- Trump’s GENIUS Act boosts Ripple’s stablecoin ambitions, especially with RLUSD, but it’s unlikely to have much effect on XRP’s price.

- XRP supply remains massive, and burned token volume is too small to move markets significantly.

- Regulatory uncertainty still looms over XRP, though future bills like the CLARITY Act could shift the tide.

Last Friday, the U.S. crypto scene got a bit of a jolt. President Donald Trump signed the GENIUS Act into law, setting the stage for a more structured path for stablecoins. And while that’s good news for platforms like Ripple, it doesn’t necessarily mean XRP is about to moon.

Omni Network’s co-founder, Austin King, told Decrypt that Ripple is in a solid spot to benefit here. The new law basically clears the runway for stablecoins like USDC and RLUSD, Ripple’s own dollar-pegged token, to chase institutional demand. “That’s where the big players make their moves,” King said. No argument there.

RLUSD Could Be Ripple’s Big Move

Stablecoins are already locked in a battle royale—USDC, USDT, PayPal USD… all vying for dominance. But Ripple? It’s got the upper hand in cross-border liquidity. According to Yuri Brisov from Digital & Analogue Partners, the arrival of RLUSD could help Ripple go toe-to-toe with the likes of USDC inside the U.S.—not just overseas.

Brisov said that with RLUSD in the mix, Ripple might reshape itself into “a core infrastructure provider” within America’s traditional financial system. That’s not just branding—it’s about being in the middle of big money flows.

But let’s be real for a second—does any of this pump XRP’s price? Probably not.

XRP’s Price? Not Likely to Budge (Much)

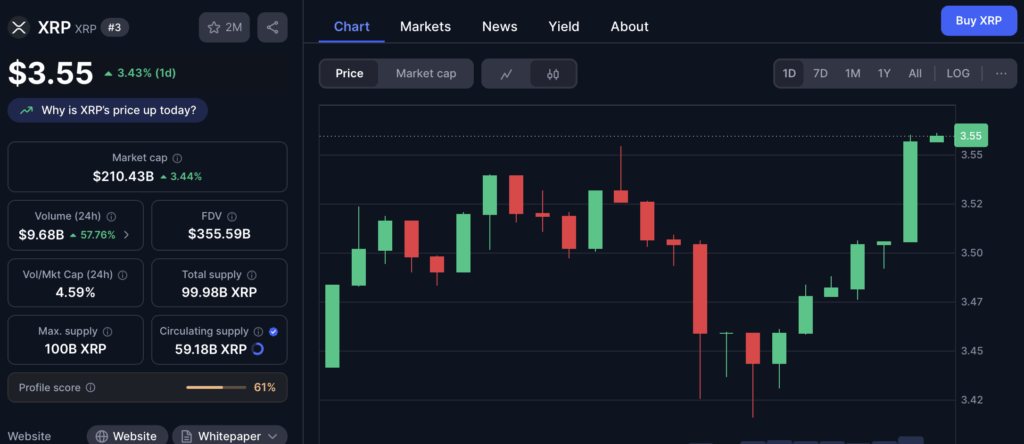

Sure, every RLUSD transaction burns a tiny amount of XRP as a fee. But XRP’s supply? It’s huge. Like, 59.1 billion coins huge. The total XRP burned since launch is only 14 million. That’s basically a rounding error.

Even Ripple CTO David Schwartz has been upfront about this. “I still don’t think burned XRP will significantly reduce the supply anytime soon,” he said. And when the guy building it says that—maybe temper those moonshot dreams.

Also, there’s the elephant in the room: The SEC lawsuit. It’s still dragging on. And the legal grey area around XRP’s classification continues to hang over its future like a fog.

XRP’s Legal Limbo and Ripple’s Next Steps

Right now, XRP isn’t considered a security when it’s traded on exchanges. But it might be one in private placements, depending on how it’s sold. That’s the murky part, and according to Brisov, that makes XRP’s future more complex than clear.

That’s why Ripple may lean harder into RLUSD—to hedge its bets and reduce its reliance on XRP in uncertain legal zones. It’s not about ditching XRP. It’s about diversifying without jumping ship.

Still, if the CLARITY Act ever becomes law, things could change real fast. That bill would create a legal framework for crypto tokens to evolve from securities into commodities. For XRP, it could finally bring some clean air to breathe.

“Clarity would eliminate ambiguity,” Brisov added, “and open the door for more tokenization strategies.”