- Solana surged nearly 13% to $206.70, with trading volume spiking 158%.

- YZY token launch and ETF filing sparked demand, pushing network activity and TVL higher.

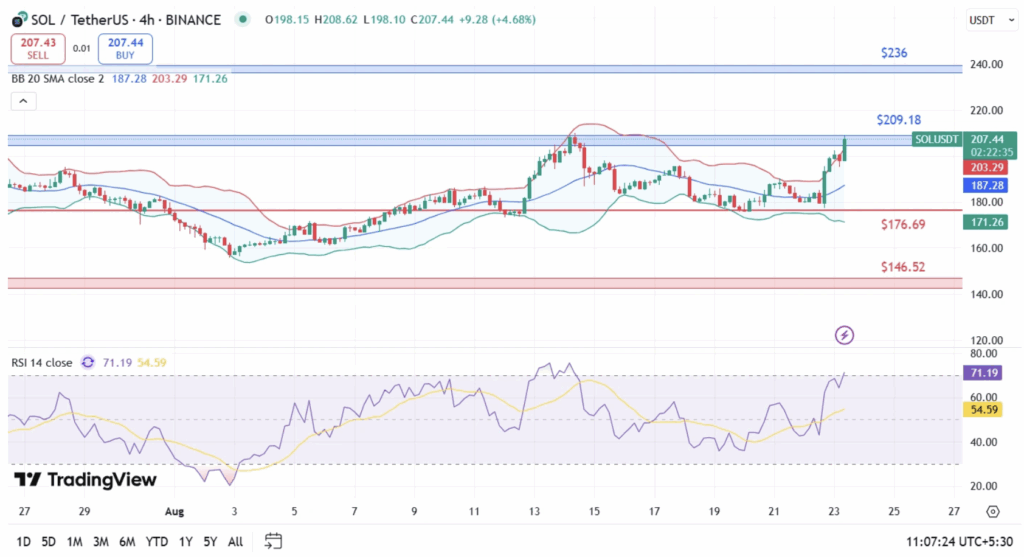

- SOL now eyes resistance at $209 and $236, though staking and leverage raise volatility risks.

Solana has been on a tear, jumping nearly 13% to trade around $206.70. Its market cap has now swelled to $112 billion, with intraday volume exploding 158% to $11.9 billion. Over the past day, SOL bounced between $177 and $205, catching the attention of both retail traders and institutions. With the token now only about 30% shy of its all-time high at $294, speculation over where it goes next is heating up fast.

What’s Driving the Surge

A big spark came from the launch of Kanye West’s YZY token on August 21. The coin rocketed 6,800% to $3.16 before sliding back to $1, but not before churning out $386 million in daily volume. That frenzy pumped Solana’s network activity by 139% and lifted total value locked (TVL) 25% higher to $15.3 billion. On top of that, institutional demand is growing too—Tidal Trust II just filed for a 2x leveraged Solana ETF. Regulatory approval could take time, but the filing alone signals confidence. With about 70% of all SOL staked, the liquid supply is thin, meaning any fresh demand has an outsized effect on price swings.

Technical Picture

From a technical standpoint, SOL broke above its 50-day moving average at $180 and cleared Fibonacci resistance at $197, kicking off a sharp rally. The MACD histogram turned positive at +0.33, while RSI sits at 63.5—bullish, but still with room before hitting overbought levels. The breakout above $193 also triggered algorithmic buying, with the funding rate climbing to +0.01%, the highest in a month.

Immediate resistance sits at $209.67, the recent August swing high, with a bigger barrier looming at $236. Support levels are set at $176.69 and $146.52. As long as bulls keep control, a test of $209 looks likely, with an extended push toward $236 on the table.

Risks to Watch

The rally isn’t without risks. Heavy staking plus leveraged long positions can turn a pullback into sharp volatility fast. If demand cools suddenly, the thin supply could cut both ways, sending prices sliding just as quickly as they’ve climbed. For now, though, momentum is firmly on Solana’s side, and the market is watching closely to see if this breakout has more fuel left.