- LINK jumped to $26.70, its highest since January, after Powell’s speech.

- Whales increased holdings by 27% in a month, while exchange balances keep falling.

- Technicals point to a breakout pattern targeting $51, backed by rising demand and strong fundamentals.

Chainlink ripped higher on August 22, hitting $26.70—its best level since January. The rally followed Jerome Powell’s dovish comments at Jackson Hole, which gave the broader crypto market a boost. But for LINK specifically, it wasn’t just macro chatter driving the move. Whales and so-called smart money investors have been piling in, fueling momentum as a bullish technical setup starts to take shape.

Whales and Smart Money Keep Buying

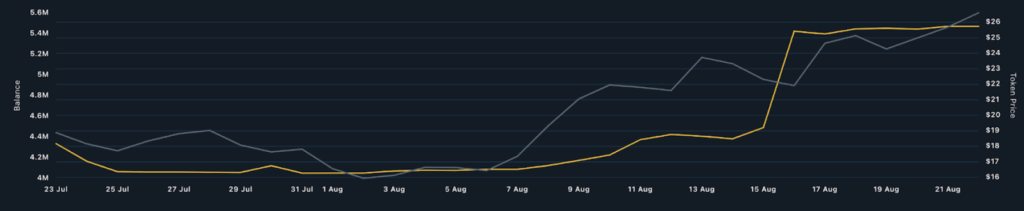

Data from Nansen shows whales have grown their LINK holdings by 27% over the past month, now sitting at 5.47 million tokens. That’s up from under 3 million last year, showing a steady build-up of confidence. Meanwhile, smart money wallets—those with a reputation for buying low and selling high—have also been scooping up LINK. In fact, LINK was the top token purchased by these investors in the last week.

At the same time, exchange balances keep dropping. Just 270 million LINK remain on centralized platforms, down from 280 million earlier this month. That’s a healthy sign: fewer tokens on exchanges means less immediate selling pressure. Combined with rising wallet addresses, it suggests demand is outpacing supply.

Derivatives Fuel More Upside

The derivatives market is backing the rally too. Funding rates for LINK have stayed positive since June, showing that traders are willing to pay to keep long positions open. Open interest has also hit a new all-time high of $1.58 billion, signaling more demand and deeper liquidity in futures markets.

On the fundamentals side, Chainlink continues to lead the oracle sector, securing over $57 billion in value—far ahead of competitors like Band Protocol or Pyth. Partnerships with JPMorgan, SWIFT, ANZ Bank, UBS, and Coinbase keep adding weight to its RWA tokenization narrative. The launch of Strategic LINK Reserves, now above $3 million, further reinforces long-term confidence.

Technical Picture: Cup and Handle Forming

Technically, LINK is shaping up nicely. The daily chart shows a developing cup-and-handle pattern, with resistance around $30 and support near $10. The pattern’s depth is about 67%, which projects a breakout target close to $51—the token’s all-time high.

If whales keep buying, derivatives remain supportive, and Chainlink continues to strengthen its grip on real-world adoption, LINK could realistically be lining up for a run well beyond $30 and toward new highs.