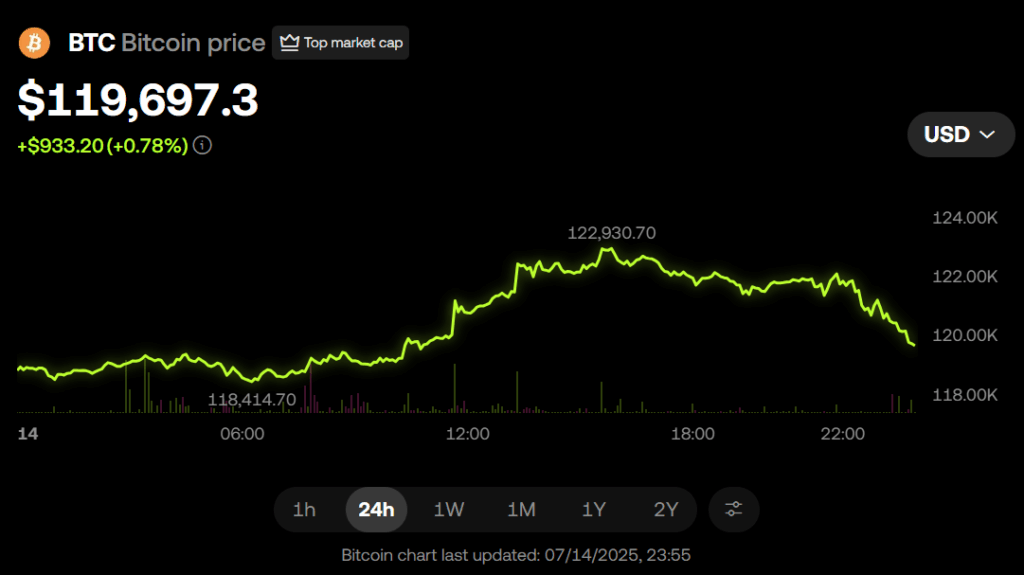

- Bitcoin hit a new all-time high of $122,600, pushing its market cap to $2.4 trillion and surpassing Amazon, Silver, and Alphabet.

- Over 265 companies now hold BTC, while ETFs have added more than $1 billion in weekly inflows, fueling price momentum.

- Bitcoin could challenge Apple and Microsoft’s valuations if ETF demand continues and pro-crypto regulation gains traction.

Bitcoin is flexing serious financial muscle. With its price soaring to a new all-time high of $122,600 on Monday, BTC now holds a market cap of $2.4 trillion, surpassing Amazon ($2.3T), Silver ($2.2T), and even Google-parent Alphabet ($2.19T). Bitcoin now stands as the fifth-largest asset on Earth—trailing only Apple, Microsoft, Saudi Aramco, and gold.

This rapid rise, nearly 13% in just one week, signals a deeper shift in how traditional and institutional investors are viewing Bitcoin—not as a speculative asset, but as a real contender in the global financial system. Analysts suggest that Bitcoin’s current trajectory could even challenge Apple’s throne if momentum continues.

Institutional Adoption Fuels the Climb

According to Enmanuel Cardozo of Brickken, increasing allocations from titans like BlackRock and MicroStrategy are making Bitcoin’s presence unavoidable in global finance. Over 265 companies now hold BTC in their treasuries, with over 3.5 million BTC in corporate reserves.

Notably, spot Bitcoin ETFs have added massive firepower. Over 1.4 million BTC—roughly 6.6% of Bitcoin’s supply—is now held via ETFs. These funds have been on a buying spree, adding over $1 billion in inflows last Friday alone. Analysts point to these flows as a core driver behind Bitcoin’s latest surge.

Next Stop: Apple and Microsoft?

Bitcoin’s market cap is now just $730 million shy of Apple—a gap that could close with a BTC price of around $142,000. But some bulls have their eyes set even higher. Surpassing Microsoft would require Bitcoin to hit $167,000—and with ETF demand and regulatory tailwinds, that milestone is not out of reach.

US lawmakers are also ramping up attention with a string of crypto-friendly bills in what’s being dubbed “Crypto Week.” If passed, these laws could further solidify Bitcoin’s standing and trigger even more inflows.