- TRON Inc.’s treasury hit $220M after its top shareholder injected another 312.5M TRX.

- TRON leads all blockchains in transactions and USDT minting, with over 9.4M transactions logged this year.

- Price hovers near $0.337, with bulls eyeing $0.50 long-term if support holds.

The Nasdaq might’ve found a new obsession—crypto treasuries. More listed firms are stacking digital assets, and TRON Inc. has joined the trend in a big way. As of September 5, the company’s treasury swelled to $220 million after its biggest backer doubled down on TRX.

Bitcoin was the first darling of Wall Street’s treasury playbook, but the tide has clearly shifted. Ethereum, Solana, and now TRON are carving out their place, with big money starting to take them seriously.

TRON Inc. Expands Its TRX Stash

Bravemorning Limited, TRON Inc.’s largest shareholder, just pumped another 312.5 million TRX into the treasury—worth around $110 million. That boost took the company’s total holdings up to $220 million and increased Bravemorning’s share to over 86%.

The move signals that institutions aren’t ignoring TRON anymore, despite the coin’s rocky path since the 2021 altcoin mania. Still, the stock didn’t react kindly—TRON Inc. shares slipped 9% in a day to trade near $3.91, well off their highs above $10 shortly after its July Nasdaq debut.

TRON Leads in Transactions and Stablecoin Action

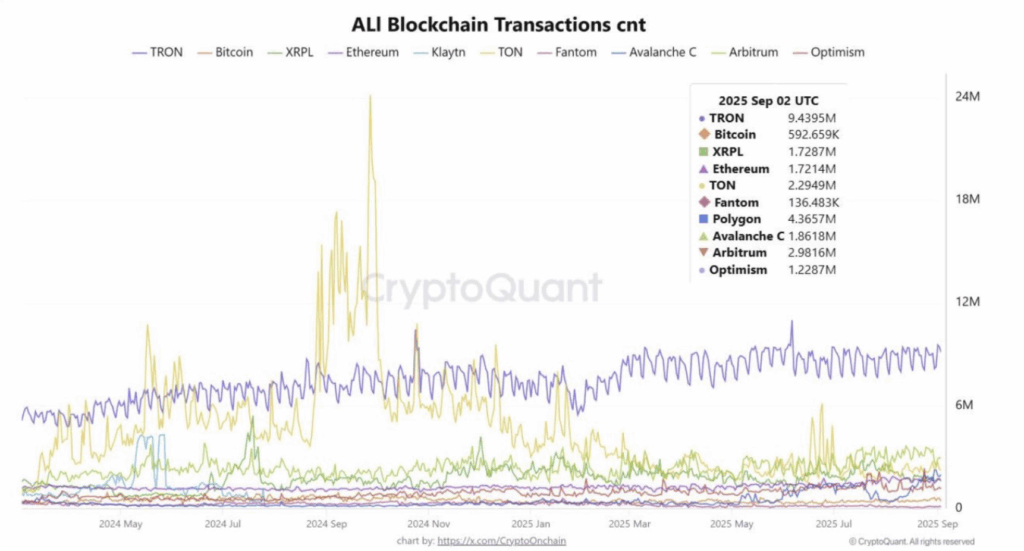

Even if the stock’s lagging, the blockchain’s raw numbers look strong. TRON led the entire market in transaction count this year, clocking in 9.43 million—over double Polygon’s 4.36 million. Ethereum, Arbitrum, Toncoin, XRP Ledger, and even Bitcoin were left trailing.

Much of that dominance comes from USDT activity. Tether Treasury keeps minting billions of dollars’ worth of stablecoins on TRON, while Binance has been busy swapping billions in USDT between TRON and Ethereum. Liquidity is clearly flowing into the network.

Interoperability plays a role too. TRON partnered with Near Protocol to enable USDT swaps without the hassle of bridges or wallets, using SwapKit and THORSwap as the engines. Add over 25 new cross-chain connections via deBridge, and it’s clear the chain is widening its reach.

TRX Price Tests Key Levels

On the charts, TRX is wobbling after a break of structure around $0.34. The token’s trading just above $0.337, with bulls needing to hold the line at support. A bounce above $0.342 could re-open the path higher, while losing the current level risks sliding back to $0.336 or worse.

Bears are showing teeth in the short term, but the long game still favors bulls. If TRX manages to reclaim momentum, the $0.50 target becomes realistic. That would push its market cap north of $50 billion—roughly $19 billion higher than today.

For now, TRON looks caught in a tug-of-war between profit-taking whales and a blockchain that’s firing on all cylinders. Traders with patience may see it as a setup worth watching.