- DOGE broke bullish structure above $0.259 in July, but volume and momentum remain weak.

- Long-term growth hinges on flipping $0.35–$0.45 into support, with $1 as the near-term dream target.

- To hit $5 by 2030, Dogecoin needs stronger fundamentals—network growth, adoption, and sustained whale accumulation.

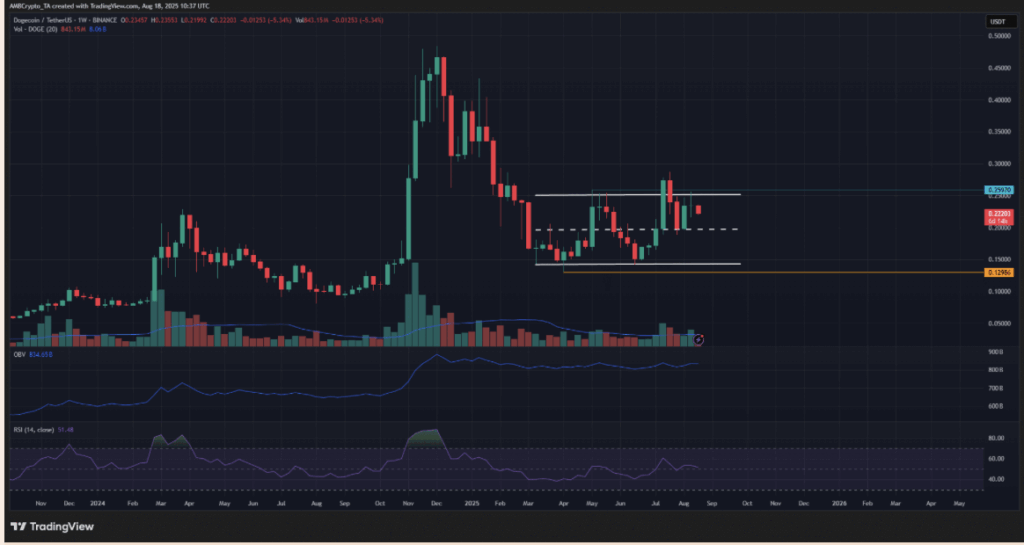

Dogecoin has been trying to claw its way higher, but progress has been choppy. On the weekly timeframe, DOGE flashed some bullish structure when it broke past $0.259 in mid-July, yet bulls couldn’t hold the breakout. Since then, $0.20 has acted as a floor, though the trading volume hasn’t been strong enough to spark another rally.

Whale Conviction and Market Lag

Interestingly, whale activity has shown confidence—big buys came during dips—but the memecoin still lags behind Bitcoin and Binance Coin, both of which set fresh all-time highs. Technical signals show some promise: RSI flipped above neutral 50 and OBV is creeping higher, hinting at growing buying pressure. Still, DOGE needs more than charts to sustain momentum.

Long-Term Road to $1 and Beyond

On the monthly view, things get trickier. Losing the $0.35–$0.45 zone as support earlier this year was a setback, and reclaiming it is crucial for long-term bullish strength. A $1 target would give DOGE a $116B market cap, putting it in BNB’s league but far behind Ethereum’s $517B. Reaching $5 by 2030 would require huge growth in active addresses, transactions, and broader adoption—basically, DOGE needs to mature beyond hype alone.

Risk, Reward, and Reality Check

For now, DOGE remains a high-risk, high-reward play. Its community and decentralized nature give it resilience, but its future still hinges on sentiment, hype cycles, and whether big players actually adopt it. In short: the $1 dream isn’t impossible, but without stronger fundamentals, it’s more a bet on culture and conviction than on clear utility.