- July CPI data shows cooling inflation at 2.7%, boosting September Fed rate cut odds to 93.9%.

- Bitcoin eyes $120K breakout, with analysts targeting $130K–$137K if momentum sustains.

- Key support sits at $117,650–$115,650, with risk of deeper pullback toward $100K if bulls fail to reclaim $120K.

Bitcoin’s price action this week has been dancing around a critical psychological mark, with fresh macro data adding fuel to the rally narrative. The July US Consumer Price Index (CPI) came in at 2.7% year-over-year — unchanged from June and below the 2.8% forecast. Core CPI, stripping out food and energy, ticked up 3.1% in line with expectations. On a monthly basis, overall CPI slowed to 0.2%, down from June’s 0.3%, while core CPI rose 0.3%, slightly higher than the previous 0.2%.

Macro Tailwinds Building

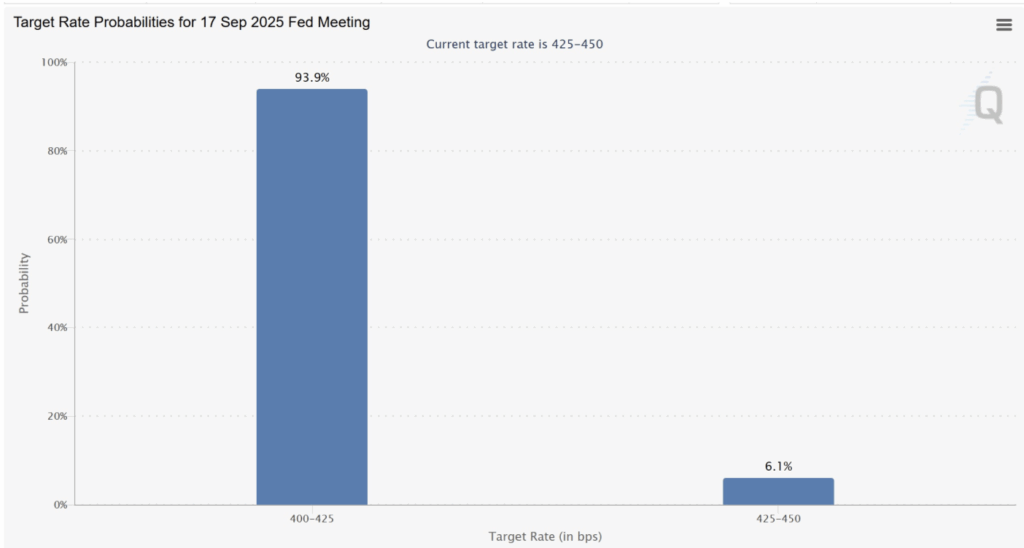

The softer inflation print reinforces the case for monetary easing, a backdrop historically friendly to risk-on assets like Bitcoin. Lower rates reduce the opportunity cost of holding BTC, potentially attracting more institutional and retail inflows. After the CPI release, CME FedWatch data showed September rate cut odds soaring to 93.9%, as traders leaned heavily into dovish expectations. That said, the steady core CPI hints that the Fed might still wait for further evidence before acting. Eyes are now on next week’s Producer Price Index (PPI) — a cooler-than-expected reading could strengthen the bullish setup.

Technical Picture Points Higher

BTC’s price briefly touched $122,190 earlier this week before slipping 3% to $118,500. Post-CPI, it rebounded to $119,500, but traders are watching for a decisive daily close above $120,000 — a milestone that’s never been reached before. On the charts, a bullish flag recently broke upward, and current price action looks like a retest before continuation. Analysts like Titan of Crypto see potential for $130,000, even $137,000, if momentum holds.

Risks Still on the Table

Failure to reclaim $120,000 could invite short-term selling, with immediate support sitting between $117,650 and $115,650 — an area overlapping with a CME gap from the weekend. A deeper correction could even retest $100,000, and in a worst-case slide, $95,000. Still, with macro winds shifting and technicals leaning bullish, the stage is set for Bitcoin’s next big move — the only question is whether bulls can seize the moment.