- Solana’s first U.S. staking ETF (SSK) logged $13M inflows and $66M in volume in a single day, its strongest yet.

- Whale accumulation is rising in lockstep with ETF demand, now making up 20% of SSK’s AUM.

- Analysts eye $250 price target, though resistance near $206 could cause short-term pauses.

Solana just saw one of its strongest institutional moments yet. The first U.S. Solana staking ETF (SSK by REXShares)booked its biggest day on record, pulling in $13 million in new inflows while trading volume spiked to $66 millionwithin 24 hours. This sudden surge highlights how quickly demand for regulated Solana exposure is ramping up. The timing was no coincidence either—SOL had just rallied 33% off a key Fibonacci retracement zone, a level that has historically triggered powerful upside moves in previous cycles.

Whale Activity Aligns with Institutional Flows

On-chain data is confirming the story behind the charts. Whales have been steadily accumulating positions, shown by a rising Exchange Whale Ratio. This comes at the same time as ETF inflows accelerate, suggesting big players are making coordinated moves before a potential breakout. History has shown that when ETF demand and whale buying converge, Solana tends to experience explosive rallies. At the moment, SOL inflows already account for nearly 20% of SSK’s total assets under management—a clear sign of mounting institutional conviction.

Building Momentum Toward $250—But Watch Resistance

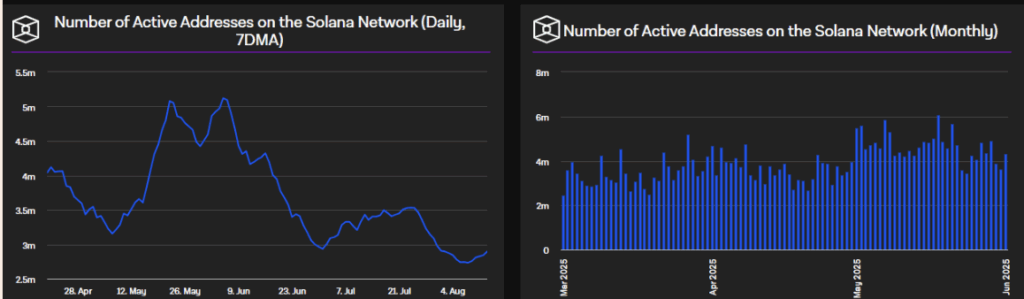

Beyond ETFs and whales, the broader Solana ecosystem is flashing bullish signals. Active addresses are climbing, and momentum across Layer-1 projects is strengthening as risk appetite returns to altcoins. Analysts are now eyeing $250 as the next major price target, but the path isn’t without hurdles. There’s a tough resistance zone sitting just below $206, where profit-taking could temporarily slow things down. Still, if inflows remain this strong and accumulation continues, that resistance may only be a speed bump on Solana’s push higher.