- Ethereum is up over 70% since July 1, fueled by a massive short squeeze and early institutional buys from Trump-linked firms and BlackRock.

- A potential executive order may allow $8.7 trillion in 401(k) retirement funds to enter crypto markets, supercharging ETH’s upside.

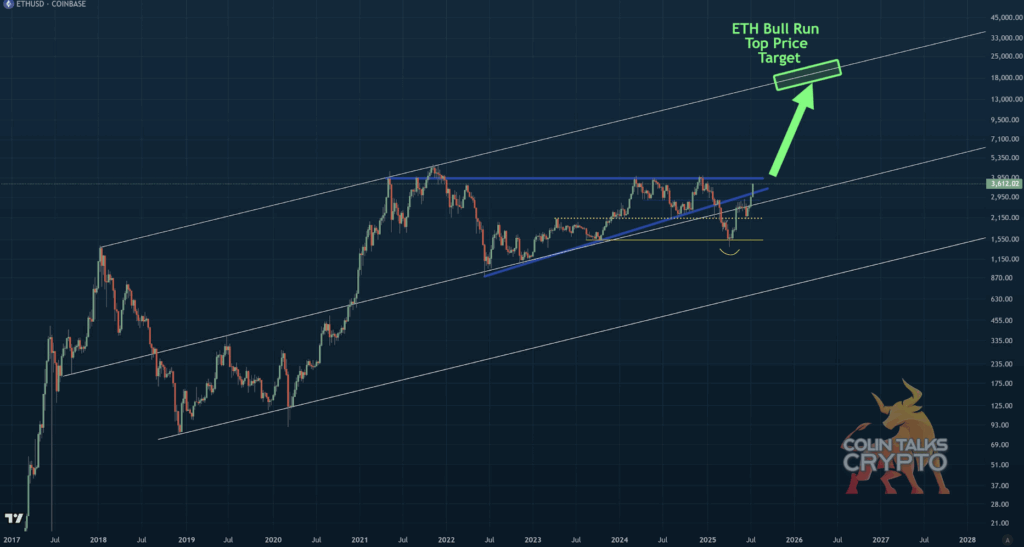

- With new U.S. crypto regulations and ETF demand rising, ETH could realistically hit $15K–$20K this cycle, according to analysts.

Ethereum’s having a moment—actually, more like a full-on breakout. Since July 1st, ETH has surged over 70%, adding around $150 billion to its market cap. What’s behind the pump? It’s a mix of a monster short squeeze, big-money moves from Trump’s crew and BlackRock, and a regulatory shift in the U.S. that’s turning pretty crypto-friendly. With the $9 trillion retirement market maybe opening its doors, this run might still be in early innings.

Why ETH Took Off Like a Rocket in July

Let’s start with the short squeeze. Ethereum had been under heavy pressure—shorts were stacking up, 25% higher than the February peak. That kind of bearish overload doesn’t last forever. Once ETH started ticking up, billions in short positions got liquidated, kicking off a firestorm. It’s one of the biggest short squeezes the crypto market’s ever seen. And according to The Kobeissi Letter, if ETH climbs another 10%, it could wipe out another $1B in shorts. That’s… not small.

Guess Who Bought Early? Yep, Trump and BlackRock

Now, let’s talk timing. A day before Kobeissi’s post blew up, World Liberty Financial (a group tied to Trump) snagged $5 million worth of ETH. BlackRock’s ETF has been on a buying spree too—29 out of the last 30 days they’ve been adding ETH like clockwork. That kind of front-running tells you one thing: the smart money wasn’t sleeping. They saw what was coming, and they moved before the crowd even noticed.

Bitcoin’s Back Too, But ETH’s Leading the Charge

While Ethereum’s been stealing the show, Bitcoin quietly pushed back above $120K. That’s a near $900 billion recovery since April. XRP’s also been moving, which points to a broader altcoin rotation in play. And folks like Colin Talks Crypto aren’t shy about price targets—he sees ETH hitting somewhere between $15K and $20K this cycle. Big numbers, yeah, but the market setup kinda supports it.

Retirement Market About to Join the Party?

Here’s where things get wild. There’s buzz that Trump’s prepping an executive order to let 401(k)s invest in crypto. That’s an $8.7 trillion market just waiting on the sidelines. If that door opens, it’s more than double the size of the current crypto market ready to come flooding in. For ETH, that kind of demand could be fuel for a whole new level of growth.

U.S. Crypto Policy Finally Starts Making Sense?

Don’t underestimate the power of regulation. In July, three big bills passed the House:

- The Clarity Act – clears up what counts as a digital asset

- The Genius Act – sets the rules for stablecoins

- The Anti-CBDC Act – keeps the Fed from overreaching on digital dollars

With both sides of the aisle supporting these, the market’s starting to feel… less wild west, more Wall Street. That’s huge for institutions thinking about long-term exposure.

So… Can ETH Really Hit $20K?

ETH’s last big high was around $4,800 back in 2021. If it does hit $15K–$20K, that’s a 3x–4x move from there. Sounds ambitious, sure. But with strong technicals, ETFs buying daily, fresh legislation, and trillions in retirement cash potentially flowing in—it’s not so crazy anymore.

Final Thoughts: The Shift Has Begun

This isn’t just another rally. Ethereum’s latest breakout signals something deeper: crypto’s pivot from hype-fueled chaos to structured, institution-led expansion. The money’s smarter. The laws are catching up. And for the first time ever, retirement funds are eyeing ETH like it belongs in the portfolio.

$15K? It’s not a pipe dream—it might just be a matter of “when.”