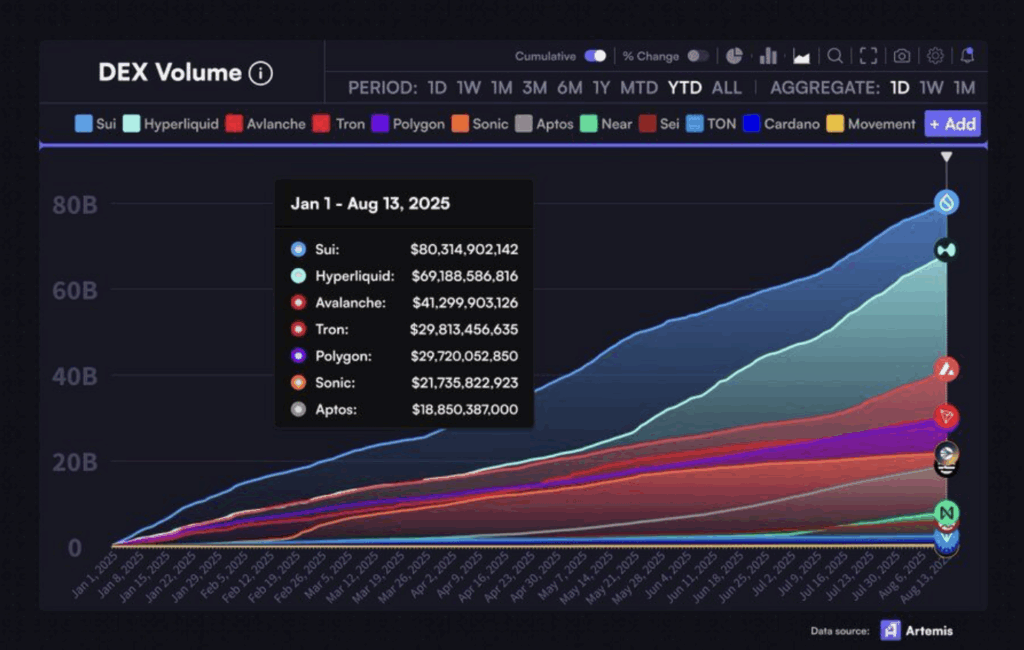

- $80B DEX milestone: Sui outpaced Avalanche, Aptos, and Hyperliquid in decentralized trading volume, signaling rapid ecosystem growth.

- Bullish setup: Analysts eye resistance at $4.42 and $5.33 as key targets if SUI can maintain weekly bullish momentum.

- Derivatives cooldown: Trading activity eased, but funding rates remain balanced—hinting at cautious optimism rather than bearish pressure.

Sui is back in the spotlight after smashing through $80 billion in DEX volume this year—an impressive milestone that places it ahead of other buzzy chains like Hyperliquid, Avalanche, and Aptos. Even with the broader market wobbling, SUI has managed to keep traders talking. At press time, the token trades at $3.68, holding a market cap of $8.69 billion. The past 24 hours saw price dip 3.87%, but given the scale of volume flowing across its ecosystem, investors aren’t exactly panicking.

DeFi Growth Surges Past Rivals

The Sui community recently revealed that more than $80 billion worth of transactions have been processed through decentralized exchanges in just the first half of 2025. For context, that’s higher than several rivals that were previously stealing the DeFi limelight. The takeaway here? Activity on Sui is growing faster than many expected, showing that user adoption and network demand are gaining serious traction.

Price Targets and Technical Momentum

On the charts, SUI is showing signs of heating up again. Analysts at Altcoinpedia pointed out that the project closed the week with a strong bullish candle, hinting that momentum could carry into the next leg higher. The immediate test sits at $4.42 resistance. If bulls clear that level, $5.33 comes into play, which would put SUI close to retesting record highs. For long-term traders, this type of setup is exactly what they’ve been waiting on—a clean breakout supported by strong fundamentals.

Derivatives Market Cools Off

Interestingly, derivatives data is telling a slightly different story. Trading volume has dropped over 20%, with open interest sliding 3.26% to $1.89 billion. That suggests investors may be stepping back for the moment, waiting for a clearer direction before loading up again. The OI-weighted funding rate, though, is sitting at 0.0087%—pretty balanced, showing neither longs nor shorts are aggressively in control.

This cooling in leverage markets doesn’t necessarily mean weakness—it might just reflect traders biding time while spot activity leads the charge. In fact, with volatility levels staying relatively calm, the current setup could be priming SUI for its next big swing once momentum builds again.