- Cardano is trading near $0.91 after shedding 4%, with $0.84 marked as key support.

- On-chain data shows holders realizing heavy losses, signaling capitulation and selling pressure.

- If ADA holds support, it could aim for $1 again, but failure risks a deeper slide.

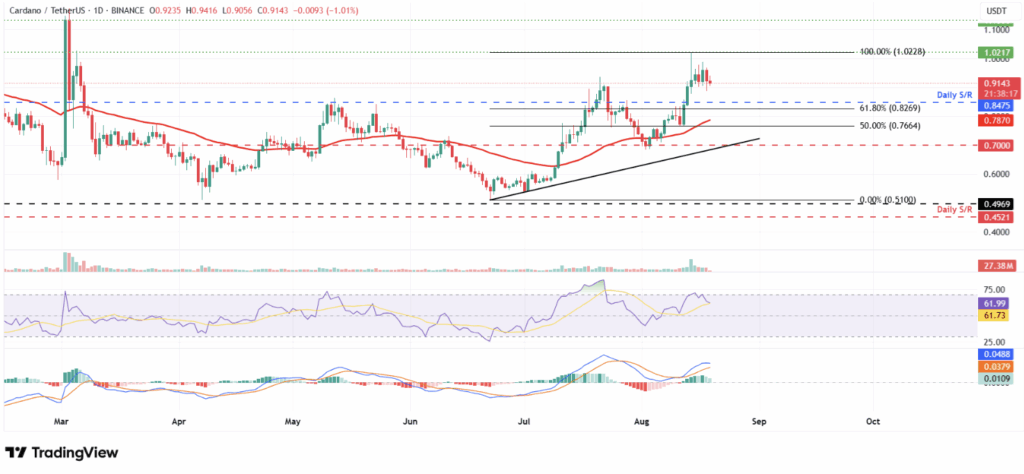

Cardano hasn’t caught a break lately. At the time of writing, ADA trades near $0.91, slipping almost 4% in the last session after briefly topping $1 just a week ago. On-chain data paints a shaky picture, with holders locking in losses, fueling concerns of deeper downside. Bears are eyeing $0.84 as the next key support, a level that could decide if ADA bounces or bleeds further.

On-Chain Metrics Signal Capitulation

Santiment’s Network Realized Profit/Loss (NPL) metric flipped hard from +23M on Sunday to -26M on Monday. That swing means most traders were selling at a loss—a classic sign of capitulation. Historically, these kinds of dips sometimes precede a sharp rebound, but only after short-term pain. Adding to the bearish weight, CryptoQuant’s Taker CVD is firmly negative, suggesting ADA is stuck in a seller-dominated phase.

Technical Picture: Bears in Control, But Room for Rebound

Technicals back up the bearish outlook for now. The RSI cooled off from overbought levels, now sitting at 61, hinting at fading bullish momentum. MACD histogram bars are shrinking too, another sign bulls are losing steam. If ADA breaks $0.84, things could unravel quickly. But if buyers step back in, the $1 psychological mark remains the key upside target to watch.

The Big Picture

In short, Cardano’s price action is shaky, caught between fading momentum and looming support. On-chain signals scream caution, but crypto has a way of bouncing when sentiment is darkest. For now, the playbook is clear: $0.84 is the floor to watch, and $1 the ceiling. Whichever side cracks first may decide ADA’s next big move.