- ADA price is rebounding, with OI climbing close to record highs.

- Stablecoin activity on Cardano is rising, adding liquidity and network strength.

- Support sits at $0.82–$0.84, while upside targets include $1.02 and $1.17.

Cardano (ADA) price has started clawing its way back up after bouncing from a critical support zone last week. Optimism is slowly returning, with rising open interest in derivatives and a steady uptick in its stablecoin market cap giving bulls a reason to lean in again. The recent drop in bearish momentum has traders wondering if ADA is ready to push higher in the coming sessions.

Derivatives and On-Chain Data Back the Move

Fresh numbers from CoinGlass show futures open interest (OI) in ADA climbed from $1.54 billion on Friday to $1.77 billion on Monday, nearly brushing up against its record of $1.87 billion. That kind of rise usually signals new money pouring into the market, a sign that buyers might be gearing up for a bigger move.

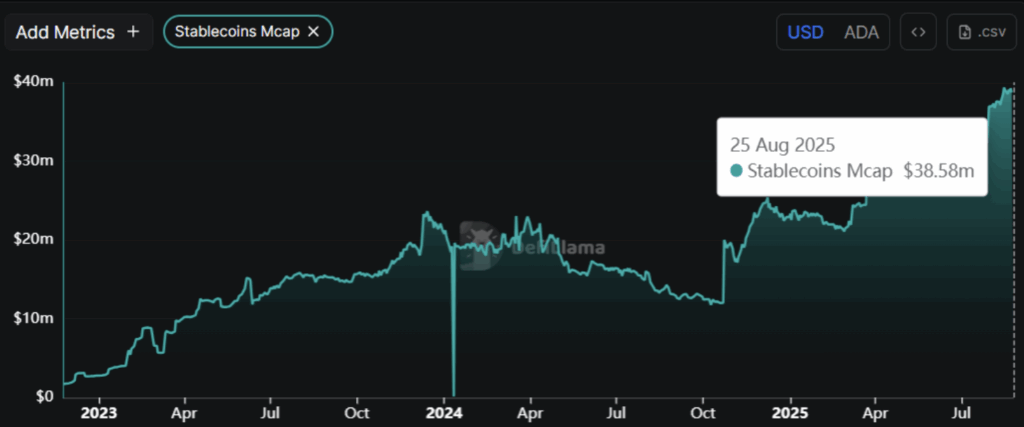

At the same time, DefiLlama data reveal that stablecoin market capitalization tied to Cardano has been climbing steadily since late July, hitting $38.58 million as of Monday. A growing stablecoin base often means more liquidity and network activity—both of which tend to reinforce bullish sentiment across an ecosystem.

Key Support Levels and Price Action

On August 13, ADA broke through a descending trendline that had capped it for months, before quickly retesting the $1 psychological barrier. The rally didn’t hold, though. ADA slipped 5.4% last week but managed to rebound right at its broken trendline support, which conveniently lines up with the 61.8% Fibonacci retracement around $0.82. That makes the $0.82–$0.84 range a critical defense line for bulls.

As of early Monday, ADA is hovering near $0.92. If momentum carries it back toward the August 14 high of $1.02, a strong close above that level could set the stage for a run at $1.17—its peak for the year so far.

Indicators Show Early Bullish Signs

The Relative Strength Index (RSI) currently reads 58, just above neutral, hinting at growing bullish traction. Meanwhile, the MACD lines are converging tightly, a sign of indecision but also a potential setup for a sharper move ahead.

Still, traders should stay cautious. If ADA fails to hold $0.90 and sellers regain control, a dip back to $0.84 isn’t out of the question. But as long as support holds and volumes keep rising, the odds of a stronger rally remain in play.