- SHIB is up 13.3% in the past month, following Bitcoin’s breakout to $122K and surging 10,786% in token burns.

- CoinCodex predicts a breakout to $0.00002 by August 22, though short-term consolidation around $0.000014 is expected.

- Institutional inflows and shifting US policy are supporting SHIB’s rally, while retail investors have yet to fully return.

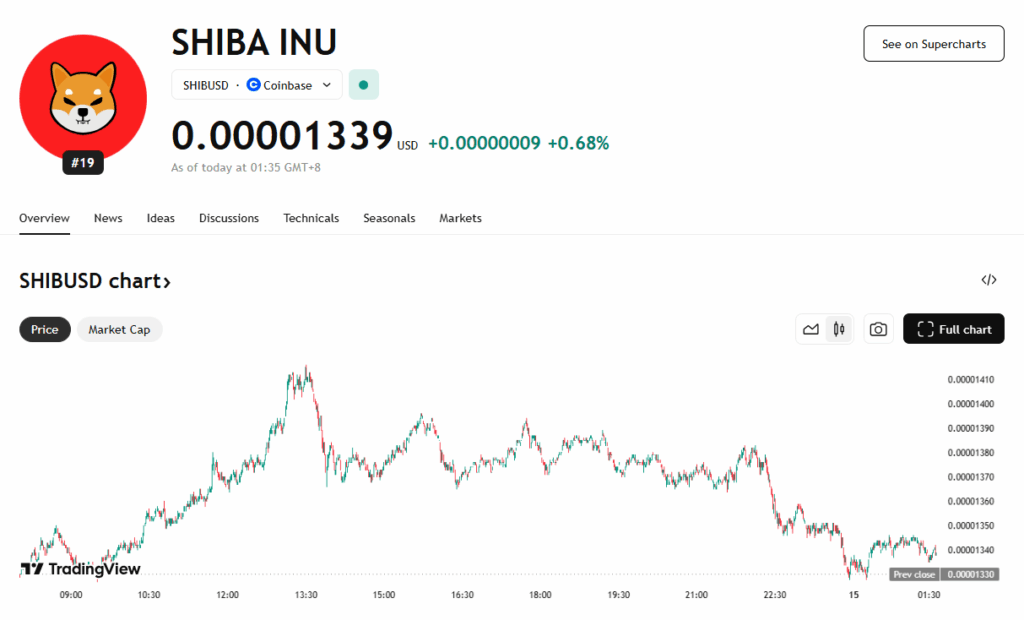

Shiba Inu (SHIB) is riding the crypto market’s bullish wave, notching gains of 4.6% over the past 24 hours and climbing 13.3% over the past month. Weekly and biweekly returns are also solid, up 16.6% and 19.1%, respectively. Despite the short-term momentum, SHIB remains down 21.3% from its price levels in July 2024, highlighting the long road to full recovery.

Can SHIB Hit $0.00002 This Cycle?

SHIB’s latest surge is closely tied to Bitcoin’s recent breakout to new all-time highs, with BTC peaking at $122,369 on July 14. That upward movement has rippled through the altcoin market, giving SHIB a fresh jolt of energy. According to CoinCodex, SHIB may consolidate near the $0.000014 level in the short term, but the platform forecasts a breakout to $0.00002 by August 22.

Adding to the optimism is a 10,786% spike in SHIB’s burn rate, which has significantly reduced supply and boosted market sentiment. Analysts caution, however, that a market dip is possible in the coming weeks if institutional inflows slow or large players decide to take profits.

Institutional Momentum and Policy Tailwinds Drive SHIB

Crypto ETFs have drawn steady institutional capital in recent months, fueling Bitcoin’s rally and lifting assets like SHIB in its wake. Retail traders remain mostly sidelined for now, but renewed engagement from that segment could keep the momentum going.

US economic policy may also be contributing to the positive outlook. President Trump has leaned into pro-crypto rhetoric, while the SEC appears to be dialing back its aggressive stance. Several lawsuits from the previous administration have been dropped, potentially paving the way for a more favorable regulatory environment for digital assets.