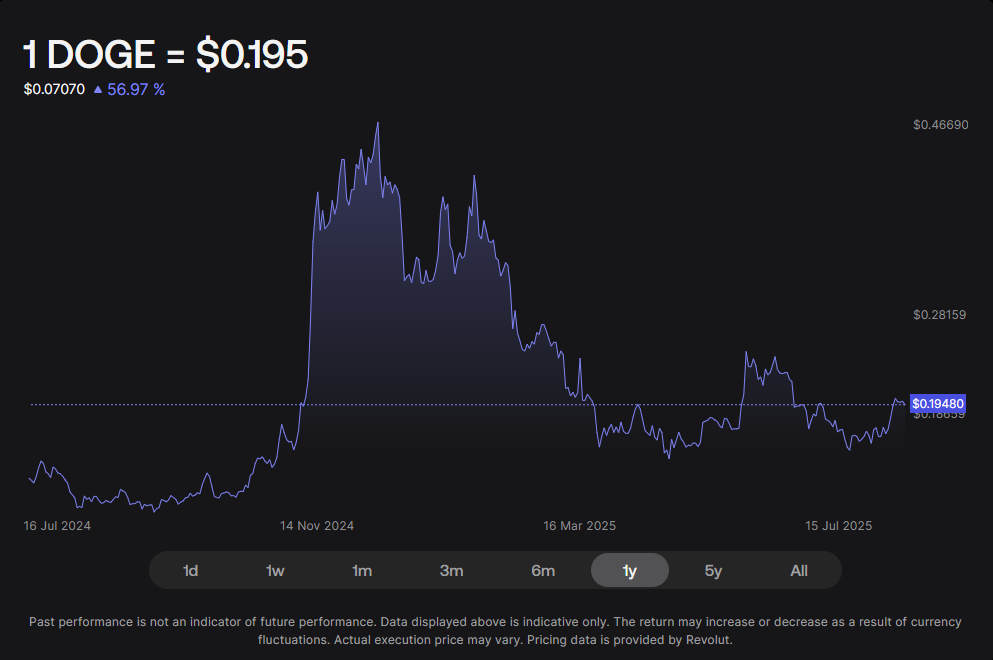

- Dogecoin fell 7.1% in 24 hours but remains up 60.7% since July 2024.

- The dip likely reflects profit-taking as Bitcoin cools off from its recent all-time high.

- With retail activity still muted and Fed rates steady, further corrections may follow.

Dogecoin (DOGE) took a hit in the last 24 hours, falling by 7.1% in sync with a broader market correction. Despite this sudden dip, the meme coin is still showing decent strength—up 13.2% over the past week, 17.6% in the last 14 days, and 8.7% over the past month. Since July 2024, DOGE has surged by over 60%, proving its ability to bounce back during this cycle.

Bitcoin (BTC) touched a new all-time high of $122,838 on July 14 but has since cooled down to around $116,000. DOGE’s rally was largely driven by BTC’s momentum, and now it seems to be retracing as Bitcoin’s energy fades. The recent drop could be attributed to profit-taking across the market.

Is It Time to Buy the Dogecoin Dip?

For seasoned investors, buying the dip is a classic strategy—but only if timed correctly. Right now, the market appears to be losing steam. BTC has been sliding since its recent peak, and DOGE may follow suit in the short term. Many investors are likely locking in gains after the rapid rally, especially with the macro uncertainty in play.

Retail traders haven’t made a major comeback this cycle, which is another factor weighing on DOGE’s short-term momentum. While institutional money has fueled Bitcoin’s rise, it hasn’t flowed as heavily into altcoins like DOGE. That makes predicting the next move tricky.

Fed Policy and Market Sentiment Add Uncertainty

The Federal Reserve’s decision to maintain current interest rates may have added some caution to the mix. It signals ongoing concerns about inflation, which can rattle risk assets like cryptocurrencies. Until retail enthusiasm returns or macro conditions shift, DOGE might not see the kind of runaway rally it experienced in past cycles.

Still, long-term holders may view the current dip as an opportunity. With DOGE’s brand recognition and integration into platforms like X still in play, future upside remains on the table—though likely with more volatility ahead.