- Ethereum and Bitcoin ETFs hit $40B in volume this week, with ETH ETFs alone pulling $17B.

- Analysts like ex-BlackRock’s Joe Chalom call ETH a “generational opportunity” tied to tokenized finance growth.

- ETH/BTC ratio breaks above 365-day MA, hinting at a possible new cycle despite subdued retail sentiment.

Ethereum may still trail Bitcoin in sheer price dominance, but this week it stole the spotlight. Spot Bitcoin and Ether ETFs combined for a staggering $40 billion in trading volume, the biggest week on record. Interestingly, Ethereum ETFs accounted for $17 billion of that flow—more than doubling their previous high—and briefly ranking among the most heavily traded ETFs and even stocks in the U.S.

Bloomberg’s Eric Balchunas summed it up bluntly: “It’s like it was asleep for 11 months and then crammed a year’s worth of action into six weeks.” For Ethereum, this was more than just a spike in numbers—it was a moment that hinted at something deeper, maybe even a shift in how institutions are viewing the network’s role in global finance.

Why Analysts See ETH as a Generational Bet

Former BlackRock digital assets head Joe Chalom called this a “generational ETH opportunity.” His reasoning? Every $2 secured on Ethereum and its Layer 2s tends to mirror $1 in ETH’s market cap. With stablecoins, tokenized assets, and real-world finance set to flood blockchains in the trillions, Ethereum is increasingly seen as the base layer of trust. Chalom wasn’t shy: “This isn’t a trade… It’s a chance to be early in a paradigm shift.”

At the same time, Ethereum’s price action versus Bitcoin is showing quiet signs of life. The ETH/BTC ratio just climbed above its 365-day moving average for the first time since the Merge, a potential marker of a long-term trend reversal.

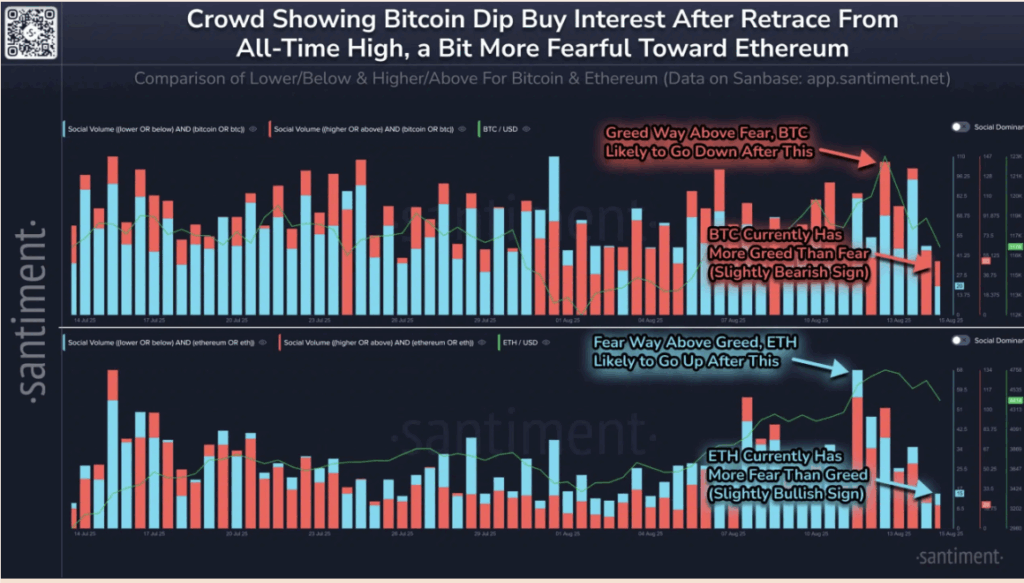

Fear vs Greed: A Tale of Two Coins

Despite outperforming BTC over the last three months, Ethereum still sits in a zone of cautious sentiment. Santiment data showed fear outweighing greed for ETH holders—ironically a “slightly bullish” setup compared to Bitcoin’s overextended greed signals. Analysts say if ETH can sustain this structural momentum, the ETH/BTC pair could claw back toward 0.08, levels last seen during its previous dominance cycle.

Ethereum’s fundamentals may still be underpriced relative to Bitcoin hype. The market may not be cheering as loudly yet, but that’s exactly what some analysts argue makes this moment so powerful—it’s opportunity hidden under a layer of caution.