- Pi Coin has dropped over 20% in a week and 88.6% since its February all-time high.

- Losses stem from the Fed’s rate-hold decision, global trade tensions, and broader risk-off sentiment.

- A September rate cut could aid recovery, but macro uncertainty remains a major obstacle.

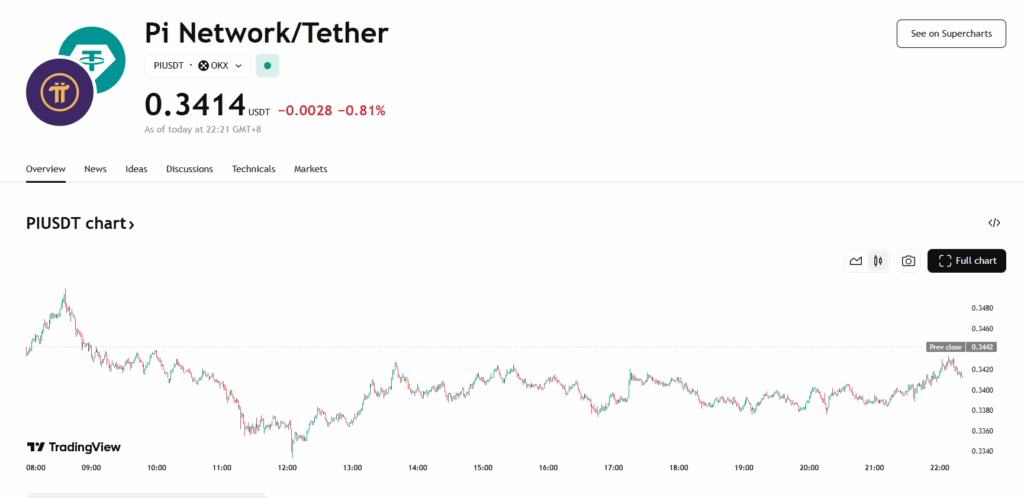

Pi Coin (PI) has been hit hard by recent market conditions, logging some of the steepest losses among the top 100 cryptocurrencies. Over the past 24 hours, PI fell 4.5%, while weekly losses hit 20.2%. The decline extends to a 28.7% drop over the last two weeks and a 27% slide in the past month. CoinGecko data shows PI leading weekly declines across major projects, underscoring the severity of the pullback.

Macro and Market Pressures Driving Sell-Off

The correction follows the Federal Reserve’s decision to keep interest rates unchanged, a move that has shifted investor capital toward safer assets. PI, considered a higher-risk crypto, has seen demand fall as borrowing remains expensive. Broader macroeconomic uncertainty—including global trade tensions and new U.S. tariffs under President Trump—has weighed further on risk appetite. This pressure hit both the crypto market and U.S. equities, triggering widespread sell-offs.

From February Peak to 88% Drawdown

PI reached an all-time high of $2.99 in late February, defying a broader market downturn at the time. That surge was fueled by the asset’s open mainnet launch and a burst of retail interest. However, the rally proved short-lived, and PI has since dropped 88.6% from its peak. The latest market downturn has only deepened the losses, pushing sentiment further into negative territory.

Outlook Hinges on Fed Policy and Macro Trends

A potential interest rate cut in September could inject fresh optimism into risk markets, possibly sparking renewed buying in PI. Lower borrowing costs generally encourage greater risk-taking, which could benefit smaller-cap cryptos. Still, persistent macro risks—such as ongoing trade disputes and global economic headwinds—could limit the scope of any recovery. PI’s rebound prospects will likely hinge on both improved macro conditions and renewed on-chain or adoption catalysts.