- RBI Governor has called for a blanket ban on crypto, adding that the digital asset is “pure gambling.”

- Indian Central bank has remained firm in its anti-crypto stance, forcing exchanges out of the country.

- Das, RBI governor, says CBDC is better than crypto.

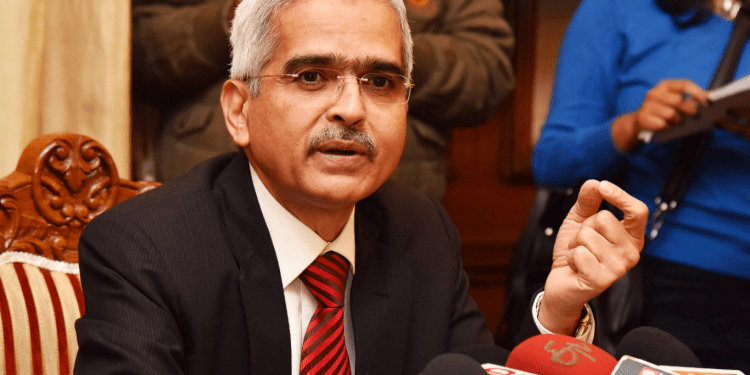

The Governor of the Reserve Bank of India, Shaktikanta Das, has called for an outright ban on cryptocurrency while expressing his concern amount the growing demand for the digital asset and their negative effect on the country.

Speaking on the position of the crypto industry in the country’s financial economy at the Business Today Banking and Economy Summit on Friday, Das said,

“Crypto should be banned, given its no underlying value in the market. Like every asset, every financial product comes with some underlying value. Still, in the case of crypto, there is no underlying… not even a tulip…hence the value of crypto is based on the make-believe factor.”

“Crypto is a form of gambling without any underlying value and is nothing but a 100 percent speculation world. Our country does not promote gambling, and if people still want to continue investing in it, lay down proper rules for the same,” he added. Das also commented that crypto could not be called a financial asset or a product but pure gambling and “100% speculation” and, therefore, should be banned in the country.

The RBI Governor spoke on the potential “dollarization” of the economy, seeing as cryptocurrencies are dollar-dominated, and many economies are heavily dependent on their currencies for monetary control. If not checked, crypto could cause India to lose control of the money supply and the US dollar to usurp the Indian rupee.

“The Reserve Bank, being the country’s monetary authority as the central bank, will lose control over the money supply in the economy … It will undermine the authority of the RBI and lead to the dollarization of the economy,” he cautioned. “These are not empty alarm signals. One year ago, in the Reserve Bank, we had said this thing is likely to collapse sooner than later. And if you see the developments over the last year, climaxing in the FTX episode, I think I don’t need to add anything more.”

India’s Anti-Crypto Stance

The Reserve Bank of India has been consistent in its stance against crypto operations within the country and has several times advocated for a blanket ban over the past year. The Central bank has made it almost impossible for local banks to engage with crypto platforms in India and has caused exchanges like Coinbase to halt trading services.

Brian Amstrong, Coinbase’s chief executive, cited “informal pressure” and heavy taxation law, which resulted in a sharp decline in trading volume, as the reason it shut down operations in the country last year.

Binance has also come under fire with India’s Enforcement Directorate (ED), as the exchange was asked to freeze $2.5 million worth of Bitcoin as part of a money-laundering investigation relating to a gaming app in November.

T. Rabi Sankar, deputy governor of RBI, told an audience at a banking conference in February that crypto was designed to bypass the regulated financial system.

RBF Governor Endorses Digital Rupee, Shuns Crypto

Shaktikanta Das had previously warned of the risks associated with crypto assets, using FTX’s collapse as an example of the financial ruin that would follow if the purchases were allowed to grow.

“Cryptocurrencies have… huge inherent risks for our macroeconomic and financial stability,” he said at an event in December last year.

“It [private cryptocurrency trade] is a hundred percent speculative activity, and I would still hold the view that it should be prohibited … because, if it is allowed to grow, if you try to regulate it and allow it to grow, please mark my words, the next financial crisis will come from private cryptocurrencies,” he said.

He, however, showed full support for the CBDC project and pilot program of India’s digital rupee, which is supposed to launch this year. Unlike cryptocurrencies which pose only financial risks, Das said the digital rupee would expedite international money transactions and reduce the need for logistics, like printing fiat notes.

“I think CBDC is the future of money…since lots of central banks are doing/working on it and we cannot be left behind, but at the same time, we have to ensure that its technology is robust and very safe and ensure that it’s not cloned or counterfeited.”