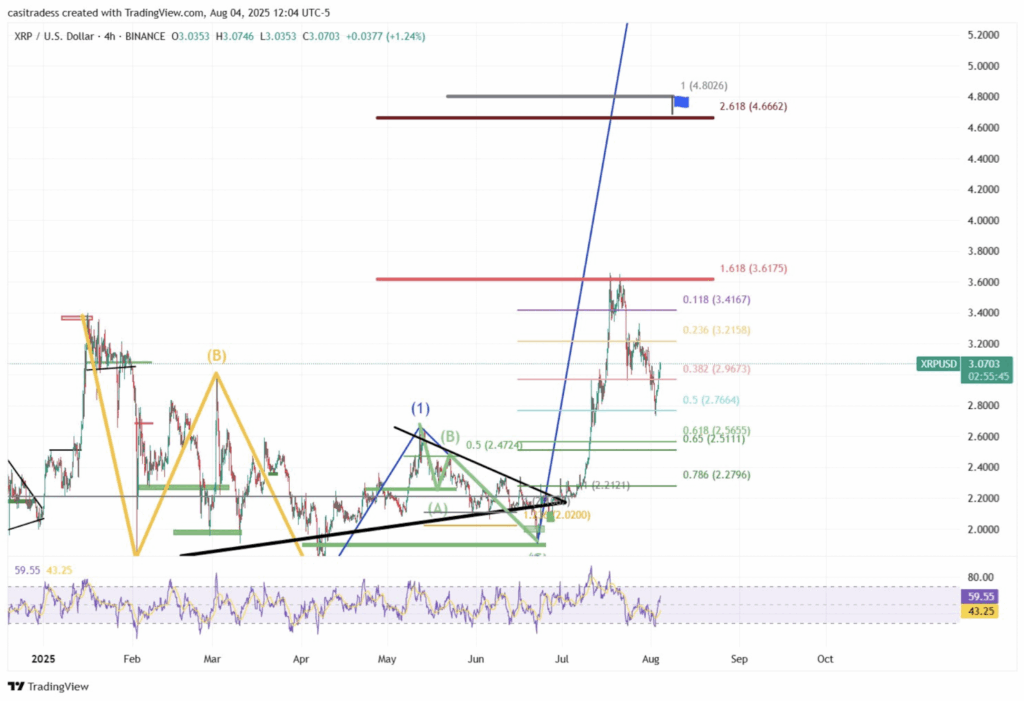

- XRP tested support at $2.75 and reclaimed $3.00, keeping its larger bullish structure intact despite short-term dips.

- A breakout above $3.21 could confirm the end of the correction, setting sights on $4.00–$4.80.

- Trading volume spiked nearly 28%, and open interest rose, hinting at strong bullish momentum building up.

XRP’s been dancing around key levels lately, and while it’s hit a few speed bumps, the bigger picture might still be pointing up. According to CasiTrades, the crypto isn’t down for the count. It bounced off the $3.00 level (a .382 Fibonacci retracement, if you’re into the math), then shot up to $3.31… but couldn’t quite hold that high.

That resistance at $3.31 turned out to be a wall. After failing to smash through, the momentum fizzled. Some traders started wondering: was this part of a deeper correction? Maybe the B-wave of an ABC structure?

Key Levels in Play: $2.75 Holds the Line (Barely)

When XRP slipped below $3.00, it slid further down to test $2.75—a 50% Fib level. That was a scary moment. If it broke below that, things could’ve unraveled fast. But nope. XRP bounced.

Not only did it bounce, it crawled right back above $3.00. Now it’s gotta hold that level tight for a few days if it wants to keep the bullish vibes going.

Despite all the whipsaws, analysts don’t think the setup’s broken. The local low of $2.75 still sits above the prior Wave 1 high at $2.65—which means the bigger bullish structure is technically intact. Plus, bullish divergences are popping up on the 15-min and 4-hour charts. That’s a good sign. Maybe the dip to $2.75 shook out the weak hands.

Next Targets? Watch $3.21… and Then Maybe $4.80

What’s next? Eyes are locked on $3.21. If XRP can punch through and hold that level, then the recent correction might be in the rearview.

From there, things could start heating up. A push toward the psychological $4.00 level is very much on the table. Beyond that? Analysts are eyeing the range between $4.60 and $4.80 as the next big zones to watch. But yeah—it all hinges on $3.21.

Sure, some projections had to be tweaked after that price dip, but the general bullish thesis hasn’t been thrown out. The Fib levels are still doing their job in guiding the narrative.

Volume’s Booming—And That’s Fuel for the Fire

Besides the charts, market activity is showing signs of life. XRP’s trading volume jumped 27.69% to a juicy $10.37 billion, according to Coinglass. That’s not small.

Open interest also nudged higher, up 4.88% to $7.51 billion. That rise in both volume and interest suggests that traders aren’t just watching—they’re betting on a move.

Despite the recent swings, the structure of the XRP chart still looks healthy. If bulls can push through that $3.21 resistance, we might just be staring down the next leg up.