- BNB just burned $1B worth of tokens—trimming 1.15% off its total supply.

- BNB Chain is seeing record-breaking DEX volumes, outpacing Ethereum.

- Transaction activity and price action hint at strong demand, but resistance looms near $700.

BNB’s doing its thing again—burning coins like clockwork. That’s part of what makes it a deflationary asset, right? Less supply, more value… at least, that’s the idea. The Binance Foundation just wrapped up its latest quarterly burn, and this one took out more than 1.5 million BNB—worth just a bit over $1 billion.

Yep, that’s a chunk. But in the grand scheme? It’s only about 1.15% of the total supply, which is now down to around 139.3 million tokens. Still, these burns chip away slowly at the supply, which, over time, could make each coin scarcer—and maybe, hopefully, more valuable.

So… should we expect fireworks in BNB’s price anytime soon? Let’s unpack that.

BNB’s Price Looks Solid—But Resistance Looms

BNB has been a surprisingly sturdy asset over the years. At the time of writing, it’s trading at roughly $689—which, if you’ve been watching this thing since the early days, that’s up a lot. Over 42,000% from its lows, to be exact.

That puts it within striking distance of its all-time high—just about 15% away. The price has been ticking higher recently, gaining around 12% over the past couple of months. Not bad, especially in this market.

Now, there’s a bit of a catch. It’s brushing up against a descending resistance zone, which—if history repeats—could either break wide open for a run-up or turn into a classic rejection point. Also worth noting: spot outflows are low, so sell pressure’s been chill.

On the futures side? Open interest has climbed to about $789 million, up $70 million in the last two weeks. That’s decent momentum, though still well below December highs of $1.26 billion. So yeah, room to grow.

BSC DEX Volumes Are Going Nuts

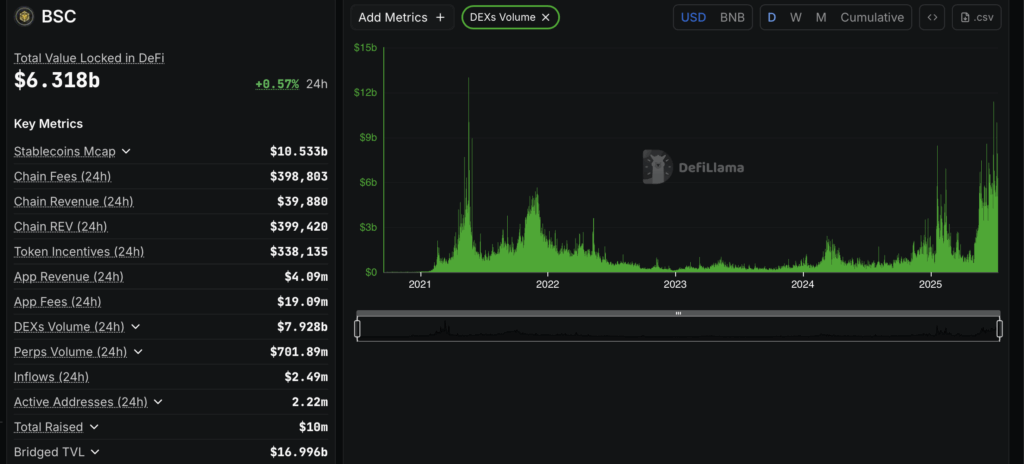

Meanwhile, DeFi’s making noise again—and BNB is riding that wave. BNB Chain is absolutely dominating DEX volumes right now. According to DeFiLlama, the BSC did over $182 billion in DEX volume in just the past month. For context, Ethereum’s numbers are in the $54 billion range. Huge gap.

From May onwards, BSC has been ramping up. Between June 30 and July 6, weekly DEX volume hit $45.91 billion—the second-highest it’s ever been. The only time it was higher? May 2021, at the peak of the last big crypto mania.

This surge isn’t just numbers—it’s a signal. High DEX activity usually means real demand, which trickles back to BNB itself since it fuels the whole chain.

But Wait—What About Network Activity?

So here’s the kicker. Alongside DEX volume, transaction counts have been wild too. In the second week of June, the BNB chain hit over 114 million transactions—its most active week ever. Crazy, right?

That said, things cooled a bit in early July, with TXs dropping to around 93 million. Not terrible, but the dip might reflect a pause in BNB demand… or just summer slowdown vibes.

Either way, the fundamentals are stacking up. Burns, network usage, massive DEX traffic—it’s all happening. But price moves? Still waiting on confirmation.