- Ripple’s SEC battle is over, clearing XRP from security status on exchanges.

- Seven asset managers, including Grayscale and Franklin Templeton, filed for XRP spot ETFs.

- Decision week is locked for October 18–25, 2025, a potential watershed for altcoin ETFs.

Could XRP finally get its own exchange-traded fund by October 2025? With Ripple’s years-long battle with the SEC officially closed, big-name asset managers are rushing to file applications. But the path isn’t clean—legal quirks from the case and market structure issues still loom large.

Ripple’s Legal Cloud Finally Clears

On August 22, 2025, a federal appeals court dropped the last remaining challenges in Ripple’s case with the SEC. That made Judge Analisa Torres’s 2023 ruling the final say. The result left Ripple paying a $125M fine for its institutional sales, but also confirmed that XRP traded on public exchanges is not a security. For everyday traders, the uncertainty hanging over XRP evaporated overnight.

Asset Managers Line Up for Spot ETFs

Almost immediately after the news, the filings poured in. Grayscale, Franklin Templeton, Bitwise, and several others updated their S-1s with the SEC, signaling a coordinated effort to push XRP ETFs through. Analysts like James Seyffart and Nate Geraci said the timing suggested these firms had already been working with regulators behind the scenes. For the first time, approval feels possible.

Legal and Futures Roadblocks

But the same ruling that opened the door could also slam it shut. Judge Torres’s distinction—that institutional sales counted as securities while retail trades didn’t—creates a problem. Spot ETFs are created and redeemed by large institutions called Authorized Participants, and the SEC could argue those transactions look too similar to the sales that were ruled illegal. On top of that, the XRP futures market is still young. Volume has grown to $9B over three months on CME, but it doesn’t have the long history regulators leaned on when approving Bitcoin ETFs.

A Friendlier SEC Under Atkins

One thing working in XRP’s favor is the new SEC chair, Paul Atkins. Unlike his predecessors, Atkins has said most crypto tokens aren’t securities at all. He’s more focused on how assets are sold than what they are, which lines up closely with the Torres ruling. Under his leadership, the SEC launched Project Crypto to draft clearer digital asset rules and even issued guidance this summer to fund managers on how to structure ETF disclosures. Meanwhile, Congress is moving too—the CLARITY Act and GENIUS Act both lay new ground for crypto regulation.

Market Impact Could Be Massive

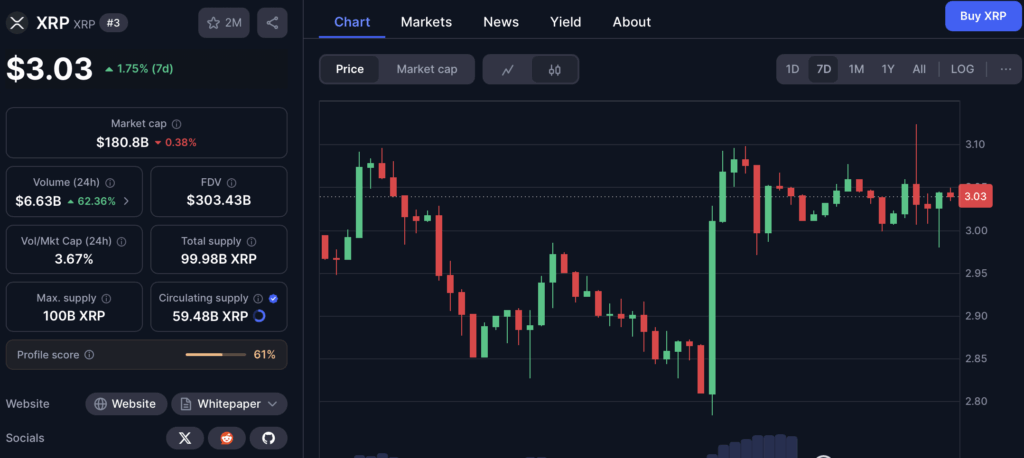

If the SEC gives the green light, analysts expect XRP ETFs could pull in $5B–$8B in their first year. That kind of inflow would radically boost liquidity and could reshape XRP’s valuation overnight. Still, it won’t be smooth sailing. Crypto has a history of “buy the rumor, sell the news,” meaning prices could dump right after approval. Plus, XRP’s supply remains concentrated—over half is in the hands of Ripple Labs or a small circle of whales, creating the risk of sudden sell-offs.

The October Decision Window

The SEC is now boxed in by deadlines. Between October 18 and October 25, 2025, it must either approve or reject the applications. Whatever it decides won’t just set XRP’s future—it’ll signal how regulators treat the next wave of altcoin ETFs waiting in line. For now, XRP sits on the edge of what could be one of its most defining moments ever.