if momentum holds.

- DeFi, stablecoins, ETFs, and futures confirm strong demand backing ETH’s bullish setup.

Crypto markets have been choppy, but Ethereum is quietly setting up for what could be its biggest move yet. ETH has cooled off from its August peak near $5,000, but history shows that pullbacks often pave the way for stronger rallies. With institutional inflows, record-breaking DeFi usage, and bullish chart signals, Ethereum may be on the verge of surprising even the most optimistic traders.

Ethereum Price Holds Above $4,100 Support

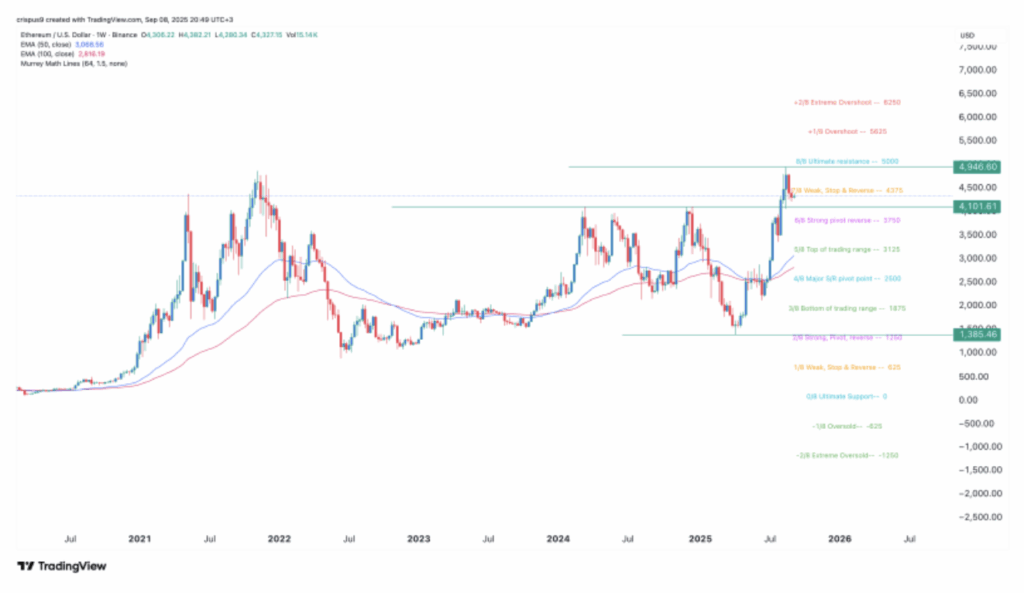

After reaching $4,945, ETH retraced to around $4,335. Despite the pullback, the token remains 210% higher than its yearly low, showing impressive resilience. More importantly, Ethereum flipped the $4,100 resistance level into support, a classic bullish signal. If this zone holds, the next leg up could form quickly. Weekly charts confirm the momentum—ETH bottomed near $1,385 in April and surged nearly 260% into August.

Ethereum Price Targets $5,000 and $6,250

The immediate target for ETH is retesting its all-time high near $4,946. A breakout here would likely ignite mainstream coverage and retail FOMO. Beyond that, the $5,000 psychological level is key, with Murrey Math Lines pointing toward $6,250 as an extended target—about 45% above current prices. Still, bulls must defend $3,750 support; losing it would break the bullish structure.

Ethereum DeFi Growth Strengthens Bullish Outlook

Ethereum’s fundamentals are powering the price story. Total value locked (TVL) in DeFi recently hit $200+ billion, far ahead of rival chains. Stablecoin supply on ETH is up 12% to $157B, transactions jumped 14% to 22.7M, and overall transaction volume surged 38% to nearly $1 trillion. These metrics show real usage, not just speculation.

Ethereum ETFs and Futures Show Institutional Demand

Institutional interest is also building. Ethereum ETFs have attracted over $12B in inflows, with BlackRock’s ETHA holding $16B in assets under management. Futures markets are equally strong, with open interest reaching $58B. Positive funding rates indicate that bullish bets remain dominant, reinforcing the narrative that big money is positioning for higher prices.