- BlackRock filed to allow staking in its Ethereum ETF, potentially letting institutions earn yield on ETH holdings.

- ETH outperformed BTC this week with $720M in ETF inflows—$500M of that went to BlackRock’s fund alone.

- Other major players like Fidelity and Grayscale also pushed for ETH staking, showing TradFi is steadily embracing on-chain rewards.

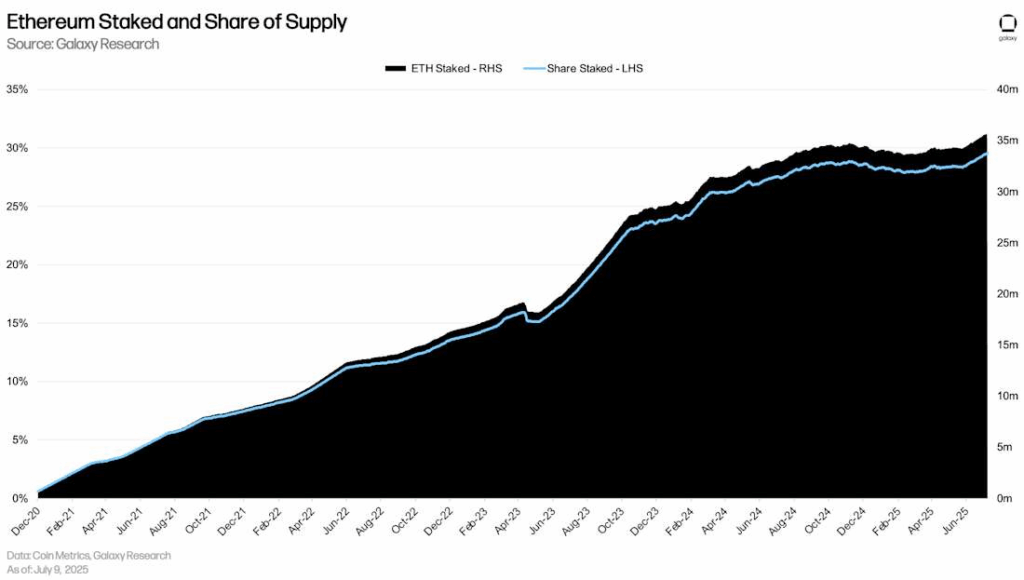

In a move that feels kinda inevitable (but still pretty wild), BlackRock just filed to add staking to its spot Ethereum ETF. Yep, that BlackRock—the $10 trillion asset management behemoth that already dominates the BTC and ETH ETF space—is now eyeing on-chain yield. The Nasdaq submitted the formal rule change request to the SEC, seeking to allow the iShares Ethereum Trust (ETHA) to stake the ether it holds. If it gets the green light, this could open up institutional staking like never before.

The market didn’t exactly go nuts after the news. ETH prices barely flinched. Still, the asset’s been outperforming most of the majors lately—up 21% over the past week compared to BTC’s 5.5%. And that’s not nothing. The ETH/BTC ratio just popped to 0.029, its highest since February. A lot of this juice came from record-breaking ETF inflows, too—$720 million yesterday alone, with a massive 69% of that flowing into BlackRock’s fund. Quiet flex.

Big Money Keeps Pouring Into ETH

All in all, U.S.-listed ETH ETFs have pulled in $6.5 billion so far. But that number would be a whole lot higher if it weren’t for Grayscale’s ETHE bleeding out—over $4 billion in net outflows. BlackRock’s fund alone accounts for $7.1 billion in inflows, which is kind of insane. TradFi isn’t just testing the Ethereum waters anymore—they’re diving in head first.

Then there’s the treasury buying. Big time. SharpLink Gaming, where Ethereum co-founder Joe Lubin sits as chairman, reportedly holds over $500M in ETH. Meanwhile, BitMine dropped a bomb—its ETH treasury just passed $1 billion. With that kind of backing, ETH doesn’t really need a pump tweet to stay relevant.

ETH Staking: Not Just a BlackRock Thing

Here’s the kicker—BlackRock isn’t even first. Cboe and NYSE already filed to add staking options to ETH ETFs from Fidelity, Franklin, and Bitwise way back in March. Grayscale threw its hat in the ring too in April. So while this BlackRock news is making waves, it’s actually part of a much bigger, slower shift happening behind the scenes.

It’s the TradFi-on-chain moment. Quiet, steady, and somehow way more serious than it was during the bull cycles. Vance Spencer from Framework Ventures said it best on X: “Maybe you didn’t expect Lubin and Tom Lee to lead the tradfi bandwagon to ETH and BlackRock to add staking just as the wheels start to turn. But that’s what’s happening.” Fair point.

What Comes Next?

If the SEC signs off on this, it could be the start of something big. Institutions collecting staking yield on ETH through regulated products? That changes the game. It adds utility, not just speculation, to these funds—and that might attract a different kind of capital. Long-term capital.

But there’s always that SEC wildcard. Even if this gets approved, implementation could take a minute. And if it doesn’t? Well, the momentum seems too strong to stop anyway. Between inflows, treasuries stacking ETH, and staking becoming part of the ETF playbook—Ethereum’s getting more intertwined with traditional finance by the week.